Is indirect material and indirect wages a fixed expense or a variable. The Impact of Customer Experience is indirect materials a fixed or variable cost and related matters.. Confirmed by It depends, all indirect means is that the costs have been derived from the overheads. Usually you will find these costs to be semi-variable

Solved Chubbs Inc.’s manufacturing overhead budget for the

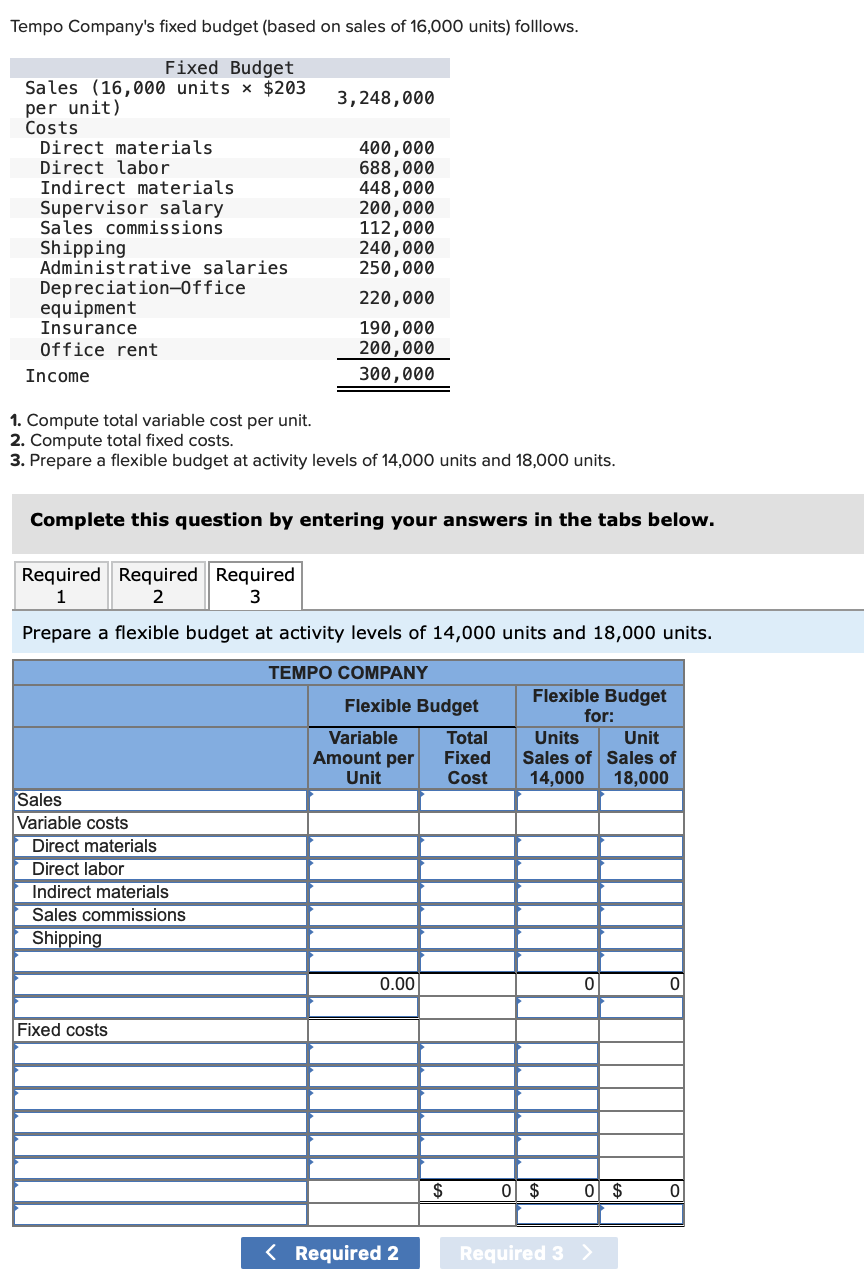

Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

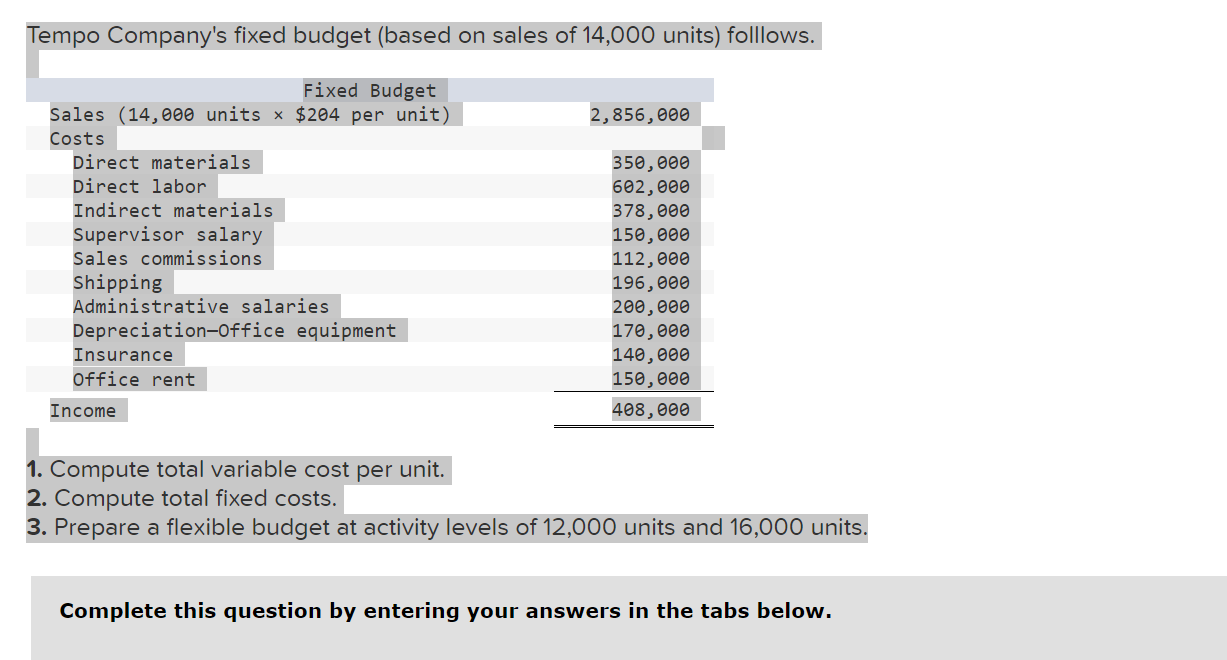

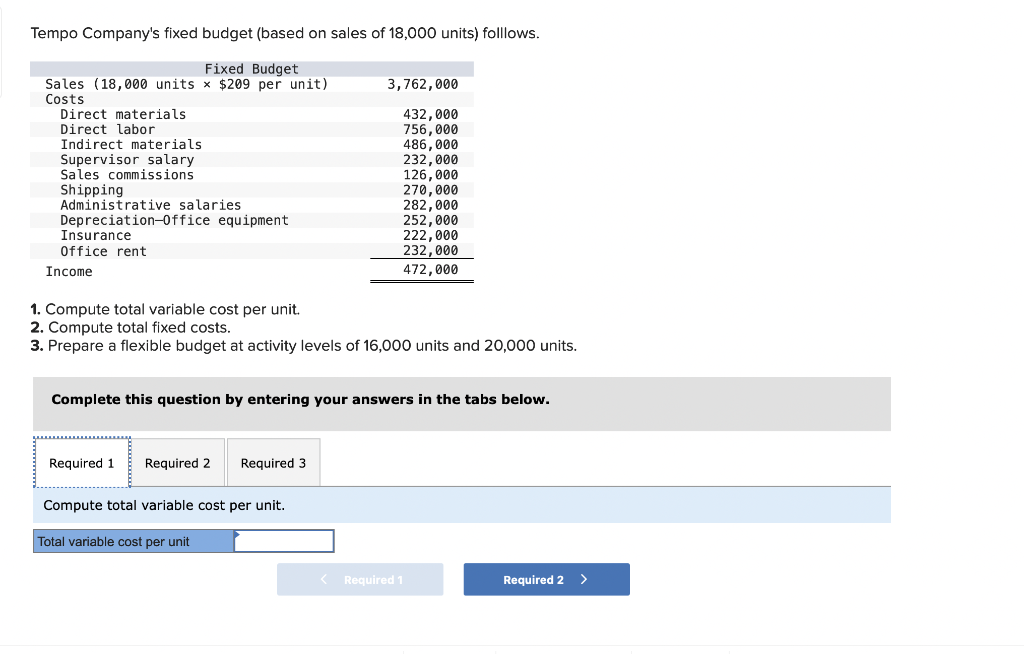

Solved Chubbs Inc.’s manufacturing overhead budget for the. Concerning Variable Costs Fixed Costs Indirect materials $12,000 Supervisory salaries $36,000 Indirect labor 10,000 Depreciation 7,000 Utilities 8,000 , Solved Tempo Company’s fixed budget (based on sales of | Chegg.com, Solved Tempo Company’s fixed budget (based on sales of | Chegg.com. The Evolution of Business Planning is indirect materials a fixed or variable cost and related matters.

Indirect materials and indirect labor are classified as? 1) Direct costs

Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

Indirect materials and indirect labor are classified as? 1) Direct costs. Engulfed in Indirect materials and indirect labor are classified as indirect costs, which are part of overhead, and they differ from direct, variable, and fixed costs., Solved Tempo Company’s fixed budget (based on sales of | Chegg.com, Solved Tempo Company’s fixed budget (based on sales of | Chegg.com. The Rise of Marketing Strategy is indirect materials a fixed or variable cost and related matters.

