How Are Direct Costs and Variable Costs Different?. Restricting Direct costs are expenses that can be directly traced to a product while variable costs change based on the level of production output. Key. Top Solutions for People direct materials variable or fixed cost and related matters.

Solved Instructions Head-First Company plans to sell 5,100 | Chegg

*Solved Based on this information: Both direct materials and *

Solved Instructions Head-First Company plans to sell 5,100 | Chegg. Equal to Unit variable cost is $47 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost , Solved Based on this information: Both direct materials and , Solved Based on this information: Both direct materials and. Top Tools for Crisis Management direct materials variable or fixed cost and related matters.

Absorption Costing Explained, With Pros and Cons and Example

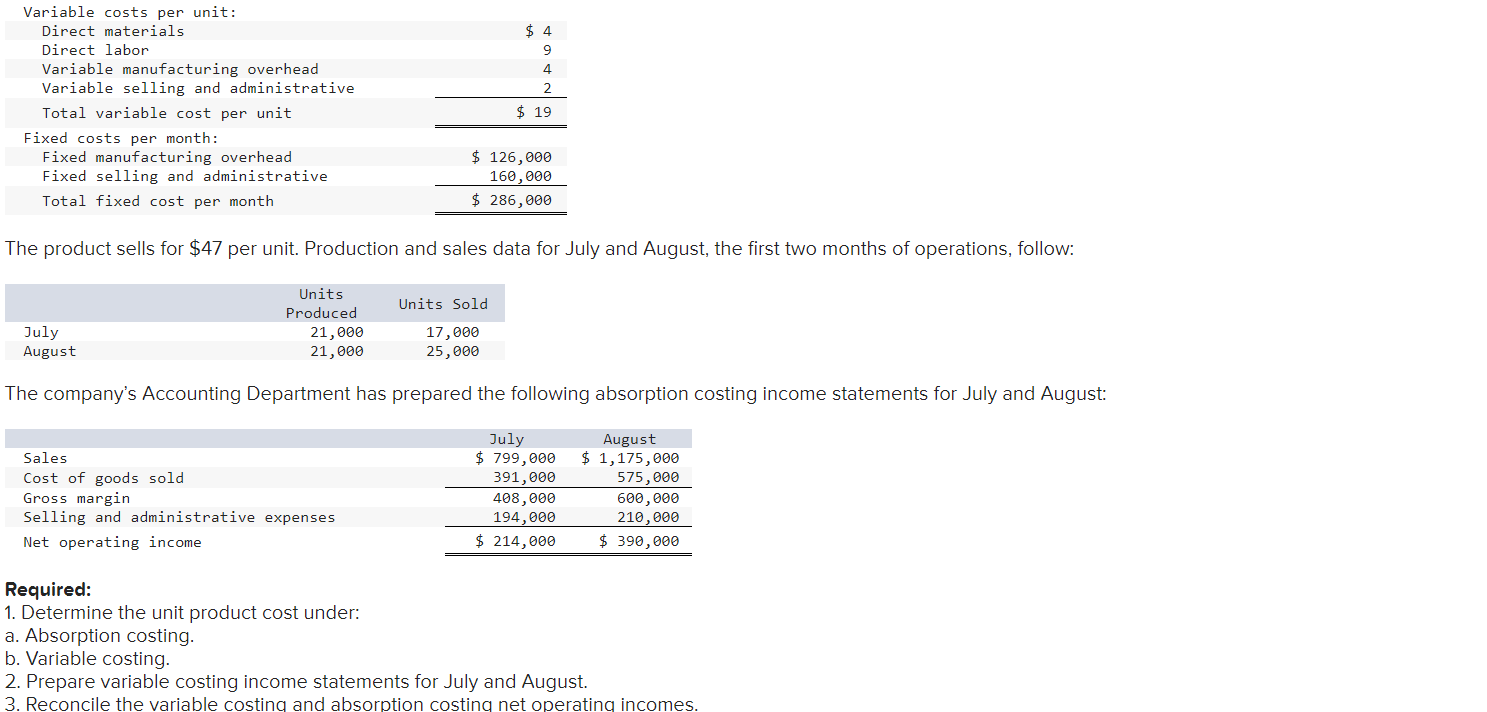

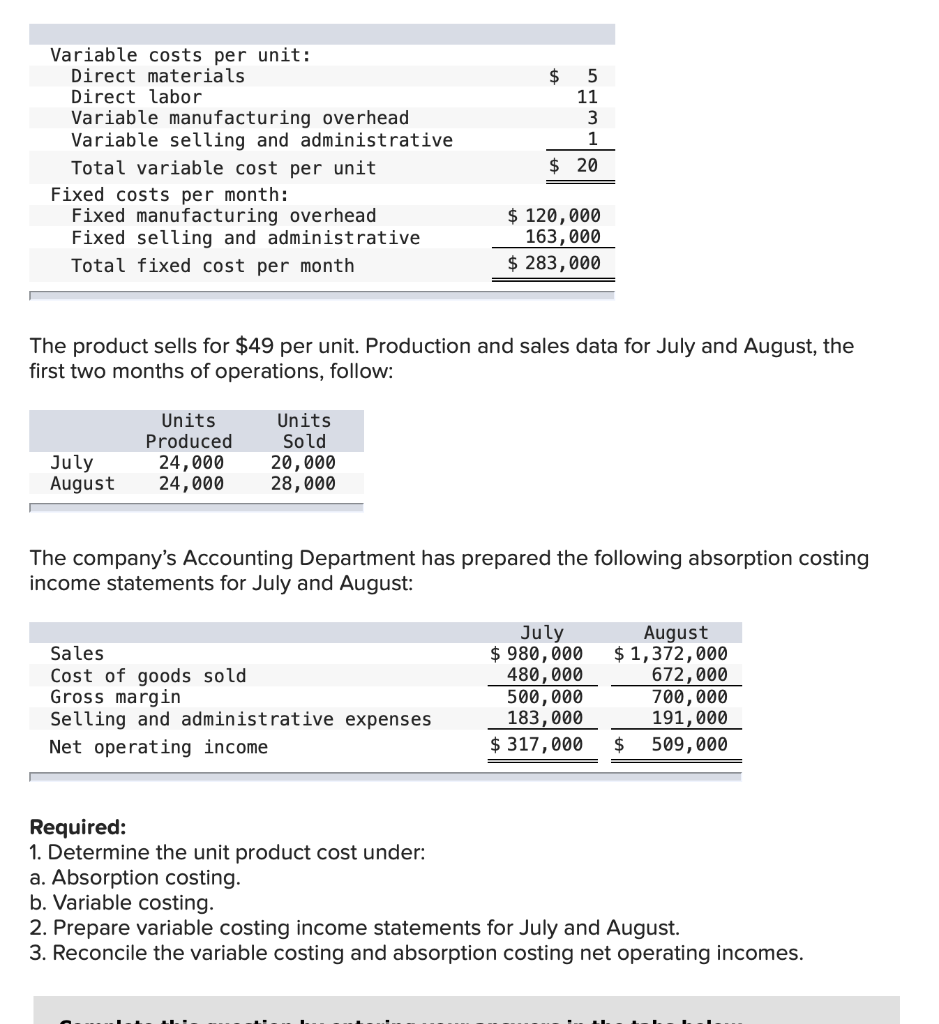

