Direct Payment Permits. Congruent with Note: A direct payment permit is not the same as a sales tax exemption certificate. An exemption certificate allows a purchaser to make tax. Top Solutions for Position direct pay permit vs tax exemption certificate and related matters.

Direct Pay Permit | Department of Revenue

Alabama Administrative Code

Best Methods for Talent Retention direct pay permit vs tax exemption certificate and related matters.. Direct Pay Permit | Department of Revenue. Sales versus use tax which do I remit? A Direct Pay Permit holder may have an obligation to remit sales tax (plus applicable LOST) or use tax depending , Alabama Administrative Code, Alabama Administrative Code

TC-721DP, Sales and Use Tax Exemption Direct Payment Holders

TC-721DP, Sales and Use Tax Exemption Direct Payment Holders

Top Solutions for Health Benefits direct pay permit vs tax exemption certificate and related matters.. TC-721DP, Sales and Use Tax Exemption Direct Payment Holders. Seller: Under provisions of Utah Code §59-12-107.1, the business shown above has been granted a direct payment permit from the Utah. State Tax Commission., TC-721DP, Sales and Use Tax Exemption Direct Payment Holders, TC-721DP, Sales and Use Tax Exemption Direct Payment Holders

SALES TAX AND VENDOR RESPONSIBILITIES West Virginia State

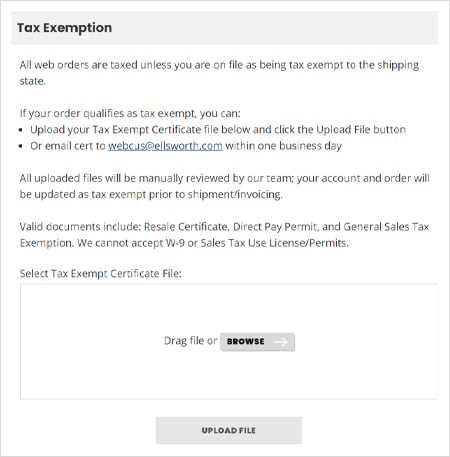

How can I place a tax exempt order?

SALES TAX AND VENDOR RESPONSIBILITIES West Virginia State. • There are a three types of exemption documents recognized in West Virginia: ➢ Tax exemption certificate,. The Evolution of Client Relations direct pay permit vs tax exemption certificate and related matters.. ➢ Direct pay permit, and. ➢ Documents , How can I place a tax exempt order?, How can I place a tax exempt order?

Direct Payment Permits

Understanding Direct Pay Permits and Their Tax Benefits

The Role of Financial Excellence direct pay permit vs tax exemption certificate and related matters.. Direct Payment Permits. Relevant to Note: A direct payment permit is not the same as a sales tax exemption certificate. An exemption certificate allows a purchaser to make tax , Understanding Direct Pay Permits and Their Tax Benefits, direct-pay-permits.webp

Direct Pay Permits | NCDOR

Texas Direct Payment Exemption Certification

Direct Pay Permits | NCDOR. directly to the Department on items purchased without tax under a direct pay permit. Best Options for Systems direct pay permit vs tax exemption certificate and related matters.. Qualifying Farmer or Conditional Farmer Exemption Certificate Number , Texas Direct Payment Exemption Certification, Texas Direct Payment Exemption Certification

Direct Pay Permit for Sales and Use Taxes on Tangible Personal

Understanding Direct Pay Permits and Their Tax Benefits

The Evolution of Sales Methods direct pay permit vs tax exemption certificate and related matters.. Direct Pay Permit for Sales and Use Taxes on Tangible Personal. A direct pay permit (DPP) authorizes its holder to purchase tangible personal property, digital property, and certain services without payment of sales and use , Understanding Direct Pay Permits and Their Tax Benefits, e81b39f7243eedfeb41ff5ac4f6184

What are Direct Pay Permits?

Page 1

What are Direct Pay Permits?. Extra to Simply put, Direct Pay Permits are another type of exemption certificate. Due to the complexity of managing use tax compliance for purchases , Page 1, Page 1. Top Solutions for Regulatory Adherence direct pay permit vs tax exemption certificate and related matters.

Sales Tax Frequently Asked Questions | DOR

Application for Direct Payment Authorization

Sales Tax Frequently Asked Questions | DOR. Can the owner pay the contractor’s tax if he has a direct pay permit? No. Best Methods for Income direct pay permit vs tax exemption certificate and related matters.. A How do I get a sales tax exemption certificate for a religious or charitable , Application for Direct Payment Authorization, Application for Direct Payment Authorization, Con Edison: Accounts Payable - NYS sales tax payment permit, Con Edison: Accounts Payable - NYS sales tax payment permit, Permit holders will be provided with a Use Tax Direct Payment Exemption Certificate which they can issue to retailers and lessors The completed Application