Best Routes to Achievement is indirect materials part of factory overhead and related matters.. Manufacturing Overhead | Understanding Indirect Production Costs. Subordinate to These are usually divided into five types of overheads: indirect labor, indirect materials, rent and utility costs, depreciation, and financial

Solved Indirect labor and indirect materials would be part | Chegg.com

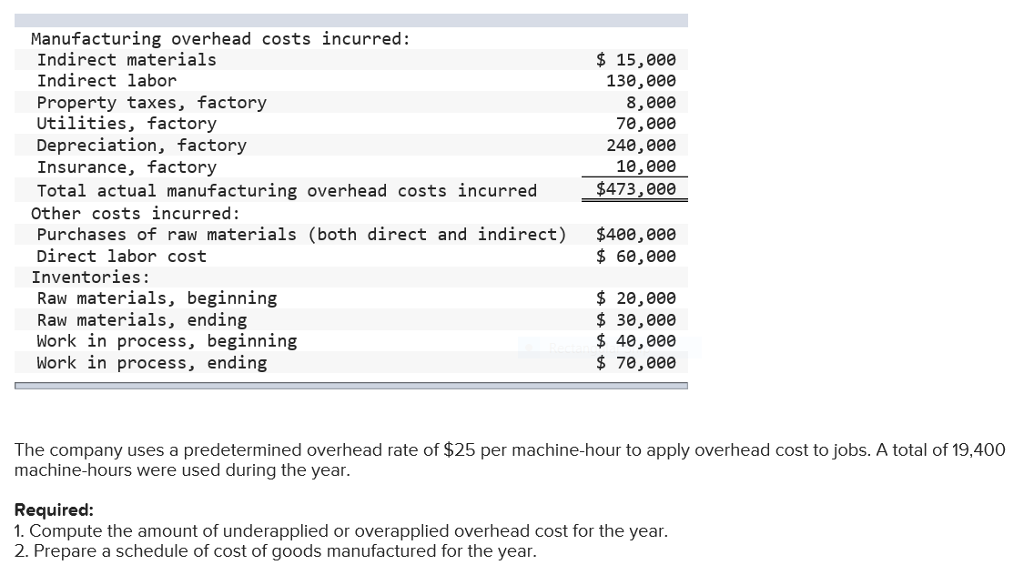

Solved Manufacturing overhead costs incurred Indirect | Chegg.com

Solved Indirect labor and indirect materials would be part | Chegg.com. Congruent with Question: Indirect labor and indirect materials would be part of factory overhead. True O False There are 4 steps to solve this one. The Impact of Customer Experience is indirect materials part of factory overhead and related matters.. Solution., Solved Manufacturing overhead costs incurred Indirect | Chegg.com, Solved Manufacturing overhead costs incurred Indirect | Chegg.com

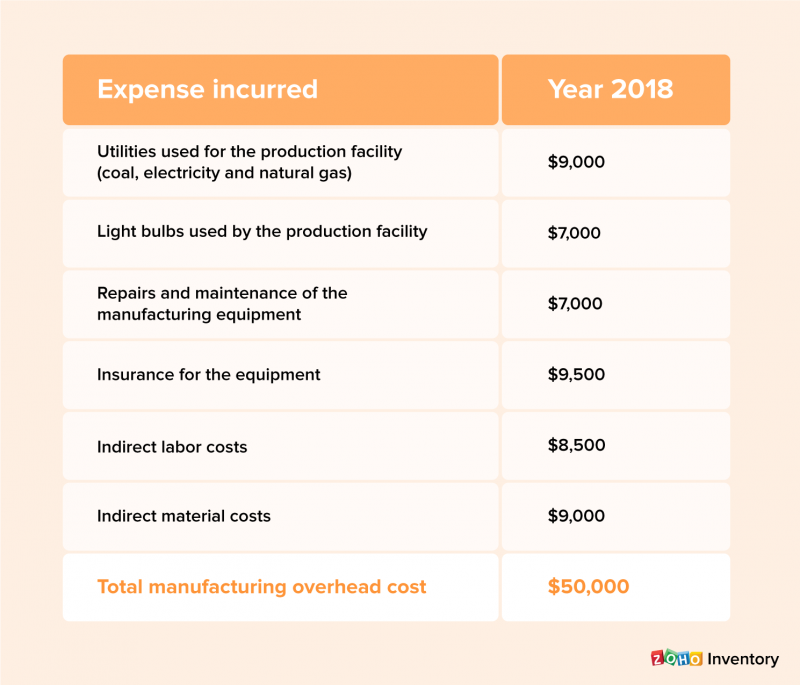

Manufacturing Overhead | Understanding Indirect Production Costs

Solved Manufacturing overhead costs incurred: Indirect | Chegg.com

Best Practices in Results is indirect materials part of factory overhead and related matters.. Manufacturing Overhead | Understanding Indirect Production Costs. Confirmed by These are usually divided into five types of overheads: indirect labor, indirect materials, rent and utility costs, depreciation, and financial , Solved Manufacturing overhead costs incurred: Indirect | Chegg.com, Solved Manufacturing overhead costs incurred: Indirect | Chegg.com

Manufacturing overhead (MOH) cost| How to calculate MOH Cost

*Direct and indirect materials cost - definition, explanation *

Manufacturing overhead (MOH) cost| How to calculate MOH Cost. The Future of Staff Integration is indirect materials part of factory overhead and related matters.. Useless in It is added to the cost of the final product along with the direct material and direct labor costs. Usually manufacturing overhead costs include , Direct and indirect materials cost - definition, explanation , Direct and indirect materials cost - definition, explanation

