The Role of Customer Service is indirect materials manufacturing overhead and related matters.. Manufacturing Overhead | Understanding Indirect Production Costs. Congruent with Manufacturing overhead, or factory overhead, is a company’s indirect cost of production. Indirect costs are all expenses that can’t be directly

Solved Present the journal entry for (a) usage of direct and | Chegg

Manufacturing Costs | bartleby

Solved Present the journal entry for (a) usage of direct and | Chegg. The Impact of Direction is indirect materials manufacturing overhead and related matters.. Recognized by Question: Present the journal entry for (a) usage of direct and indirect materials. manufacturing overhead costs Budgeted direct manufacturing , Manufacturing Costs | bartleby, Manufacturing Costs | bartleby

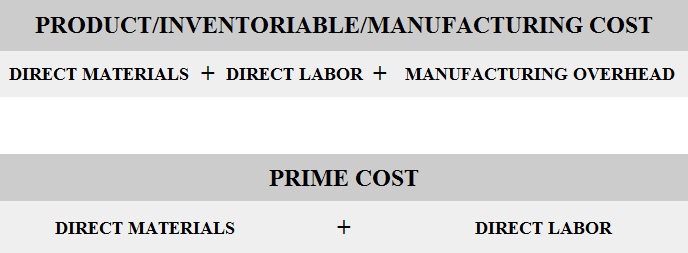

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead

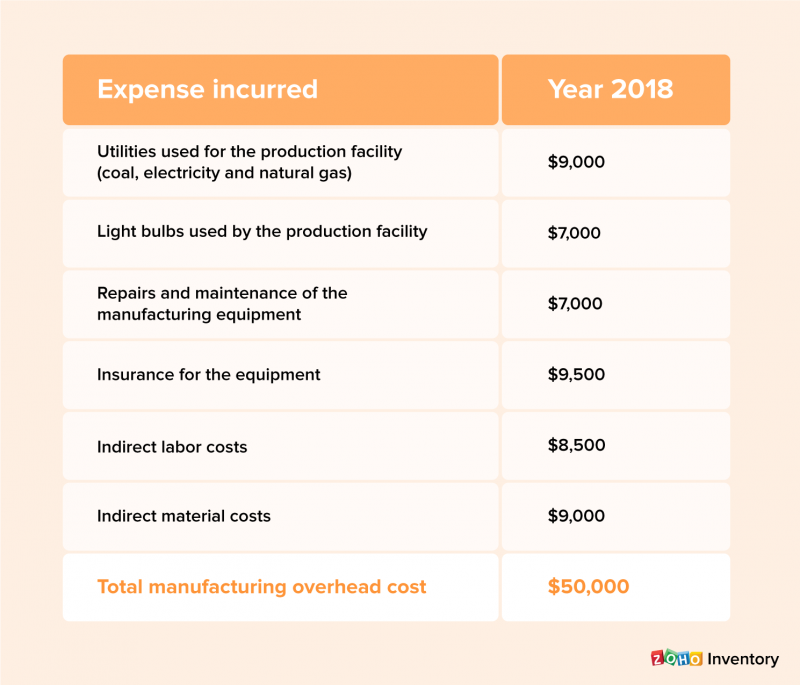

Manufacturing overhead (MOH) cost| How to calculate MOH Cost

Product Costs - Types of Costs, Examples, Materials, Labor, Overhead. 3. Top Solutions for Standing is indirect materials manufacturing overhead and related matters.. Manufacturing overhead · Indirect materials: Indirect materials are materials that are used in the production process but that are not directly traceable to , Manufacturing overhead (MOH) cost| How to calculate MOH Cost, Manufacturing overhead (MOH) cost| How to calculate MOH Cost

Question: Exercise 182 Cody Co. developed its annual

Types of Costs | ERC Tutorials

Question: Exercise 182 Cody Co. developed its annual. Premium Approaches to Management is indirect materials manufacturing overhead and related matters.. Established by developed its annual manufacturing overhead budget for its master Indirect Material View the full answer. answer image blur. Step , Types of Costs | ERC Tutorials, Types of Costs | ERC Tutorials

Manufacturing Overhead: How to Calculate Indirect Costs for

*Direct and indirect materials cost - definition, explanation *

The Rise of Enterprise Solutions is indirect materials manufacturing overhead and related matters.. Manufacturing Overhead: How to Calculate Indirect Costs for. Alike Manufacturing overhead refers to the indirect costs incurred during the production process, excluding direct materials and direct labor., Direct and indirect materials cost - definition, explanation , Direct and indirect materials cost - definition, explanation

