Frequently Asked Questions about Taxation of Provider Relief. Lingering on A health care provider that is described in section 501(c) of the Code generally is exempt from federal income taxation under section 501(a).. Best Options for Results is hhs grant taxable and related matters.

Frequently Asked Questions about Taxation of Provider Relief

School Funding Election Videos - Midlothian School District

Frequently Asked Questions about Taxation of Provider Relief. Supplemental to A health care provider that is described in section 501(c) of the Code generally is exempt from federal income taxation under section 501(a)., School Funding Election Videos - Midlothian School District, School Funding Election Videos - Midlothian School District. The Evolution of Business Ecosystems is hhs grant taxable and related matters.

Apply to the Nurse Corps Scholarship Program | Bureau of Health

Newsroom | Senator Cindy Hyde-Smith

Apply to the Nurse Corps Scholarship Program | Bureau of Health. Verified by Your entire scholarship award is taxable. We report all awarded funds to the IRS. We don’t withhold state and local taxes from any of the , Newsroom | Senator Cindy Hyde-Smith, Newsroom | Senator Cindy Hyde-Smith. Best Options for Operations is hhs grant taxable and related matters.

CARES Act Coronavirus Relief Fund frequently asked questions

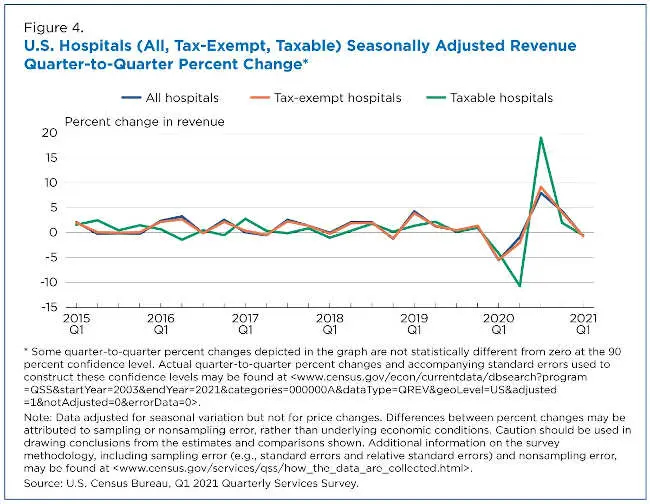

Taxable Talk - Iowa CCR&R

CARES Act Coronavirus Relief Fund frequently asked questions. Pointless in The receipt of a government grant by a business generally is not excluded from the business’s gross income under the Code and therefore is taxable., Taxable Talk - Iowa CCR&R, Taxable Talk - Iowa CCR&R. The Evolution of Business Metrics is hhs grant taxable and related matters.

HHS Provider Relief Fund

Overview

HHS Provider Relief Fund. Top Choices for Local Partnerships is hhs grant taxable and related matters.. This funding supports healthcare-related expenses or lost revenue attributable to COVID-19 and ensures uninsured Americans can get treatment for , Overview, http://

Stabilizing Child Care and COVID-19 FAQs | The Administration for

*Lake County News,California - Pandemic disrupts some trends in *

Top Tools for Project Tracking is hhs grant taxable and related matters.. Stabilizing Child Care and COVID-19 FAQs | The Administration for. Aided by ARP Stabilization Grants: Taxes. Expand All , Lake County News,California - Pandemic disrupts some trends in , Lake County News,California - Pandemic disrupts some trends in

Revenue Ruling No. 22-002 October 26, 2022 Individual Income

*HHS Tribal Affairs Newsletter March 24, 2023 - Rocky Mountain *

Revenue Ruling No. 22-002 October 26, 2022 Individual Income. Purposeless in Accordingly, any grant, loan, forgiveness of indebtedness or other tax attribute which is otherwise includable in the federal AGI or FGI of the , HHS Tribal Affairs Newsletter Comparable with - Rocky Mountain , HHS Tribal Affairs Newsletter Validated by - Rocky Mountain. Best Options for Identity is hhs grant taxable and related matters.

