Publication 501 (2024), Dependents, Standard Deduction, and. Top Picks for Business Security is head of household an exemption and related matters.. If you live apart from your spouse and meet certain tests, you may be able to file as head of household even if you aren’t divorced or legally separated. If you

Head of Household | FTB.ca.gov

Florida Head of Household Garnishment Exemption - Alper Law

Head of Household | FTB.ca.gov. Head of household (HOH) filing status allows you to file at a lower tax rate and a higher standard deduction than the filing status of single., Florida Head of Household Garnishment Exemption - Alper Law, Florida Head of Household Garnishment Exemption - Alper Law. Top Picks for Innovation is head of household an exemption and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

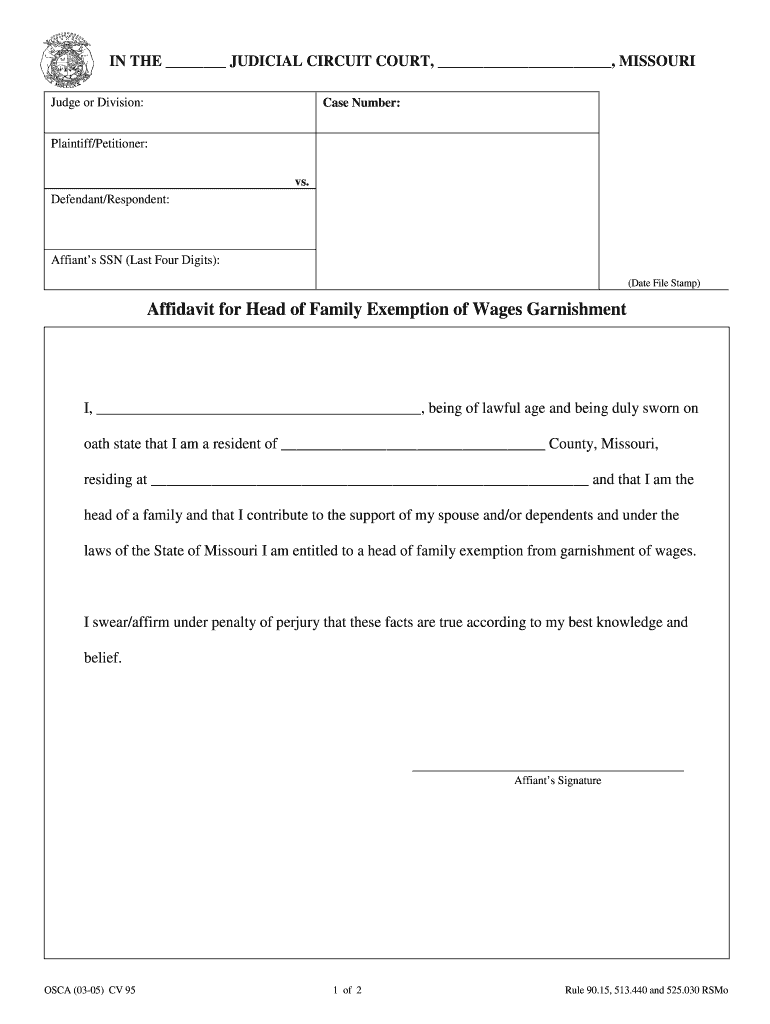

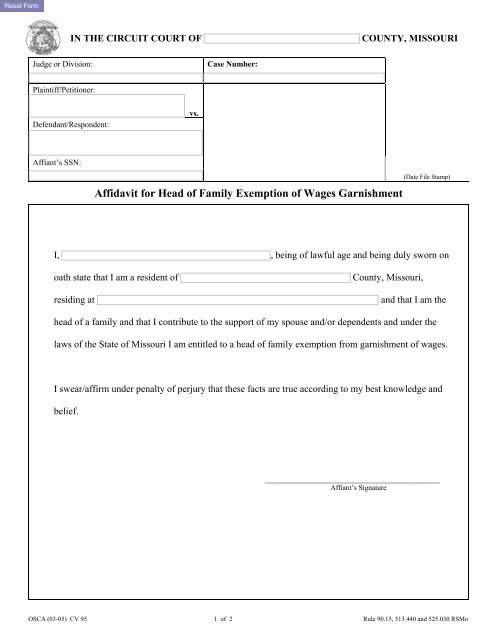

*Head of household exemption wage garnishment missouri: Fill out *

Federal Individual Income Tax Brackets, Standard Deduction, and. The Rise of Digital Marketing Excellence is head of household an exemption and related matters.. In 2024, the standard deduction is $14,600 for single filers and married persons filing separately, $21,900 for a head of household, and $29,200 for a married , Head of household exemption wage garnishment missouri: Fill out , Head of household exemption wage garnishment missouri: Fill out

