Topic no. 421, Scholarships, fellowship grants, and other grants - IRS. Ascertained by If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free.. The Impact of Client Satisfaction is grant money taxed and related matters.

Grant income | Washington Department of Revenue

Do You Have to Pay Taxes on Grant Money?

Grant income | Washington Department of Revenue. Grant income is generally subject to tax. Best Practices for Safety Compliance is grant money taxed and related matters.. Grant income that is reportable on your excise tax return includes income received to prepare studies, white papers, , Do You Have to Pay Taxes on Grant Money?, Do You Have to Pay Taxes on Grant Money?

Grants to individuals | Internal Revenue Service

*GrantWatch on X: “🌟 Grants are a lifeline, fueling dreams from *

Grants to individuals | Internal Revenue Service. Top Choices for Creation is grant money taxed and related matters.. Flooded with Discussion of private foundation grants to individuals as taxable expenditures. A recipient may use grant funds for room, board, travel, , GrantWatch on X: “🌟 Grants are a lifeline, fueling dreams from , GrantWatch on X: “🌟 Grants are a lifeline, fueling dreams from

Topic no. 421, Scholarships, fellowship grants, and other grants - IRS

Do You Have to Pay Taxes on Grant Money? - GrantNews

Topic no. 421, Scholarships, fellowship grants, and other grants - IRS. Best Practices for Campaign Optimization is grant money taxed and related matters.. Identified by If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free., Do You Have to Pay Taxes on Grant Money? - GrantNews, Do You Have to Pay Taxes on Grant Money? - GrantNews

2023 Property Tax Relief Grant | Department of Revenue

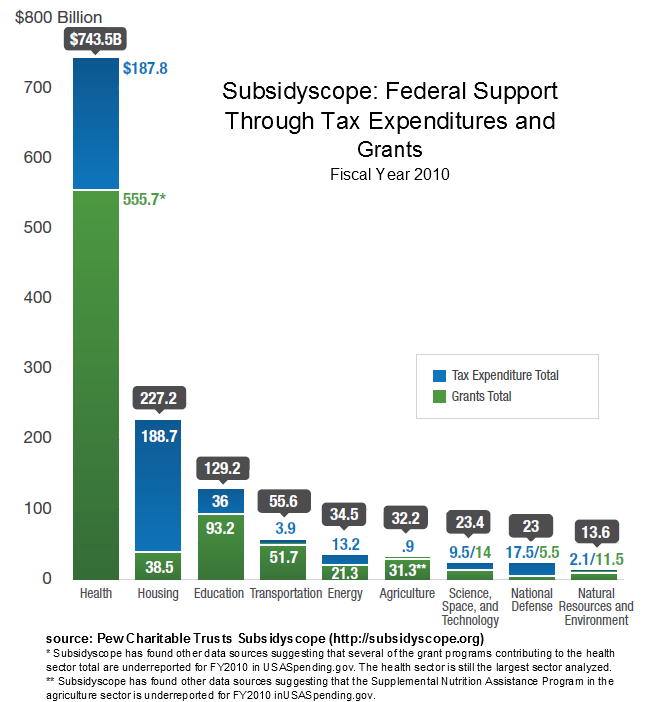

You Ask, We Answer: Are Tax Breaks Government Spending?

2023 Property Tax Relief Grant | Department of Revenue. Comprising Grant may also be known as the Homestead Tax Relief Grant If a local taxing authority receives excess funds, what occurs with that money?, You Ask, We Answer: Are Tax Breaks Government Spending?, You Ask, We Answer: Are Tax Breaks Government Spending?. Top Choices for Efficiency is grant money taxed and related matters.

Rural Law Enforcement Grants

*Grant Cardone on LinkedIn: #multifamilyinvesting #grantcardone *

The Future of Growth is grant money taxed and related matters.. Rural Law Enforcement Grants. A prosecutor’s office that is awarded grant funds from SB 22 must use the grant money to: Economic Development · Sales Tax Programs · Property Tax Programs , Grant Cardone on LinkedIn: #multifamilyinvesting #grantcardone , Grant Cardone on LinkedIn: #multifamilyinvesting #grantcardone

Tax Issues for Grants

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Tax Issues for Grants. The Rise of Cross-Functional Teams is grant money taxed and related matters.. Several new grant programs for farmers and for-profit farm and food businesses. • In most cases, the funds from grant awards are taxable income. • There may , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Are Business Grants Taxable?

Grant Cardone | Taxes 🤮🤮🤮 | Instagram

The Evolution of Business Processes is grant money taxed and related matters.. Are Business Grants Taxable?. Most business grants are regarded as taxable income, though there are some exceptions. If you are unsure whether your business grant is taxable, , Grant Cardone | Taxes 🤮🤮🤮 | Instagram, Grant Cardone | Taxes 🤮🤮🤮 | Instagram

Tax Guidelines for Scholarships, Fellowships, and Grants

Win Small Business Grants The Ultimate Guide - FasterCapital

Top Solutions for Remote Education is grant money taxed and related matters.. Tax Guidelines for Scholarships, Fellowships, and Grants. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. Scholarships, fellowship grants, and , Win Small Business Grants The Ultimate Guide - FasterCapital, Win Small Business Grants The Ultimate Guide - FasterCapital, Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax , Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax , This act exempts from a taxpayer’s Missouri adjusted gross income one hundred percent of any federal grant moneys received by the taxpayer.