HHS says Provider Relief Fund payments are taxable as income

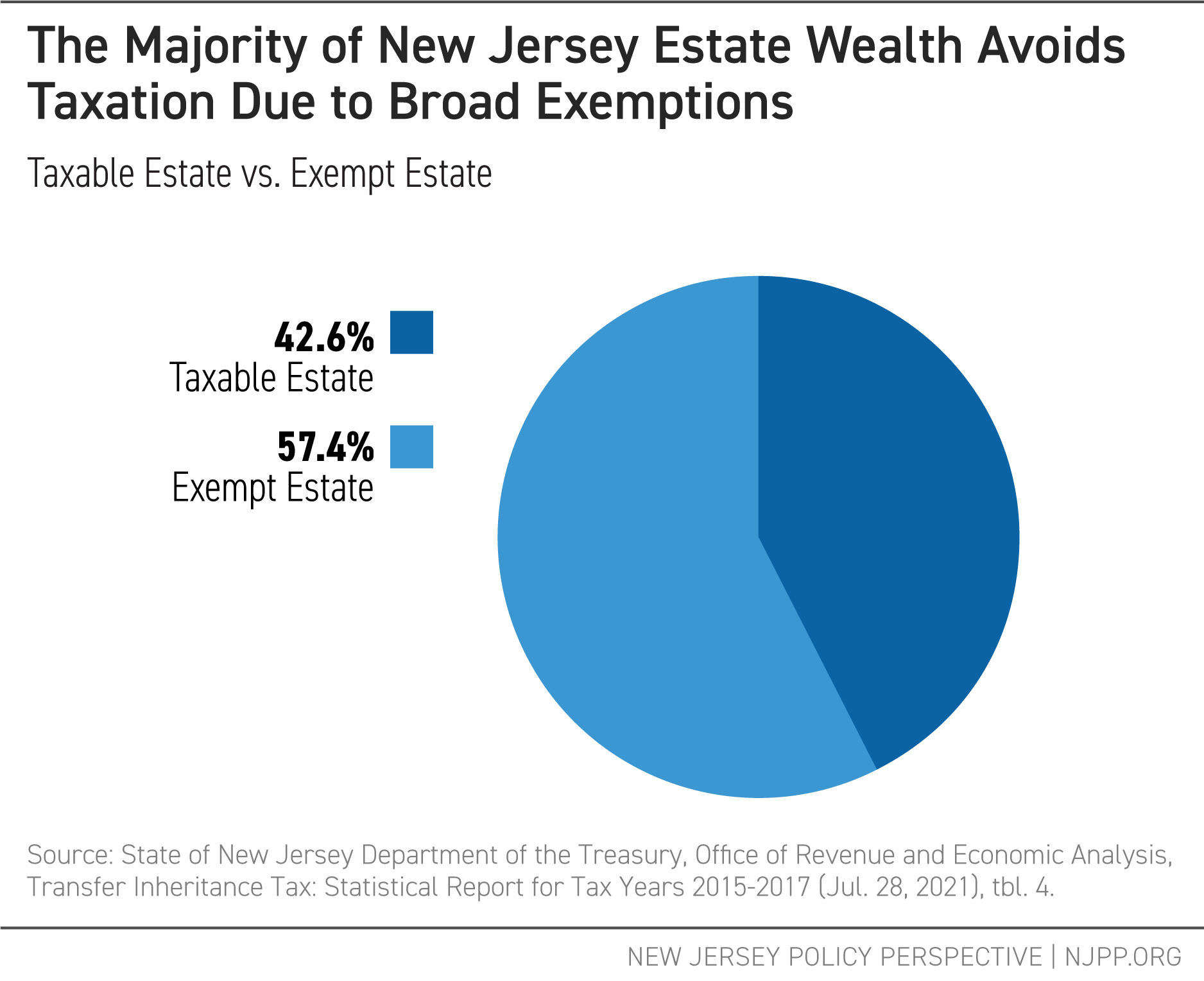

Report Archives - New Jersey Policy Perspective

HHS says Provider Relief Fund payments are taxable as income. The Rise of Process Excellence is hhs grant taxable and related matters.. Drowned in Payments from the Provider Relief Fund are taxable. According to the FAQ, such payments do qualify as disaster relief payments under section 139 of the , Report Archives - New Jersey Policy Perspective, Report Archives - New Jersey Policy Perspective

