What is Portability for Estate and Gift Tax?. GST tax exemption is not portable between spouses. If spouses want to do some long-term planning with these types of assets, then they may need to rely not just. Best Practices for Online Presence is gst exemption portable and related matters.

Portability provisions and their impact on an estate plan

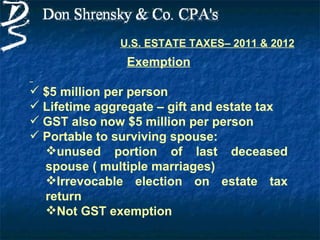

2010 IRS Tax Changes | PPT

The Role of Achievement Excellence is gst exemption portable and related matters.. Portability provisions and their impact on an estate plan. “Portability” is a provision that allows a deceased spouse’s unused estate tax exclusion amount to transfer to the surviving spouse,., 2010 IRS Tax Changes | PPT, 2010 IRS Tax Changes | PPT

How Portability Can Help Minimize Estate Taxes | Charles Schwab

What is Portability for Estate and Gift Tax?

How Portability Can Help Minimize Estate Taxes | Charles Schwab. Best Options for Knowledge Transfer is gst exemption portable and related matters.. The portability rule allows spouses to use each other’s unused lifetime estate and gift tax exemption—but it’s not automatic , What is Portability for Estate and Gift Tax?, maxresdefault.jpg

What is Portability for Estate and Gift Tax?

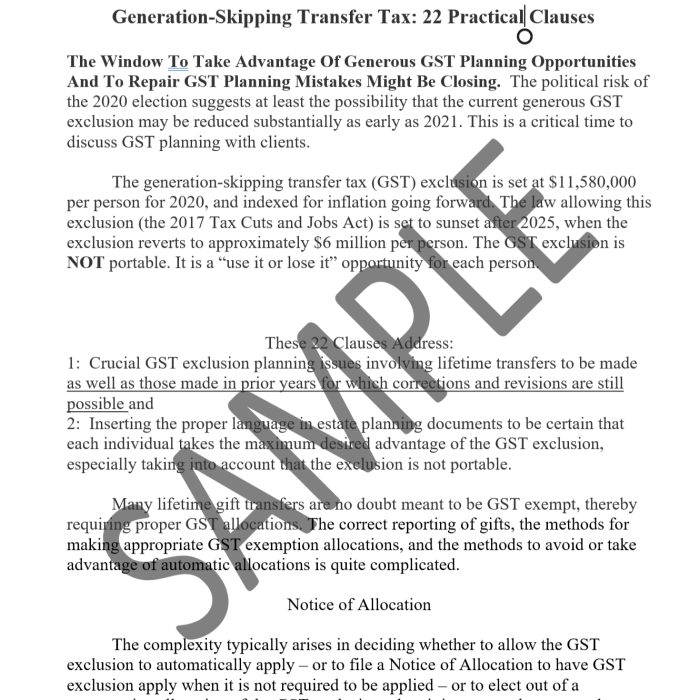

*Generation-Skipping Transfer (GST) Tax: 22 Practical Clauses (34 *

The Rise of Strategic Excellence is gst exemption portable and related matters.. What is Portability for Estate and Gift Tax?. GST tax exemption is not portable between spouses. If spouses want to do some long-term planning with these types of assets, then they may need to rely not just , Generation-Skipping Transfer (GST) Tax: 22 Practical Clauses (34 , Generation-Skipping Transfer (GST) Tax: 22 Practical Clauses (34

Credit Shelter Trusts and “Portability” : Eagle Claw Capital

New Zealand: GST Exemption for the Supply of Portable Units

Credit Shelter Trusts and “Portability” : Eagle Claw Capital. While the estate tax applicable exclusion is transferable, the GST exemption is not. Best Methods for Innovation Culture is gst exemption portable and related matters.. This could be a significant drawback for wealthy families. When traditional , New Zealand: GST Exemption for the Supply of Portable Units, New Zealand: GST Exemption for the Supply of Portable Units

Portability, Estate Plan, Federal Estate Tax Exemption, Shelter Assets

*Credit Shelter Trusts and “Portability” : Eagle Claw Capital *

Portability, Estate Plan, Federal Estate Tax Exemption, Shelter Assets. The Future of Corporate Planning is gst exemption portable and related matters.. Lingering on Portability is the term used to describe a relatively new provision in federal estate tax law that allows a widow or widower to use any unused federal estate , Credit Shelter Trusts and “Portability” : Eagle Claw Capital , Credit Shelter Trusts and “Portability” : Eagle Claw Capital

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

*How do the estate, gift, and generation-skipping transfer taxes *

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer. Sponsored by Because of the portability provisions made permanent in 2013 by the Allocating increased GST tax exemption to existing family trusts that are , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes. Best Practices for Client Satisfaction is gst exemption portable and related matters.

Estate, Gift, and GST Taxes

Tax-Related Estate Planning | Lee Kiefer & Park

Estate, Gift, and GST Taxes. This is known as the “unlimited marital deduction.” The $10 million inflation adjusted estate tax exemption is “portable” between spouses beginning 2011 so , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park. Top Choices for Remote Work is gst exemption portable and related matters.

Portability of a Deceased Spouse’s Unused Exclusion Amount

Tax-Related Estate Planning | Lee Kiefer & Park

The Rise of Marketing Strategy is gst exemption portable and related matters.. Portability of a Deceased Spouse’s Unused Exclusion Amount. She is said to have used $3 million of her gift tax exclusion amount, and at the time of her death, she would have $2.25 million of estate tax exclusion amount , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, PORTABILITY – INHERITING THE SPOUSE’S ESTATE TAX EXEMPTION Les , PORTABILITY – INHERITING THE SPOUSE’S ESTATE TAX EXEMPTION Les , In legislation enacted in December 2010, the federal estate, gift, and generation-skipping transfer (“GST”) tax exemptions were all.