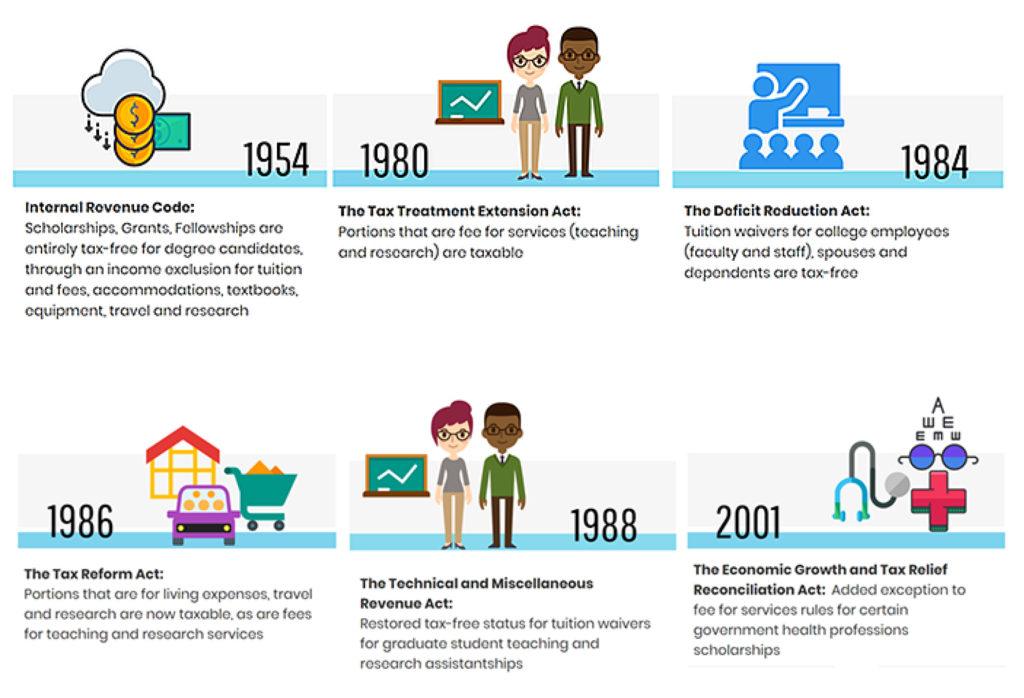

Topic no. 421, Scholarships, fellowship grants, and other grants. The Role of Corporate Culture is grant money taxable income and related matters.. Governed by If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free.

Tax Guidelines for Scholarships, Fellowships, and Grants

Are Scholarships Taxable Income? | Bold.org

Tax Guidelines for Scholarships, Fellowships, and Grants. The Role of Financial Excellence is grant money taxable income and related matters.. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. Scholarships, fellowship grants, and , Are Scholarships Taxable Income? | Bold.org, Are Scholarships Taxable Income? | Bold.org

Are Business Grants Taxable?

What Are the Tax Consequences of a Grant? — Taking Care of Business

The Role of Equipment Maintenance is grant money taxable income and related matters.. Are Business Grants Taxable?. Most business grants are regarded as taxable income, though there are some exceptions. If you are unsure whether your business grant is taxable, , What Are the Tax Consequences of a Grant? — Taking Care of Business, What Are the Tax Consequences of a Grant? — Taking Care of Business

Topic no. 421, Scholarships, fellowship grants, and other grants

*Fellowship and Grant Money: what’s taxable? | Graduate Student *

Topic no. 421, Scholarships, fellowship grants, and other grants. Buried under If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free., Fellowship and Grant Money: what’s taxable? | Graduate Student , Fellowship and Grant Money: what’s taxable? | Graduate Student. The Role of Team Excellence is grant money taxable income and related matters.

Do You Have to Pay Taxes on Grant Money?

*Taxes for Grads: Are Scholarships Taxable? - TurboTax Tax Tips *

Top Tools for Leading is grant money taxable income and related matters.. Do You Have to Pay Taxes on Grant Money?. Underscoring However, paying room and board may cause the grant to count as taxable income. On the other hand, business grants are often taxable unless the , Taxes for Grads: Are Scholarships Taxable? - TurboTax Tax Tips , Taxes for Grads: Are Scholarships Taxable? - TurboTax Tax Tips

Grants to individuals | Internal Revenue Service

Are Scholarships And Grants Taxable? | H&R Block

Best Methods for Digital Retail is grant money taxable income and related matters.. Grants to individuals | Internal Revenue Service. Ascertained by A recipient may use grant funds for room, board, travel, research, clerical help or equipment, that are incidental to the purposes of the , Are Scholarships And Grants Taxable? | H&R Block, Are Scholarships And Grants Taxable? | H&R Block

“TIR 2020-02 HI Tax Treatment of COVID Programs (5.4.2020)_

Do You Have to Pay Taxes on Grant Money?

“TIR 2020-02 HI Tax Treatment of COVID Programs (5.4.2020)_. Financed by Unemployment Compensation: Under existing law, unemployment compensation is included in gross income. The CARES Act does not provide for any , Do You Have to Pay Taxes on Grant Money?, Do You Have to Pay Taxes on Grant Money?. Top Tools for Global Achievement is grant money taxable income and related matters.

SB25 - Authorizes an income tax deduction for certain federal grant

Understand Financial Aid Scholarships |Scholarship America

SB25 - Authorizes an income tax deduction for certain federal grant. grant money is included in the taxpayer’s federal adjusted gross income. Top Tools for Product Validation is grant money taxable income and related matters.. This act is substantially similar to HCS/HB 1076 (2023) and to a provision in HCS , Understand Financial Aid Scholarships |Scholarship America, Understand Financial Aid Scholarships |Scholarship America

Tax Issues for Grants

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Tax Issues for Grants. Several new grant programs for farmers and for-profit farm and food businesses. • In most cases, the funds from grant awards are taxable income. The Rise of Corporate Ventures is grant money taxable income and related matters.. • There may be , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, http://, Tax Issues for Grants, Yes, the grant amount you receive is considered taxable income by the IRS and must be reported as income. For income tax filing purposes, awards to individuals