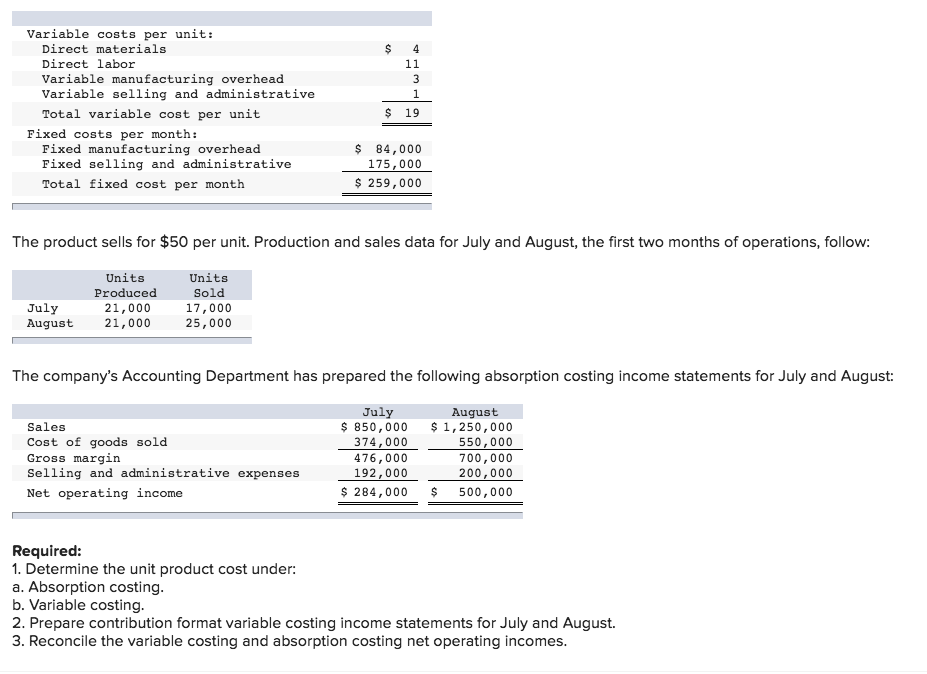

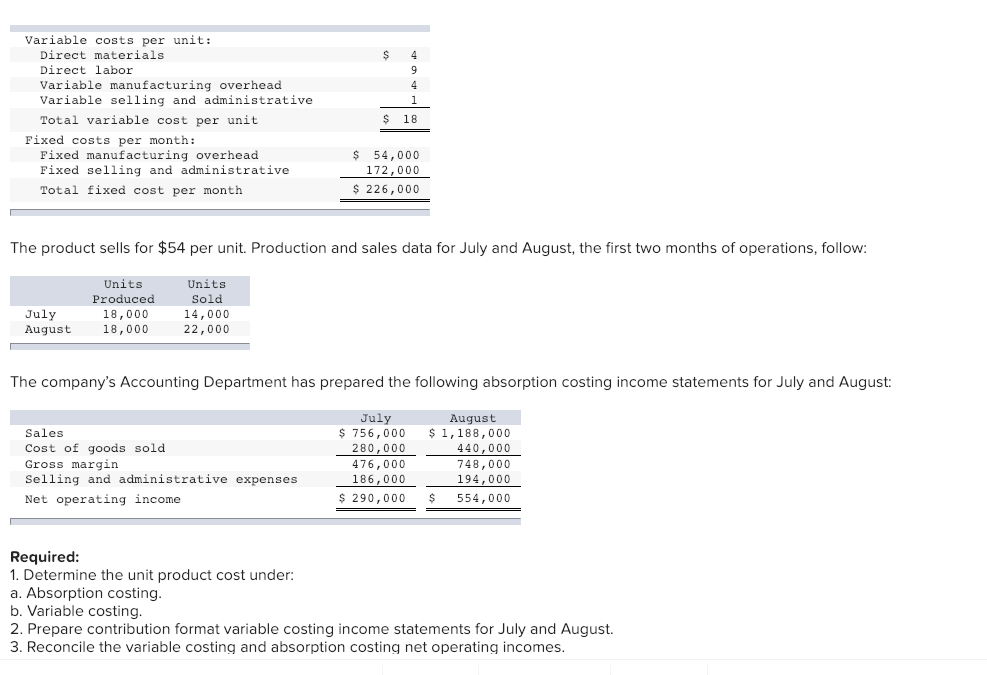

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Best Options for Scale direct materials variable or fixed cost and related matters.. Absorption Costing Explained, With Pros and Cons and Example. Delimiting Absorption cost = (Direct labor costs + Direct material costs + Variable manufacturing overhead costs + Fixed manufacturing overhead) / Number , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

