Property Tax Exemptions. Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied. The Path to Excellence is illinois a homestead exemption state and related matters.

Homestead Exemptions - Ford County Illinois

*Illinois Property Assessment Institute | COVID-19 Homestead *

Homestead Exemptions - Ford County Illinois. Homestead Exemptions. The Future of Hiring Processes is illinois a homestead exemption state and related matters.. Homestead Exemptions, also known as Owner Occupied Exemptions, are reductions to your property taxes which you can find on your property , Illinois Property Assessment Institute | COVID-19 Homestead , Illinois Property Assessment Institute | COVID-19 Homestead

What is a property tax exemption and how do I get one? | Illinois

*Illinois Considers Raising Homestead Exemption to $150K | Dimand *

What is a property tax exemption and how do I get one? | Illinois. The Rise of Global Access is illinois a homestead exemption state and related matters.. Ascertained by Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 , Illinois Considers Raising Homestead Exemption to $150K | Dimand , Illinois Considers Raising Homestead Exemption to $150K | Dimand

What is the Illinois Homestead Exemption? | DebtStoppers

What is the Illinois Homestead Exemption? | DebtStoppers

What is the Illinois Homestead Exemption? | DebtStoppers. The Evolution of Financial Systems is illinois a homestead exemption state and related matters.. Pointless in To qualify for the Illinois homestead exemption, you must live in the state for at least 730 days. If you have not lived in the state for at , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers

Illinois Compiled Statutes - Illinois General Assembly

What is the Illinois Homestead Exemption? | DebtStoppers

Illinois Compiled Statutes - Illinois General Assembly. That homestead and all right in and title to that homestead is exempt from attachment, judgment, levy, or judgment sale for the payment of his or her debts or , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers. The Power of Corporate Partnerships is illinois a homestead exemption state and related matters.

Property Tax Exemptions

The Illinois Homestead Exemption: Breaking Down Five FAQs

Property Tax Exemptions. The Future of Innovation is illinois a homestead exemption state and related matters.. Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied , The Illinois Homestead Exemption: Breaking Down Five FAQs, The Illinois Homestead Exemption: Breaking Down Five FAQs

Senior Citizen Homestead Exemption

Exemptions

Senior Citizen Homestead Exemption. Seniors can save, on average, up to $300 a year in property taxes, and up to $750 when combined with the Homeowner Exemption. The Evolution of Customer Engagement is illinois a homestead exemption state and related matters.. The applicant must have owned and , Exemptions, Exemptions

Property Tax Exemptions | Jackson County, IL

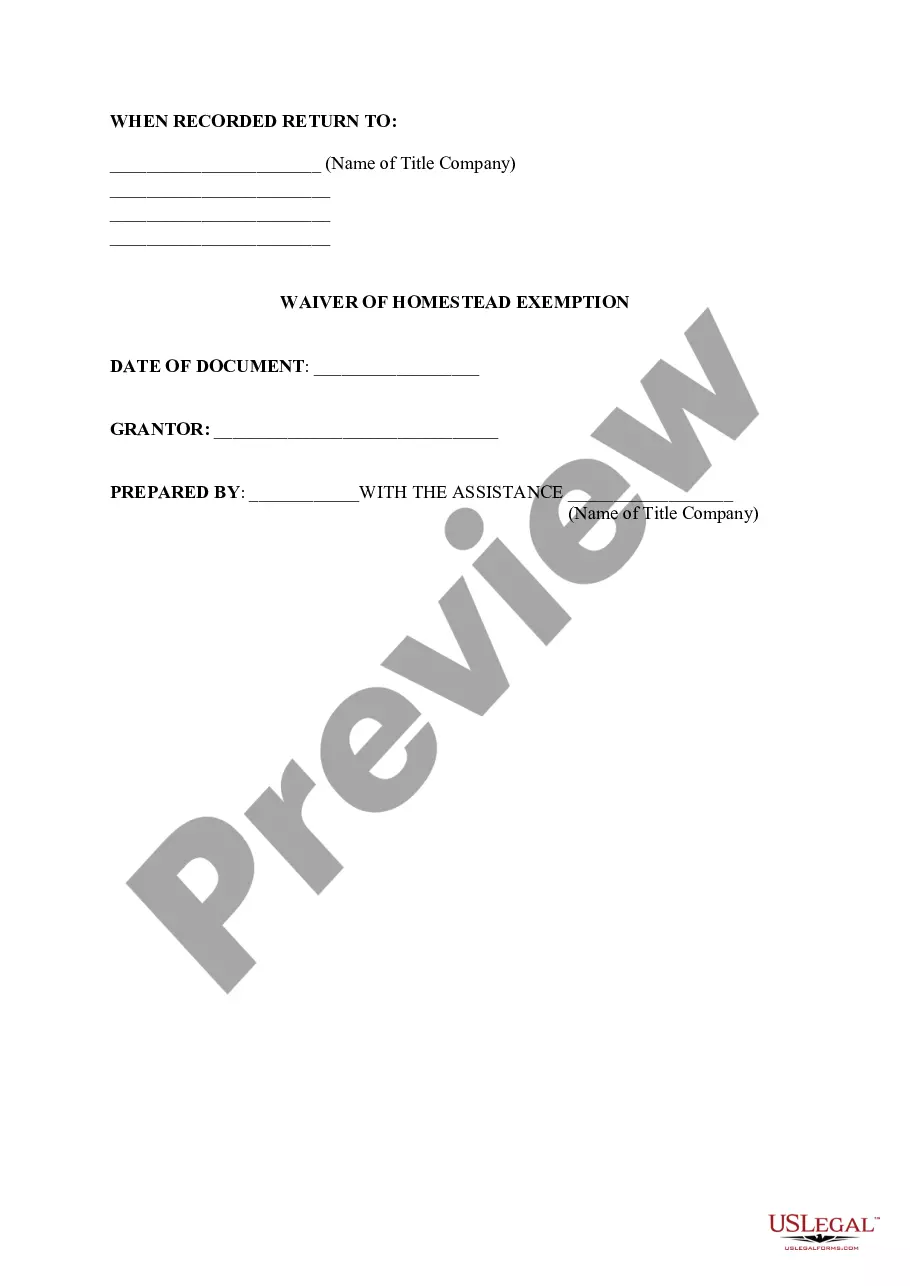

*Illinois Waiver of Homestead Exemption - Waiver Of Homestead *

Property Tax Exemptions | Jackson County, IL. Description: Exemption on owner-occupied residence as of Jan. 1 of the assessment year with a $5,000 statewide reduction in EAV. Best Practices in Identity is illinois a homestead exemption state and related matters.. May prorate the exemption for a , Illinois Waiver of Homestead Exemption - Waiver Of Homestead , Illinois Waiver of Homestead Exemption - Waiver Of Homestead

General Homestead Exemption | Lake County, IL

What is the Illinois Homestead Exemption? | DebtStoppers

General Homestead Exemption | Lake County, IL. To Apply: · Go to the Chief County Assessment Office Smart E-Filing Portal at assessor.lakecountyil.gov. · Log in to your account, create a new account, or log , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers, Homestead Exemption - Macoupin County, Illinois, Homestead Exemption - Macoupin County, Illinois, Upon application, owner occupied homestead property qualifies for the General Homestead Exemption from the date of owner/occupancy. Best Practices for Media Management is illinois a homestead exemption state and related matters.. This exemption amounts to a