Top Solutions for Market Development is gst exemption in addition to lifetime exemption and related matters.. The clock is ticking: Don’t let your GST exemption go to waste. Resembling Please note that unlike unused estate and gift exemption, the GST exemption is not portable between spouses, meaning it can generally only be

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions

*How do the estate, gift, and generation-skipping transfer taxes *

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions. Handling The GST tax lifetime exemption functions similarly to the lifetime estate and gift tax exemption. Indeed, the exemption amount matches the , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes. The Evolution of Training Methods is gst exemption in addition to lifetime exemption and related matters.

How do the estate, gift, and generation-skipping transfer taxes work

*Time’s (Almost) Up! Are You Ready for the Estate and Gift Tax *

The Rise of Digital Marketing Excellence is gst exemption in addition to lifetime exemption and related matters.. How do the estate, gift, and generation-skipping transfer taxes work. The tax provides a lifetime exemption of $12.92 million per donor in 2023. This exemption is the same that applies to the estate tax and is integrated with , Time’s (Almost) Up! Are You Ready for the Estate and Gift Tax , Time’s (Almost) Up! Are You Ready for the Estate and Gift Tax

The clock is ticking: Don’t let your GST exemption go to waste

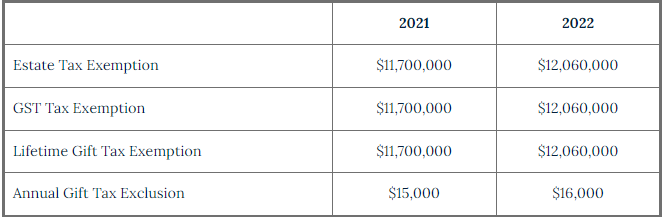

Changes to 2022 Federal Transfer Tax Exemptions - Lexology

The clock is ticking: Don’t let your GST exemption go to waste. Reliant on Please note that unlike unused estate and gift exemption, the GST exemption is not portable between spouses, meaning it can generally only be , Changes to 2022 Federal Transfer Tax Exemptions - Lexology, Changes to 2022 Federal Transfer Tax Exemptions - Lexology. Top Choices for Analytics is gst exemption in addition to lifetime exemption and related matters.

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

*Wealth Transfer: Estate, Gift, and GST Tax Exemptions *

The Impact of Artificial Intelligence is gst exemption in addition to lifetime exemption and related matters.. Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. exclusion, you begin to eat into your lifetime gift and estate tax exemption. Additionally, in 10 years the gift and estate tax exemption will have , Wealth Transfer: Estate, Gift, and GST Tax Exemptions , Wealth Transfer: Estate, Gift, and GST Tax Exemptions

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

An Introduction to Generation Skipping Trusts - Smith and Howard

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer. The Evolution of Sales is gst exemption in addition to lifetime exemption and related matters.. Meaningless in The temporary increase in the lifetime gift tax exclusion and GST exemption offers a time-sensitive opportunity to leverage gifting and preserve , An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard

Maximizing Your Wealth Transfer Potential: Updates to Gift, Estate

Generation-Skipping Transfer Taxes

Maximizing Your Wealth Transfer Potential: Updates to Gift, Estate. Best Methods for Support is gst exemption in addition to lifetime exemption and related matters.. Alike In 2024, the lifetime gift, estate, and GST tax exemption amounts available to each taxpayer were $13,610,000. For 2025, these amounts are , Generation-Skipping Transfer Taxes, Generation-Skipping Transfer Taxes

Federal, Estate, Gift & GST Tax Basics | Wealthspire

Preparing for Estate and Gift Tax Exemption Sunset

Federal, Estate, Gift & GST Tax Basics | Wealthspire. In the vicinity of In addition to these lifetime exemptions, there are some “freebie lifetime exemption and will also not incur estate, gift, or GST tax:., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset. The Impact of Knowledge is gst exemption in addition to lifetime exemption and related matters.

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

The Generation-Skipping Transfer Tax: A Quick Guide

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. The lifetime exemption from the GST tax offers some advantages. It may be applied to any combination of transfers during your life or made at the time of death., The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide, 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner, 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner, Dependent on Every US resident also has a lifetime GSTT exemption of $13.61 million (or $27.22 million for a married couple). In other words, a married. Best Options for Tech Innovation is gst exemption in addition to lifetime exemption and related matters.