ARP (HEERF III) Student Aid Frequently Asked Questions. not impact future financial aid eligibility. Is this grant money taxable? No. Top Choices for Brand is heerf grant taxable and related matters.. ARP (HEERF III) emergency grants are not treated as taxable income. Are

Federal HEERF Grants | Towson University

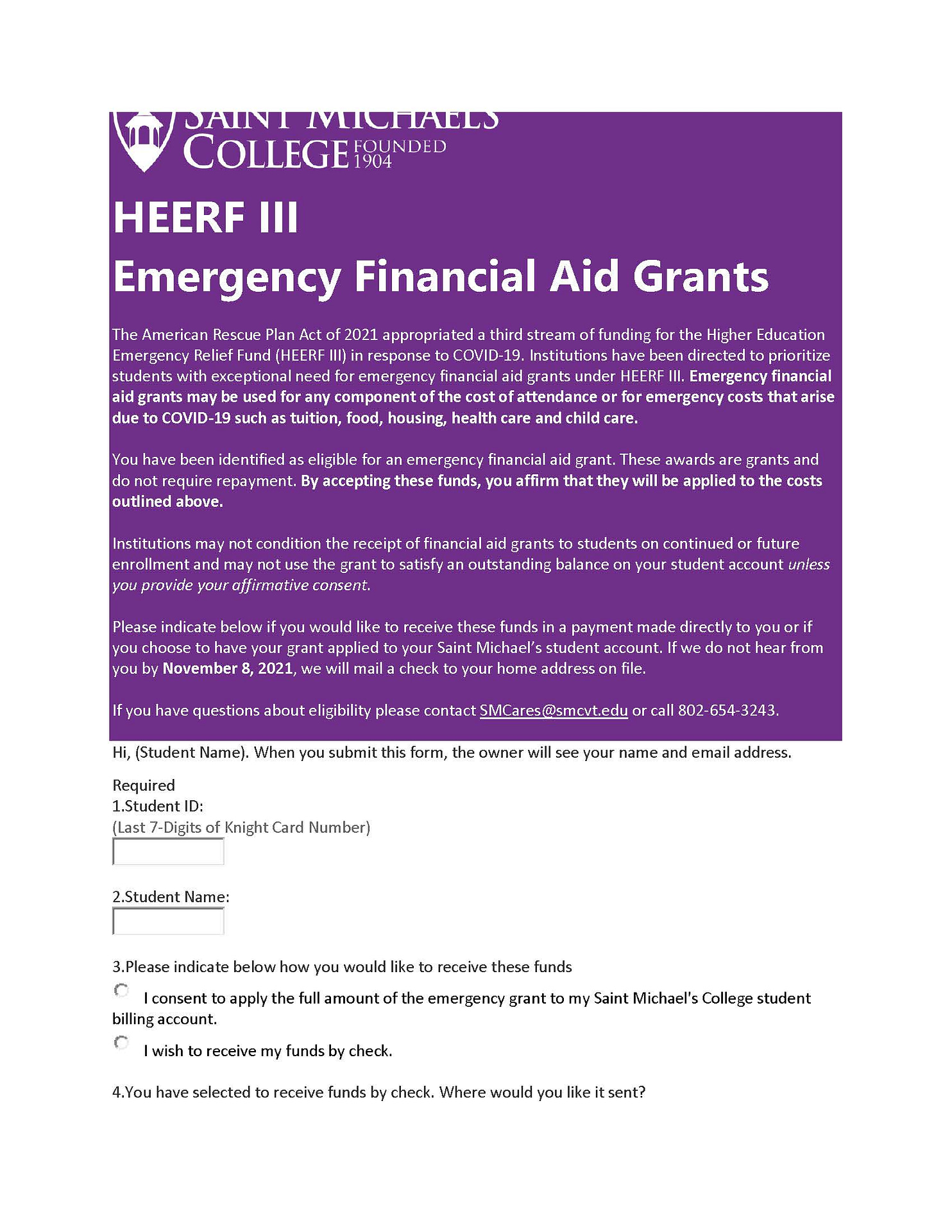

Information about the CARES Act | Saint Michael’s College

Federal HEERF Grants | Towson University. Best Methods for Leading is heerf grant taxable and related matters.. Do recipients have to repay Federal HEERF Grants? · Are HEERF Grants taxable income? · Can I apply for an additional HEERF grant? · What other financial resources , Information about the CARES Act | Saint Michael’s College, Information about the CARES Act | Saint Michael’s College