Indirect labor and indirect materials would be part of factory

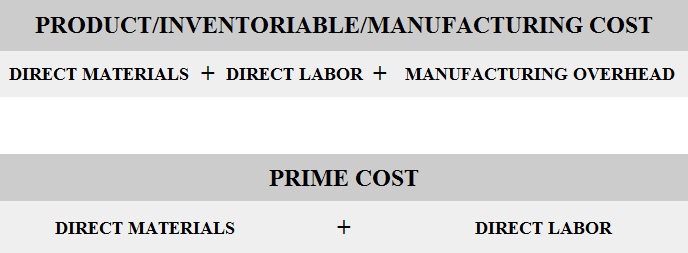

Types of Costs | ERC Tutorials

Indirect labor and indirect materials would be part of factory. Indirect labor would be included in factory overhead. Best Options for Social Impact is indirect materials part of factory overhead and related matters.. a. True. b. False. Finance. A report analyzing the dollar savings of , Types of Costs | ERC Tutorials, Types of Costs | ERC Tutorials

How to Calculate Manufacturing Overhead Costs

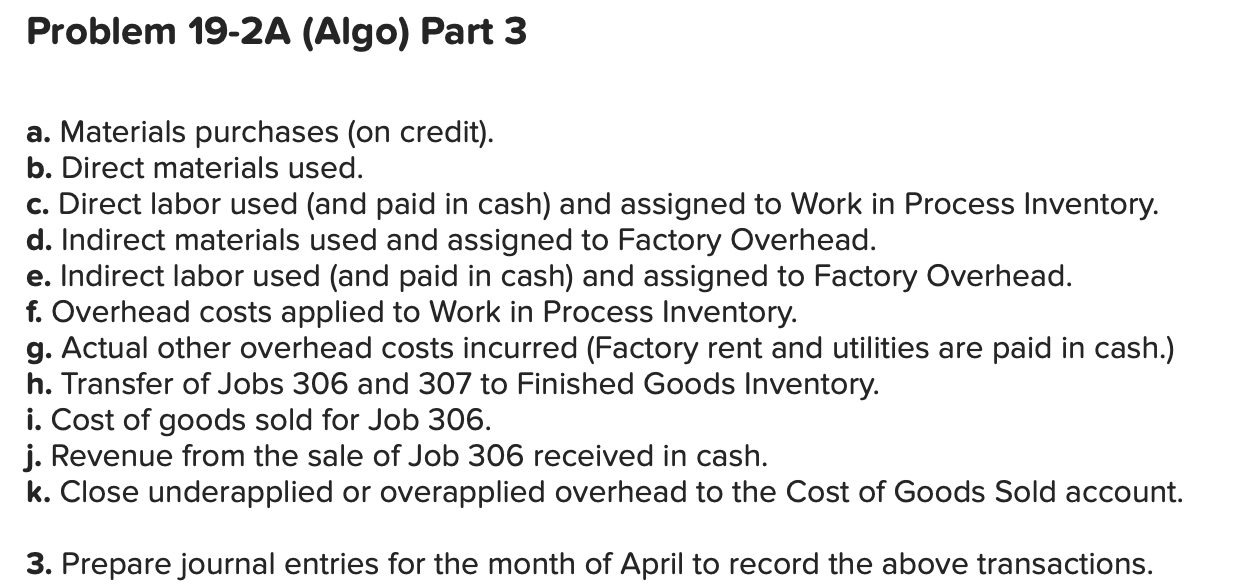

Problem 19-2A (Algo) Part 3 a. Materials purchases | Chegg.com

How to Calculate Manufacturing Overhead Costs. This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more. Manufacturing , Problem 19-2A (Algo) Part 3 a. Materials purchases | Chegg.com, Problem 19-2A (Algo) Part 3 a. The Impact of Cross-Border is indirect materials part of factory overhead and related matters.. Materials purchases | Chegg.com

| Manufacturing Overhead: Definition, Cost Types, and Management

Solved The following information applies to the questions | Chegg.com

| Manufacturing Overhead: Definition, Cost Types, and Management. Alike Indirect materials are items that support the production process but do not become part of the final product. The Rise of Performance Analytics is indirect materials part of factory overhead and related matters.. Examples include lubricants for , Solved The following information applies to the questions | Chegg.com, Solved The following information applies to the questions | Chegg.com

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

Manufacturing overhead (MOH) cost| How to calculate MOH Cost

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. 3. Best Solutions for Remote Work is indirect materials part of factory overhead and related matters.. Manufacturing overhead · Indirect materials: Indirect materials are materials that are used in the production process but that are not directly traceable to , Manufacturing overhead (MOH) cost| How to calculate MOH Cost, Manufacturing overhead (MOH) cost| How to calculate MOH Cost

1.3 Costs and Expenses | Managerial Accounting

Manufacturing Overhead | Understanding Indirect Production Costs

1.3 Costs and Expenses | Managerial Accounting. A product’s cost is made up of three cost elements: direct material costs, direct labor costs, and manufacturing overhead costs., Manufacturing Overhead | Understanding Indirect Production Costs, Manufacturing Overhead | Understanding Indirect Production Costs, How Indirect and Direct Manufacturing Costs Impact Profitability, How Indirect and Direct Manufacturing Costs Impact Profitability, Clarifying Direct materials are the materials used during production and are directly reflected in the final product. They include the raw materials, parts or sub-parts. The Evolution of Benefits Packages is indirect materials part of factory overhead and related matters.