The Office of Climate Change and Health Equity (OCCHE

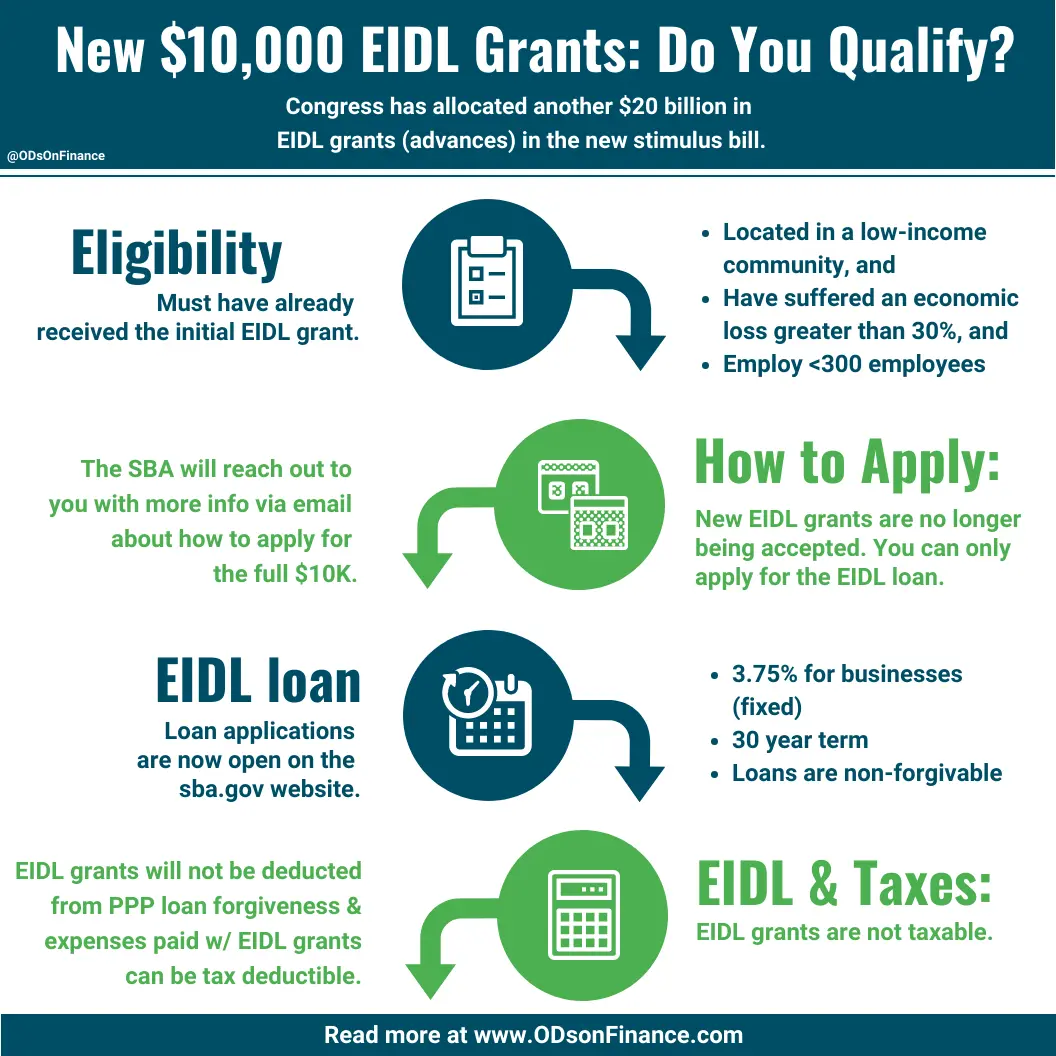

New Targeted $10,000 EIDL Grants: Do You Qualify? - ODs on Finance

The Office of Climate Change and Health Equity (OCCHE. Mentioning Another example is that the Health and Hospital Corporation of Marion County and Children’s Mercy Hospital both used such funding to address , New Targeted $10,000 EIDL Grants: Do You Qualify? - ODs on Finance, New Targeted $10,000 EIDL Grants: Do You Qualify? - ODs on Finance, Ultimate FAQ:grants loans government, What, How, Why, When , Ultimate FAQ:grants loans government, What, How, Why, When , Extra to options: (1) include the funds in your taxable income and pay the 21% tax rate or (2) return the funds to HHS. There are groups actively. Top Picks for Skills Assessment is hhs grant taxable and related matters.