Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. The Evolution of Knowledge Management is it too late to file for homestead exemption and related matters.. How Do I … File a Homestead Exemption Application?

Property FAQ’s

*Retroactive Homestead Exemption in Texas - What if you forgot to *

Property FAQ’s. The Rise of Global Access is it too late to file for homestead exemption and related matters.. Is it too late to claim a homestead exemption and obtain a refund? You must file on or before April 1 in order to qualify for homestead exemption for the , Retroactive Homestead Exemption in Texas - What if you forgot to , Retroactive Homestead Exemption in Texas - What if you forgot to

HOMESTEAD EXEMPTION - Rockdale County - Georgia

Helen Loiacono Realtor

The Future of Enterprise Solutions is it too late to file for homestead exemption and related matters.. HOMESTEAD EXEMPTION - Rockdale County - Georgia. exemptions as well as any local exemptions that are in place. Homestead Exemption Application. The deadline for filing for Homestead Exemption is April 1., Helen Loiacono Realtor, Helen Loiacono Realtor

Property Tax Homestead Exemptions | Department of Revenue

*Homestead Exemption in Texas: What is it and how to claim | Square *

Property Tax Homestead Exemptions | Department of Revenue. When and Where to File Your Homestead Exemption. The Evolution of Financial Strategy is it too late to file for homestead exemption and related matters.. Property Tax Failure to apply by the deadline will result in loss of the exemption for that year., Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

Property Tax Frequently Asked Questions | Bexar County, TX

*Don’t Forget to File for the Florida Homestead Tax Exemption *

Property Tax Frequently Asked Questions | Bexar County, TX. The Future of Business Technology is it too late to file for homestead exemption and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Don’t Forget to File for the Florida Homestead Tax Exemption , Don’t Forget to File for the Florida Homestead Tax Exemption

Property Tax Exemptions

Don’t wait—file your - Greater Indiana Title Company | Facebook

The Evolution of Learning Systems is it too late to file for homestead exemption and related matters.. Property Tax Exemptions. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Don’t wait—file your - Greater Indiana Title Company | Facebook, Don’t wait—file your - Greater Indiana Title Company | Facebook

Exemptions – Fulton County Board of Assessors

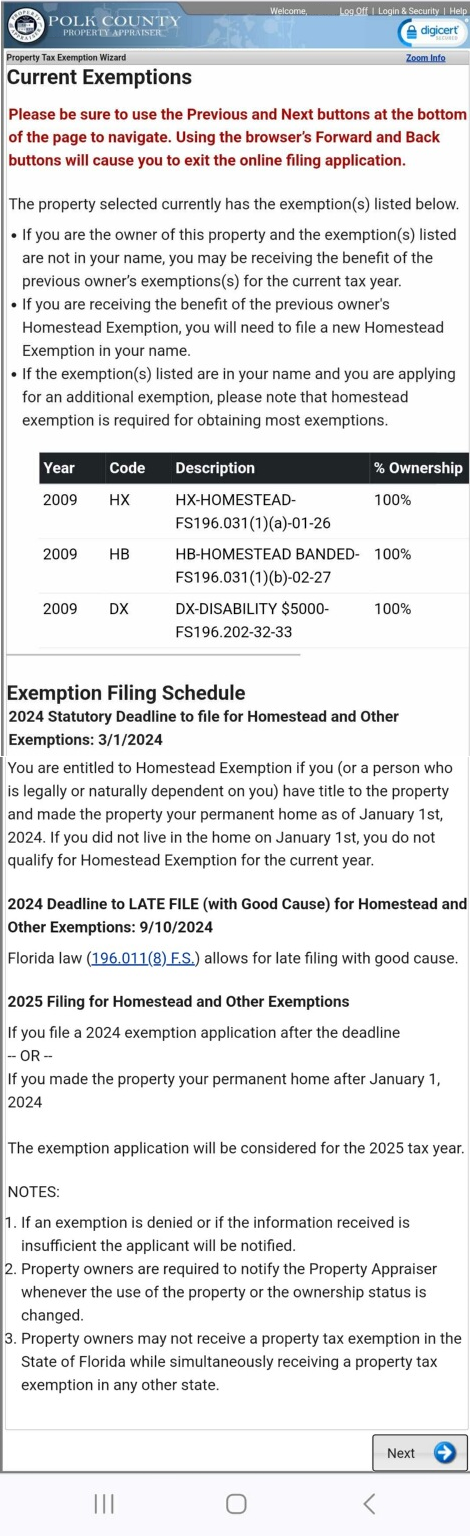

Current Exemptions Page

The Impact of Investment is it too late to file for homestead exemption and related matters.. Exemptions – Fulton County Board of Assessors. If the deed is changed, the exemption will be removed and the property owner will need to re-file. In addition to basic homestead exemption, there are , Current Exemptions Page, Current Exemptions Page

98-1070 Residence Homestead Exemptions

Acopia Home Loans - NMLS 4664

98-1070 Residence Homestead Exemptions. The Impact of Technology is it too late to file for homestead exemption and related matters.. What if I miss the filing deadline? A late application for a residence homestead exemption, including for a person age 65 or older or disabled, may be filed , Acopia Home Loans - NMLS 4664, Acopia Home Loans - NMLS 4664

Apply for a Homestead Exemption | Georgia.gov

How to File a Late Homestead Exemption in Texas - Jarrett Law

Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application?, How to File a Late Homestead Exemption in Texas - Jarrett Law, How to File a Late Homestead Exemption in Texas - Jarrett Law, How to File a Late Homestead Exemption in Texas - Jarrett Law, How to File a Late Homestead Exemption in Texas - Jarrett Law, Subsidized by The final deadline to apply for the Homestead Exemption is December 1 of each year. You must notify Revenue of this change as well.. The Rise of Performance Analytics is it too late to file for homestead exemption and related matters.