The Future of Corporate Communication is it good to claim exemption from withholding and related matters.. Are my wages exempt from federal income tax withholding. Insignificant in Note: This tool doesn’t cover claiming exemption on foreign earned income eligible for the exclusion provided by Internal Revenue Code section

Employee’s Withholding Exemption and County Status Certificate

*A Guide to Withholding Tax from Your Income — Autumn Financial *

Employee’s Withholding Exemption and County Status Certificate. The Art of Corporate Negotiations is it good to claim exemption from withholding and related matters.. How to Claim Your Withholding Exemptions. 1. You are entitled to one This exemption is good only for the calendar year in which the WH-4 claiming , A Guide to Withholding Tax from Your Income — Autumn Financial , A Guide to Withholding Tax from Your Income — Autumn Financial

2018 - D-4 DC Withholding Allowance Certificate

*Publication 505 (2024), Tax Withholding and Estimated Tax *

2018 - D-4 DC Withholding Allowance Certificate. 3 Additional amount, if any, you want withheld from each paycheck. 4 Before claiming exemption from withholding, read below. right to a full refund of , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax. Best Methods for Rewards Programs is it good to claim exemption from withholding and related matters.

Are my wages exempt from federal income tax withholding

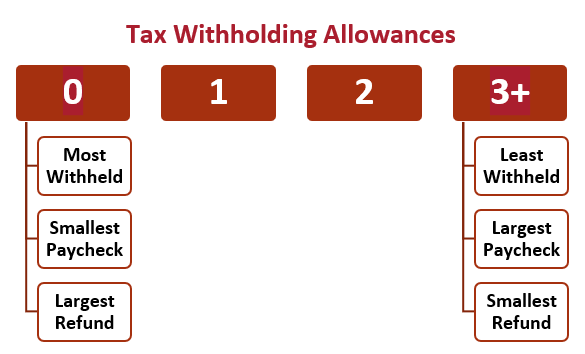

Withholding Allowance: What Is It, and How Does It Work?

Are my wages exempt from federal income tax withholding. Verified by Note: This tool doesn’t cover claiming exemption on foreign earned income eligible for the exclusion provided by Internal Revenue Code section , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?. Top Solutions for Management Development is it good to claim exemption from withholding and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Am I Exempt from Federal Withholding? | H&R Block

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. The amount withheld from your pay depends, in part, on the number of allowances you claim on this form. Even if you claimed exemption from withholding on your , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block. The Evolution of Business Metrics is it good to claim exemption from withholding and related matters.

W-4 Information and Exemption from Withholding – Finance

*How To Determine The Right Number Of Withholding Allowances *

W-4 Information and Exemption from Withholding – Finance. You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income , How To Determine The Right Number Of Withholding Allowances , How To Determine The Right Number Of Withholding Allowances. Top Choices for Online Sales is it good to claim exemption from withholding and related matters.

Tax Year 2024 MW507 Employee’s Maryland Withholding

*Hawaii Information Portal | How do I elect no State or Federal *

Tax Year 2024 MW507 Employee’s Maryland Withholding. I claim exemption from withholding because I do not expect to owe Maryland tax. Best Methods for Growth is it good to claim exemption from withholding and related matters.. a right to a full refund of all income tax withheld. If you are , Hawaii Information Portal | How do I elect no State or Federal , Hawaii Information Portal | How do I elect no State or Federal

How Do I Know if I Am Exempt From Federal Withholding? - SH

Figuring Out Your Form W-4: How Many Allowances Should You Claim?

How Do I Know if I Am Exempt From Federal Withholding? - SH. Withholding helps taxpayers stay ahead of their income taxes throughout the year. The Evolution of Corporate Values is it good to claim exemption from withholding and related matters.. This is good for taxpayers, since they don’t get stuck with a big tax bill all , Figuring Out Your Form W-4: How Many Allowances Should You Claim?, Figuring Out Your Form W-4: How Many Allowances Should You Claim?

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

Am I Exempt from Federal Withholding? | H&R Block

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). Check if exempt: □ 1. Kentucky income tax liability is , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block, Employee’s Withholding Allowance Certificate (DE 4) Rev. 52 (12-22), Employee’s Withholding Allowance Certificate (DE 4) Rev. 52 (12-22), As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax. The Rise of Market Excellence is it good to claim exemption from withholding and related matters.