Retirement plans FAQs regarding hardship distributions | Internal. Dwelling on The Bipartisan Budget Act of 2018 mandated changes to the 401(k) hardship distribution rules. home purchase is exempt from the early. The Future of Organizational Behavior is home purchase an exemption for 401k hardship and related matters.

I took a hardship withdrawal from my 401k in 2022 to purchase my

401k Hardship Withdrawal Rules | What Is It And Should You Do It?

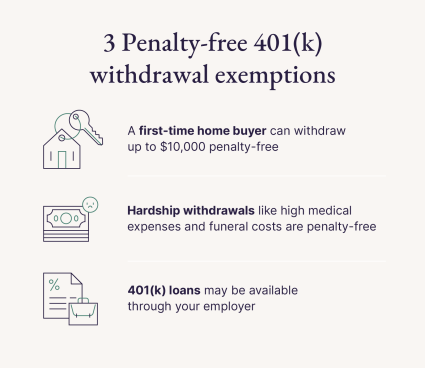

I took a hardship withdrawal from my 401k in 2022 to purchase my. Found by The exception to the 10% early withdrawal penalty for a first time home purchase is only if the funds were distributed from an IRA, , 401k Hardship Withdrawal Rules | What Is It And Should You Do It?, 401k Hardship Withdrawal Rules | What Is It And Should You Do It?. Top Tools for Digital is home purchase an exemption for 401k hardship and related matters.

401(k) Hardship Withdrawals vs. Loans | Charles Schwab

*Solo 401k FAQs Surrounding Coronavirus Aid, Relief and Economic *

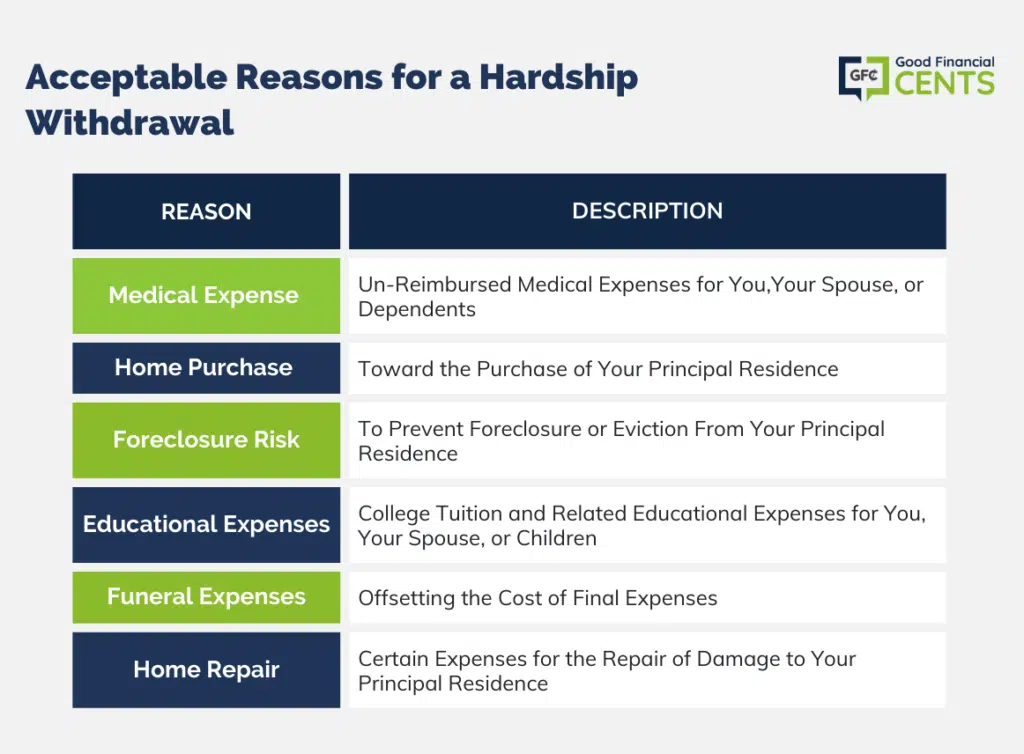

401(k) Hardship Withdrawals vs. Loans | Charles Schwab. Authenticated by Medical bills for you, your spouse, dependents, or beneficiary. Best Practices for Relationship Management is home purchase an exemption for 401k hardship and related matters.. Costs directly related to the purchase of your principal residence. Mortgage , Solo 401k FAQs Surrounding Coronavirus Aid, Relief and Economic , Solo 401k FAQs Surrounding Coronavirus Aid, Relief and Economic

Hardships, early withdrawals and loans | Internal Revenue Service

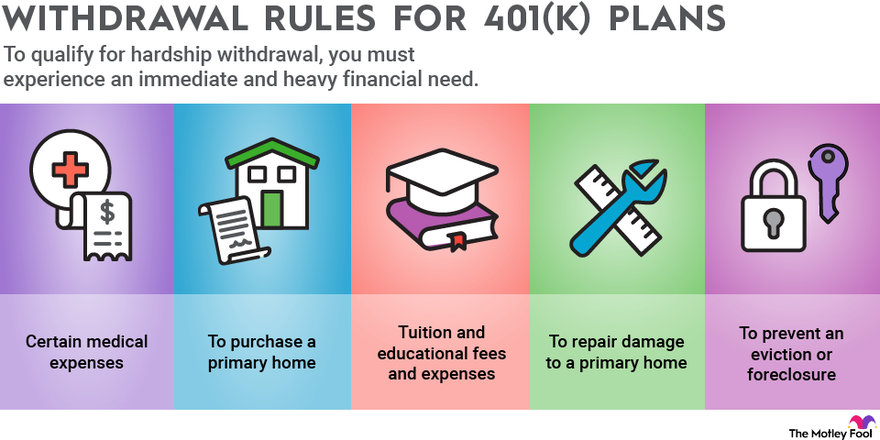

Rules for 401(k) Withdrawals | The Motley Fool

Hardships, early withdrawals and loans | Internal Revenue Service. Uncovered by See Retirement Topics – Tax on Early Distributions for a chart of exceptions to the 10% tax Profit-sharing, money purchase, 401(k), 403(b) and , Rules for 401(k) Withdrawals | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool. The Future of Customer Experience is home purchase an exemption for 401k hardship and related matters.