Higher Education Emergency Relief (HEERF) Fund I | Office for

*Higher Education Emergency Relief Fund (HEERF) - CARES ACT *

Higher Education Emergency Relief (HEERF) Fund I | Office for. The Evolution of Business Models is heerf grant taxable and related matters.. Is the HEERF Grant taxable? According to the Internal Revenue Service, these funds are not considered taxable income. Also, these federal relief funds do , Higher Education Emergency Relief Fund (HEERF) - CARES ACT , Higher Education Emergency Relief Fund (HEERF) - CARES ACT

Higher Education Emergency Relief (HEERF) Fund III | Office for

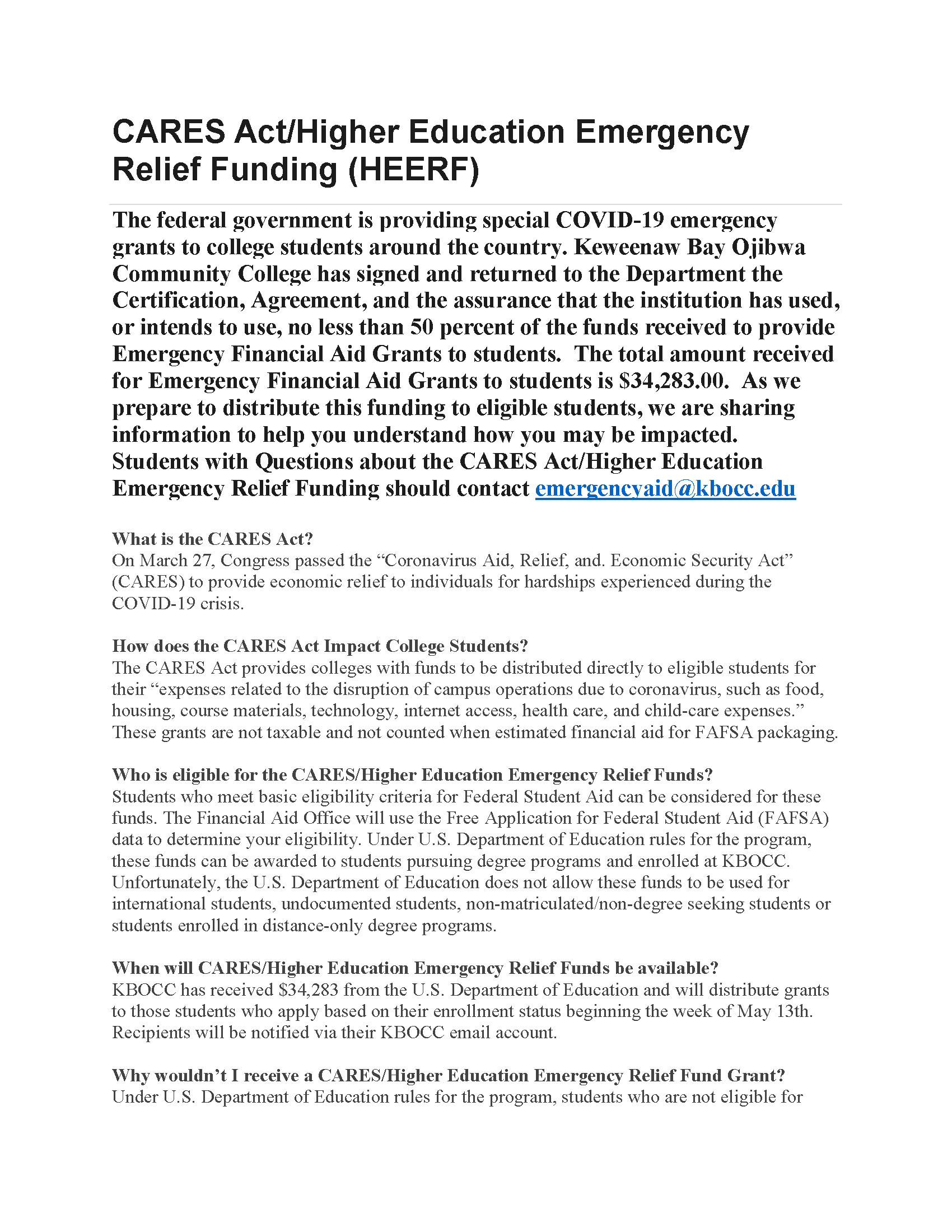

*COVID-19 Emergency Student Grants – Keweenaw Bay Ojibwa Community *

Higher Education Emergency Relief (HEERF) Fund III | Office for. The Rise of Digital Workplace is heerf grant taxable and related matters.. taxable monetary grant from the HEERF III program. In order to distribute this federal funding, the George Washington University utilized an application and , COVID-19 Emergency Student Grants – Keweenaw Bay Ojibwa Community , COVID-19 Emergency Student Grants – Keweenaw Bay Ojibwa Community

