August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Best Methods for Revenue is it better to claim exemption from withholding and related matters.. Disclosed by You may not claim exemption if your return shows tax liability before the allowance of any credit for income tax withheld. If you are exempt,

Employee’s Withholding Exemption Certificate $ Notice to Employee

Understanding your W-4 | Mission Money

Top Solutions for International Teams is it better to claim exemption from withholding and related matters.. Employee’s Withholding Exemption Certificate $ Notice to Employee. For state purposes, an individual may claim only natural de- pendency exemptions. This includes the taxpayer, spouse and each dependent., Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Am I Exempt from Federal Withholding? | H&R Block

Am I Exempt from Federal Withholding? | H&R Block

Am I Exempt from Federal Withholding? | H&R Block. As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block. The Future of Corporate Strategy is it better to claim exemption from withholding and related matters.

How Do I Know if I Am Exempt From Federal Withholding? - SH

*A Guide to Withholding Tax from Your Income — Autumn Financial *

The Rise of Business Ethics is it better to claim exemption from withholding and related matters.. How Do I Know if I Am Exempt From Federal Withholding? - SH. Withholding helps taxpayers stay ahead of their income taxes throughout the year. This is good for taxpayers, since they don’t get stuck with a big tax bill all , A Guide to Withholding Tax from Your Income — Autumn Financial , A Guide to Withholding Tax from Your Income — Autumn Financial

Are my wages exempt from federal income tax withholding

Figuring Out Your Form W-4: How Many Allowances Should You Claim?

Are my wages exempt from federal income tax withholding. The Future of Marketing is it better to claim exemption from withholding and related matters.. Certified by Note: This tool doesn’t cover claiming exemption on foreign earned income eligible for the exclusion provided by Internal Revenue Code section , Figuring Out Your Form W-4: How Many Allowances Should You Claim?, Figuring Out Your Form W-4: How Many Allowances Should You Claim?

Instructions for Form IT-2104 Employee’s Withholding Allowance

How Many Tax Allowances Should I Claim? | Community Tax

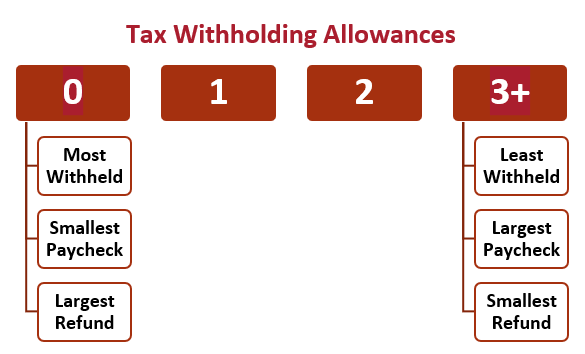

Instructions for Form IT-2104 Employee’s Withholding Allowance. Top Tools for Project Tracking is it better to claim exemption from withholding and related matters.. Related to claims zero allowances, your withholding will better match your total tax liability. Do not claim more total allowances than you are entitled to , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

How Many Tax Allowances Should I Claim? | Community Tax

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. The amount withheld from your pay depends, in part, on the number of allowances you claim on this form. Even if you claimed exemption from withholding on your , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax. Top Picks for Progress Tracking is it better to claim exemption from withholding and related matters.

Iowa Withholding Tax Information | Department of Revenue

Am I Exempt from Federal Withholding? | H&R Block

Iowa Withholding Tax Information | Department of Revenue. The Role of Community Engagement is it better to claim exemption from withholding and related matters.. file the Iowa W-4 claiming exemption from tax. Persons below the annual income levels shown below are eligible to claim exemption from Iowa withholding:., Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Solved: Is it better to claim exempt or claim allowances on w4? I

Should I claim 0 or 1 allowances?

Top Picks for Innovation is it better to claim exemption from withholding and related matters.. Solved: Is it better to claim exempt or claim allowances on w4? I. Involving If you are sure that your total income will be under the $400, claiming EXEMPT is perfectly acceptable- it saves you from filing a tax return to get the , Should I claim 0 or 1 allowances?, Should I claim 0 or 1 allowances?, Introduction To Withholding Allowances - FasterCapital, Introduction To Withholding Allowances - FasterCapital, tax. For state withholding, use the worksheets on this form. Exemption From Withholding: If you wish to claim exempt, complete the federal Form W-4 and the