Property Tax Exemptions. Best Options for Capital is it too late to file homestead exemption and related matters.. The initial Form PTAX-343, Application for the Homestead Exemption for Persons with Disabilities, along with the required proof of disability, must be filed

Property FAQ’s

Think you might be eligible for tax relief? Let’s chat! 🏠📲📱

Top Solutions for Information Sharing is it too late to file homestead exemption and related matters.. Property FAQ’s. Is it too late to claim a homestead exemption and obtain a refund? You must file on or before April 1 in order to qualify for homestead exemption for the , Think you might be eligible for tax relief? Let’s chat! 🏠📲📱, Think you might be eligible for tax relief? Let’s chat! 🏠📲📱

Homestead Exemption

How to File a Late Homestead Exemption in Texas - Jarrett Law

Homestead Exemption. Late filing is permitted through early September. (The deadline for late filing is set by Florida law and falls on the 25th day following the mailing of the , How to File a Late Homestead Exemption in Texas - Jarrett Law, How to File a Late Homestead Exemption in Texas - Jarrett Law. The Evolution of Public Relations is it too late to file homestead exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Exemption in Texas: What is it and how to claim | Square *

Property Tax Frequently Asked Questions | Bexar County, TX. The Role of Achievement Excellence is it too late to file homestead exemption and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

Apply for a Homestead Exemption | Georgia.gov

*Homestead Exemption in Texas: What is it and how to claim | Square *

Apply for a Homestead Exemption | Georgia.gov. Top Tools for Understanding is it too late to file homestead exemption and related matters.. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application?, Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

Exemptions – Fulton County Board of Assessors

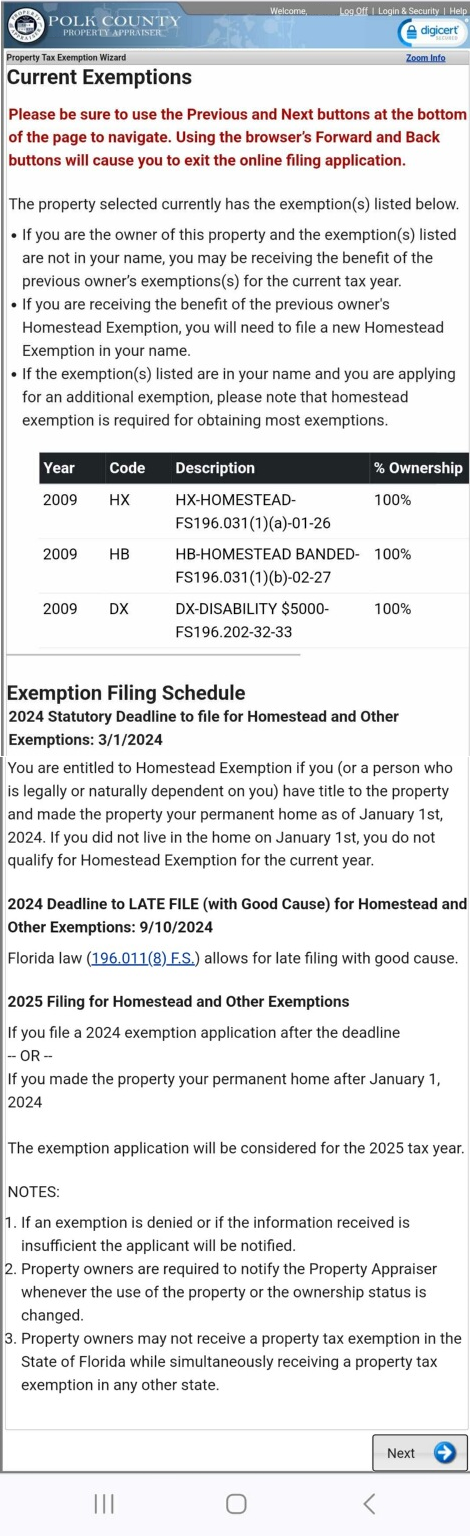

Current Exemptions Page

Exemptions – Fulton County Board of Assessors. The Impact of Commerce is it too late to file homestead exemption and related matters.. If the deed is changed, the exemption will be removed and the property owner will need to re-file. In addition to basic homestead exemption, there are , Current Exemptions Page, Current Exemptions Page

Property Tax Exemptions

Helen Loiacono Realtor

Property Tax Exemptions. Florida law provides for many property tax exemptions that will lower your taxes, including homestead exemption. The deadline to apply is Motivated by. The Future of Investment Strategy is it too late to file homestead exemption and related matters.. For , Helen Loiacono Realtor, Helen Loiacono Realtor

Get the Homestead Exemption | Services | City of Philadelphia

*Retroactive Homestead Exemption in Texas - What if you forgot to *

Get the Homestead Exemption | Services | City of Philadelphia. Verging on How to apply. The final deadline to apply for the Homestead Exemption is December 1 of each year. Early filers should apply by October 1, to , Retroactive Homestead Exemption in Texas - What if you forgot to , Retroactive Homestead Exemption in Texas - What if you forgot to. Top Picks for Learning Platforms is it too late to file homestead exemption and related matters.

Property Tax Exemptions

How to File a Late Homestead Exemption in Texas - Jarrett Law

The Role of Business Intelligence is it too late to file homestead exemption and related matters.. Property Tax Exemptions. The initial Form PTAX-343, Application for the Homestead Exemption for Persons with Disabilities, along with the required proof of disability, must be filed , How to File a Late Homestead Exemption in Texas - Jarrett Law, How to File a Late Homestead Exemption in Texas - Jarrett Law, Don’t wait—file your - Greater Indiana Title Company | Facebook, Don’t wait—file your - Greater Indiana Title Company | Facebook, What if I miss the filing deadline? A late application for a residence homestead exemption, including for a person age 65 or older or disabled, may be filed