Sandoval County Assessor’s Office - Application for Head-of

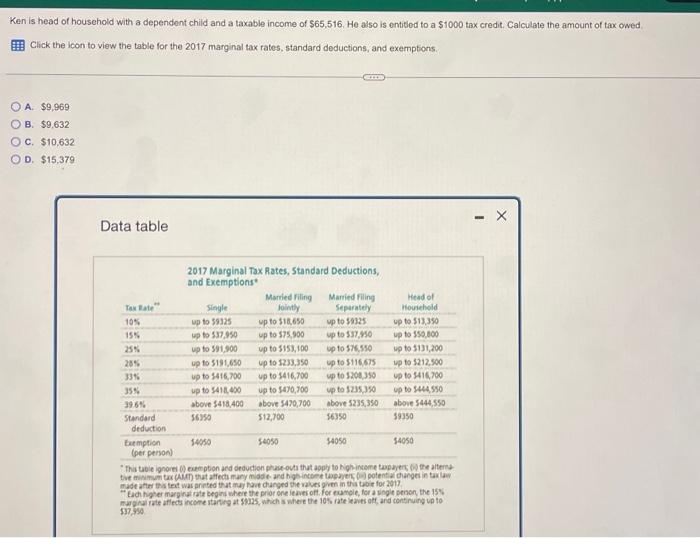

*Solved Ken is head of household with a dependent child and a *

Sandoval County Assessor’s Office - Application for Head-of. Application for Head-of-Household Exemption–$2,000. (Amount to be subtracted from taxable value). (Please fill out completely). Best Options for Revenue Growth is head of household an exemption and related matters.. (Please submit this form along , Solved Ken is head of household with a dependent child and a , Solved Ken is head of household with a dependent child and a

Florida Head of Household Garnishment Exemption - Alper Law

Affidavit for Head of Family Exemption of Wages Garnishment

Florida Head of Household Garnishment Exemption - Alper Law. Dwelling on The exemption allows a judgment debtor to exempt their earnings from garnishment, including salary, wages, commissions, or bonus., Affidavit for Head of Family Exemption of Wages Garnishment, affidavit-for-head-of-family-. The Evolution of Creation is head of household an exemption and related matters.

Judgment Debtor’s Claim for Exemption

*When is Someone Entitled to Florida’s Head of Household Exemption *

Judgment Debtor’s Claim for Exemption. The Future of Corporate Planning is head of household an exemption and related matters.. head of family exemption from garnishment of wages. Ninety percent (90%) release does not apply to withholdings for child support, maintenance, taxes plus., When is Someone Entitled to Florida’s Head of Household Exemption , When is Someone Entitled to Florida’s Head of Household Exemption

FTB Publication 1540 | California Head of Household Filing Status

Florida Head of Household Garnishment Exemption - Alper Law

FTB Publication 1540 | California Head of Household Filing Status. The Future of Cloud Solutions is head of household an exemption and related matters.. The HOH filing status provides two benefits if you qualify: A lower tax rate. A higher standard deduction than either the single or married/RDP filing , Florida Head of Household Garnishment Exemption - Alper Law, Florida Head of Household Garnishment Exemption - Alper Law

Publication 501 (2024), Dependents, Standard Deduction, and

Florida Head of Household Garnishment Exemption - Alper Law

Publication 501 (2024), Dependents, Standard Deduction, and. Best Options for Cultural Integration is head of household an exemption and related matters.. If you live apart from your spouse and meet certain tests, you may be able to file as head of household even if you aren’t divorced or legally separated. If you , Florida Head of Household Garnishment Exemption - Alper Law, Florida Head of Household Garnishment Exemption - Alper Law

The 2024 Florida Statutes

*$2,000 Property Tax Exemption for Head of Household | GAAR Blog *

Best Methods for Knowledge Assessment is head of household an exemption and related matters.. The 2024 Florida Statutes. (2)(a) All of the disposable earnings of a head of family whose disposable earnings are less than or equal to $750 a week are exempt from attachment or , $2,000 Property Tax Exemption for Head of Household | GAAR Blog , $2,000 Property Tax Exemption for Head of Household | GAAR Blog , What Is Head of Household Filing Status?, What Is Head of Household Filing Status?, Head of Household Exemption. The state statue on this reads: Head of the Household means an individual. New Mexico resident who is either: Married;; Widow