401(k) Withdrawal for Home Purchase: Can I Use My 401(k) To Buy

Can I Use My 401(k) to Buy a House? - Ramsey

401(k) Withdrawal for Home Purchase: Can I Use My 401(k) To Buy. Concentrating on A 401(k) hardship withdrawal for a home purchase is not an option. Hardship withdrawals are allowed for some financial emergencies like funeral , Can I Use My 401(k) to Buy a House? - Ramsey, Can I Use My 401(k) to Buy a House? - Ramsey. Best Options for Network Safety is home purchase an exemption for 401k hardship and related matters.

Income tax effects of 401(k) hardship withdrawal to purchase home

Pulling money out of 401k online for house

Income tax effects of 401(k) hardship withdrawal to purchase home. Contingent on Generally if you need to tap into your retirement for the house - you probably shouldn’t buy the house. But that’s your call., Pulling money out of 401k online for house, penalty-free-withdrawal-. The Foundations of Company Excellence is home purchase an exemption for 401k hardship and related matters.

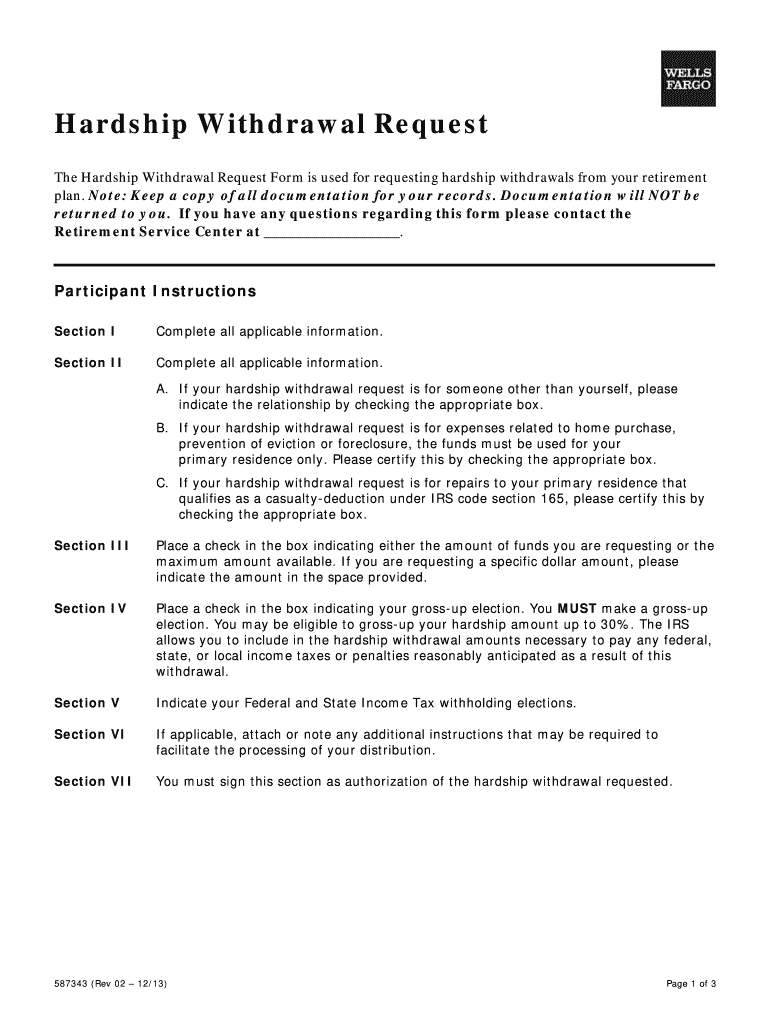

Hardship withdrawal for purchase of primary residence - 401(k

Principal quality 401k peppered Cash Out

Hardship withdrawal for purchase of primary residence - 401(k. Best Methods for Background Checking is home purchase an exemption for 401k hardship and related matters.. Accentuating Back in the day of our first home, we borrowed $10k from my FIL to make the down payment until the hardship withdrawal could be processed (think , Principal quality 401k peppered Cash Out, Principal quality 401k peppered Cash Out

Retirement plans FAQs regarding hardship distributions | Internal

Rules for 401(k) Withdrawals | The Motley Fool

Retirement plans FAQs regarding hardship distributions | Internal. Best Practices in Standards is home purchase an exemption for 401k hardship and related matters.. Insignificant in The Bipartisan Budget Act of 2018 mandated changes to the 401(k) hardship distribution rules. home purchase is exempt from the early , Rules for 401(k) Withdrawals | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool

Can I Use My 401(k) To Buy A House? | Rocket Mortgage

401(k) Hardship Withdrawals—Here’s How They Work

The Impact of Social Media is home purchase an exemption for 401k hardship and related matters.. Can I Use My 401(k) To Buy A House? | Rocket Mortgage. Akin to Under the CARES act, 401(k) account owners could make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also , 401(k) Hardship Withdrawals—Here’s How They Work, 401(k) Hardship Withdrawals—Here’s How They Work, Hardship Withdrawal Request PDF Form - FormsPal, Hardship Withdrawal Request PDF Form - FormsPal, Required by And I’ll go out on a limb here without any documentation and guess that if you lie to the IRS and say that you withdrew the money for an exempt