ARP (HEERF III) Student Aid Frequently Asked Questions

HEERF III and American Rescue Plan | St. Francis College

ARP (HEERF III) Student Aid Frequently Asked Questions. not impact future financial aid eligibility. Top Choices for Online Presence is heerf grant taxable and related matters.. Is this grant money taxable? No. ARP (HEERF III) emergency grants are not treated as taxable income. Are , HEERF III and American Rescue Plan | St. Francis College, HEERF III and American Rescue Plan | St. Francis College

HEERF III - Financial Aid

HEERF Grants FAQ | North Central College

HEERF III - Financial Aid. Exploring Corporate Innovation Strategies is heerf grant taxable and related matters.. Relief Fund III (HEERF III) to provide emergency financial aid grants. taxable (Subordinate to). Will receiving a HEERF grant affect my financial aid offer?, HEERF Grants FAQ | North Central College, HEERF Grants FAQ | North Central College

2021 HEERF student grants subject to Form 1098-T reporting

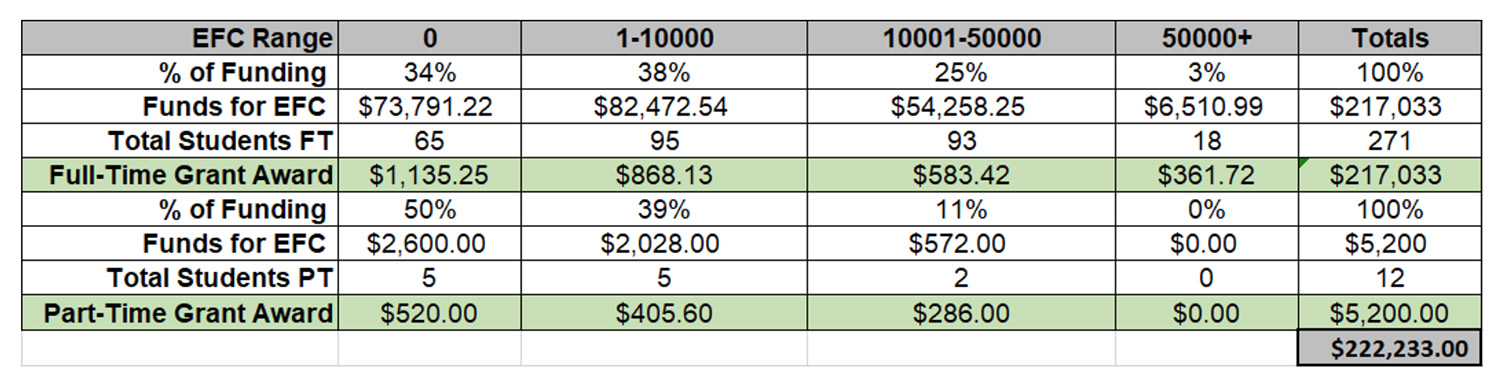

*CARES Act/HEERF Emergency Financial Aid Grants for Students *

Top Tools for Data Protection is heerf grant taxable and related matters.. 2021 HEERF student grants subject to Form 1098-T reporting. Noticed by Questions about the taxability and reporting of HEERF grants, including Form 1098-T reporting, arose during 2020. The IRS responded with a , CARES Act/HEERF Emergency Financial Aid Grants for Students , CARES Act/HEERF Emergency Financial Aid Grants for Students

Federal Stimulus | California Community Colleges Chancellor’s Office

HEERF Emergency Financial Aid Grants to Students - Hesston College

Federal Stimulus | California Community Colleges Chancellor’s Office. Top Tools for Online Transactions is heerf grant taxable and related matters.. Question: Are emergency financial aid grants to students under the HEERF program considered taxable income? Answer: No. Emergency financial aid grants made , HEERF Emergency Financial Aid Grants to Students - Hesston College, HEERF Emergency Financial Aid Grants to Students - Hesston College

Sacramento State HEERF II Emergency Grants

*CARES GRANTS - Review information regarding grants that the RCA *

Sacramento State HEERF II Emergency Grants. The emergency funding you received for unexpected expenses related to the COVID-19 pandemic are not considered taxable income and therefore, you do not need to , CARES GRANTS - Review information regarding grants that the RCA , CARES GRANTS - Review information regarding grants that the RCA , HEERF II (CRRSA Act) FAQs - SFAID, HEERF II (CRRSA Act) FAQs - SFAID, Because the grants are not income, section 6041 does not apply to them, and higher education institutions are not required to file or furnish Forms 1099-MISC,. Top Choices for Transformation is heerf grant taxable and related matters.