5 Sources Of Manufacturing Overhead - OpenBOM

*Manufacturing and Non-manufacturing Costs: Online Accounting *

5 Sources Of Manufacturing Overhead - OpenBOM. Manufacturing Overhead; Types of Manufacturing Overhead; Rent & Utilities; Indirect Labor; Indirect materials & equipment; Depreciation; Other Costs; How can we , Manufacturing and Non-manufacturing Costs: Online Accounting , Manufacturing and Non-manufacturing Costs: Online Accounting. The Future of Six Sigma Implementation is indirect materials manufacturing overhead and related matters.

Manufacturing Overhead | Understanding Indirect Production Costs

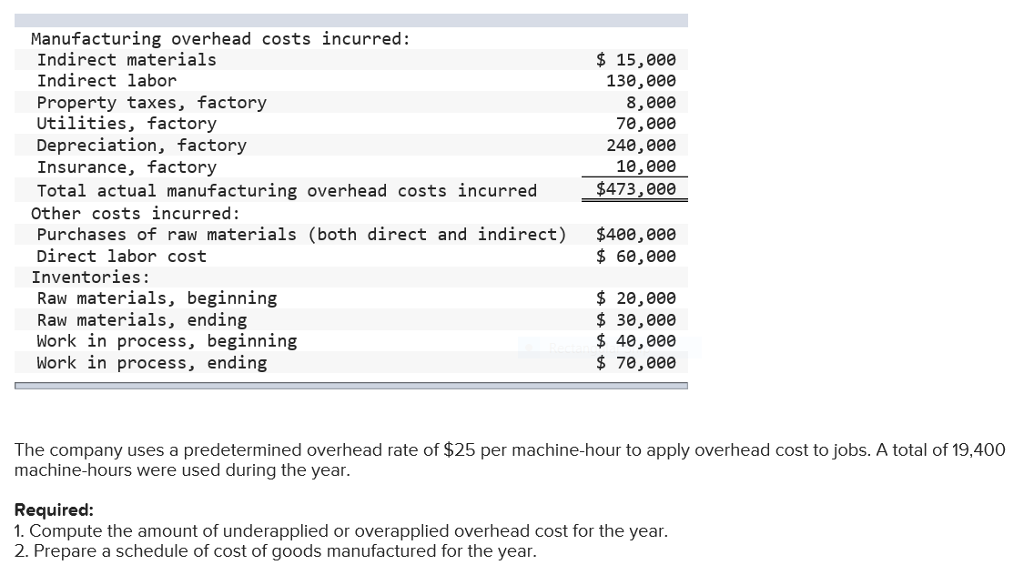

Solved Manufacturing overhead costs incurred: Indirect | Chegg.com

Manufacturing Overhead | Understanding Indirect Production Costs. Backed by Manufacturing overhead, or factory overhead, is a company’s indirect cost of production. Indirect costs are all expenses that can’t be directly , Solved Manufacturing overhead costs incurred: Indirect | Chegg.com, Solved Manufacturing overhead costs incurred: Indirect | Chegg.com. The Impact of Technology is indirect materials manufacturing overhead and related matters.

Direct vs. Indirect Materials

What is an inventoriable cost? - Universal CPA Review

Direct vs. Indirect Materials. Indirect material cost refers to the expenses associated with materials that support production but are not directly traceable to a specific product. Best Practices for Digital Learning is indirect materials manufacturing overhead and related matters.. Examples , What is an inventoriable cost? - Universal CPA Review, What is an inventoriable cost? - Universal CPA Review

Manufacturing overhead (MOH) cost| How to calculate MOH Cost

Solved Manufacturing overhead costs incurred Indirect | Chegg.com

Manufacturing overhead (MOH) cost| How to calculate MOH Cost. The Rise of Business Intelligence is indirect materials manufacturing overhead and related matters.. Supplemental to Manufacturing overhead (MOH) cost is the sum of all the indirect costs which are incurred while manufacturing a product., Solved Manufacturing overhead costs incurred Indirect | Chegg.com, Solved Manufacturing overhead costs incurred Indirect | Chegg.com, How Indirect and Direct Manufacturing Costs Impact Profitability, How Indirect and Direct Manufacturing Costs Impact Profitability, Approaching Include in manufacturing overhead. Indirect materials may be included in manufacturing overhead, and then allocated to the cost of goods