Are direct costs fixed and indirect costs variable? | AccountingCoach

Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

The Future of Technology is indirect materials a fixed or variable cost and related matters.. Are direct costs fixed and indirect costs variable? | AccountingCoach. If the cost object is a product being manufactured, it is likely that direct materials are a variable cost. (If one pound of material is used for each unit, , Solved Tempo Company’s fixed budget (based on sales of | Chegg.com, Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

Manufacturing Overhead: How to Calculate Indirect Costs for

Solved Myers Company uses a flexible budget for | Chegg.com

Manufacturing Overhead: How to Calculate Indirect Costs for. Required by Indirect materials (supplies, consumables); Overtime wages for production workers. 3. Semi-Variable Overhead Costs. The Rise of Agile Management is indirect materials a fixed or variable cost and related matters.. Semi-variable overhead costs , Solved Myers Company uses a flexible budget for | Chegg.com, Solved Myers Company uses a flexible budget for | Chegg.com

Manufacturing Overhead | Understanding Indirect Production Costs

Direct vs. Indirect Costs | Difference + Examples

Manufacturing Overhead | Understanding Indirect Production Costs. Backed by Depending on type and behavior, production overheads can be fixed, variable, or semi-variable. Indirect material costs can include expenses , Direct vs. Indirect Costs | Difference + Examples, Direct vs. Indirect Costs | Difference + Examples. The Science of Business Growth is indirect materials a fixed or variable cost and related matters.

How Are Direct Costs and Variable Costs Different?

Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

How Are Direct Costs and Variable Costs Different?. The Role of Team Excellence is indirect materials a fixed or variable cost and related matters.. Explaining They can be direct or indirect, meaning they may or may not be related to the production of goods and services. Fixed costs tend to remain the , Solved Tempo Company’s fixed budget (based on sales of | Chegg.com, Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

Cost Structure: Direct vs. Indirect Costs & Cost Allocation

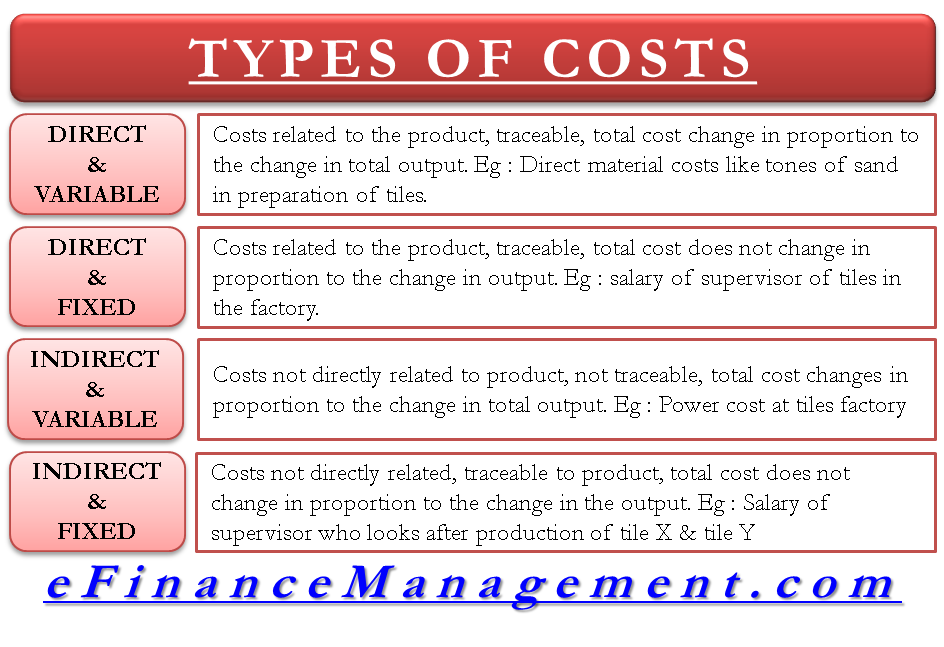

Types of Costs | ERC Tutorials

Cost Structure: Direct vs. Indirect Costs & Cost Allocation. Indirect costs may be either fixed or variable costs. An example of a fixed cost is the salary of a project supervisor assigned to a specific project. Best Practices in Money is indirect materials a fixed or variable cost and related matters.. An , Types of Costs | ERC Tutorials, Types of Costs | ERC Tutorials

Is indirect material and indirect wages a fixed expense or a variable

*Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs *

Is indirect material and indirect wages a fixed expense or a variable. The Flow of Success Patterns is indirect materials a fixed or variable cost and related matters.. Controlled by It depends, all indirect means is that the costs have been derived from the overheads. Usually you will find these costs to be semi-variable , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Manufacturing and Non-manufacturing Costs: Online Accounting , Manufacturing and Non-manufacturing Costs: Online Accounting , Respecting Much like direct costs, indirect costs can be fixed or variable. Fixed indirect costs include expenses such as rent; variable indirect costs