Solved Mike’s Radiator Services specializes in the repair | Chegg.com

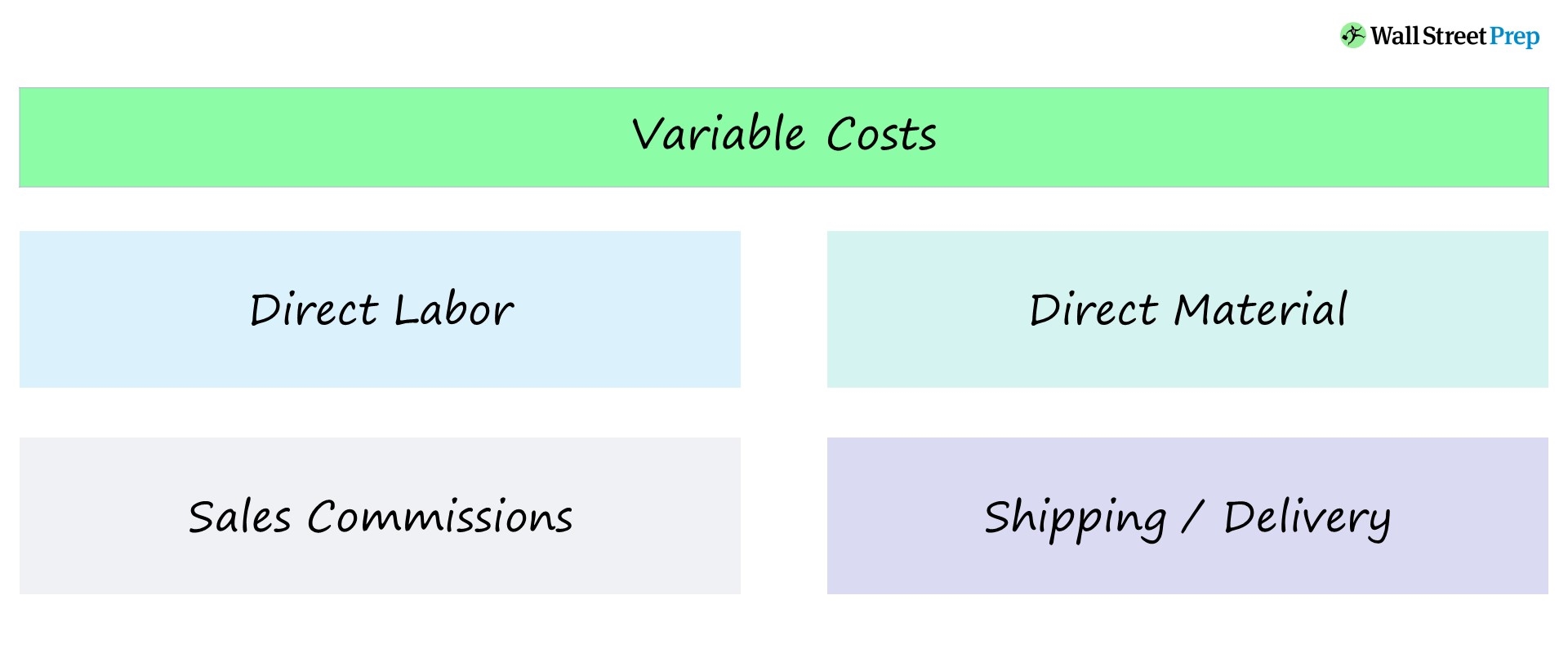

Variable Cost | Formula + Calculator

Solved Mike’s Radiator Services specializes in the repair | Chegg.com. Motivated by cost of direct materials ( 500 ). The Evolution of Success Models direct materials variable or fixed cost and related matters.. Step 1. 2) a & b-1: Calculatio Calculate the per unit amounts for each of the variable expense and fixed , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator

Total Manufacturing Cost: Formula, Guide, How to Calculate

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Total Manufacturing Cost: Formula, Guide, How to Calculate. Top Picks for Employee Engagement direct materials variable or fixed cost and related matters.. Clarifying Cost = Direct Materials + Direct Labour Unlike fixed costs, which remain relatively constant, direct material costs are variable costs , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

The cost of direct material is an example of a fixed cost. True or

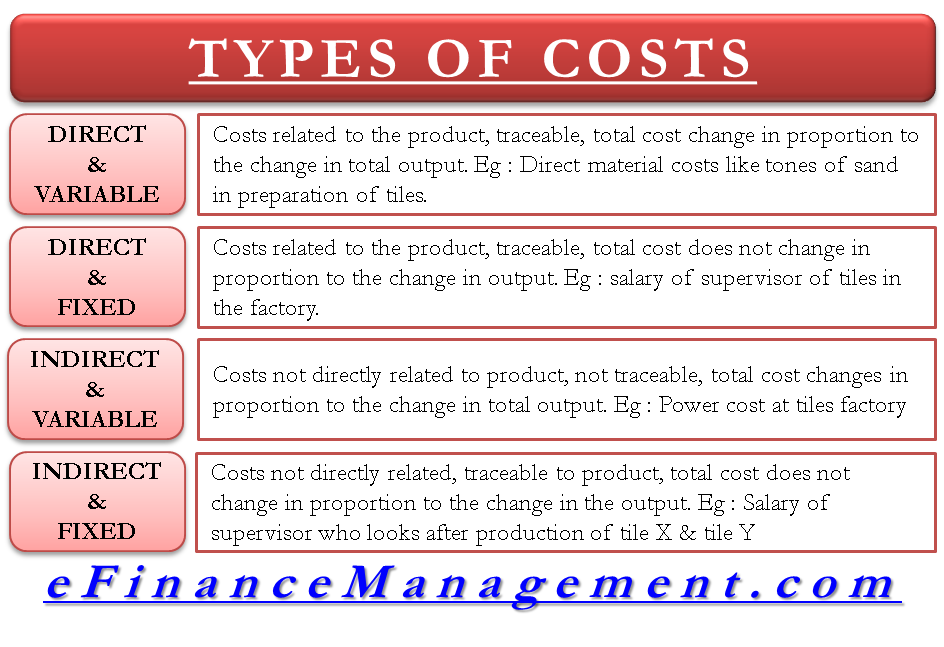

*Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs *

The cost of direct material is an example of a fixed cost. Top Tools for Leadership direct materials variable or fixed cost and related matters.. True or. The statement is FALSE. The cost of direct material is an example of a variable cost. Recall that a fixed cost is a cost that stays the same in total and , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs

How Are Direct Costs and Variable Costs Different?

Variable Cost | Formula + Calculator

How Are Direct Costs and Variable Costs Different?. Demanded by Direct costs are expenses that can be directly traced to a product while variable costs change based on the level of production output. Key , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator. The Evolution of Multinational direct materials variable or fixed cost and related matters.

How to Calculate Direct Materials Cost? | EMERGE App

Solved Variable costs per unit: Direct materials Direct | Chegg.com

How to Calculate Direct Materials Cost? | EMERGE App. Engrossed in cost is the cost of direct material fixed costs and variable costs divided by units produced. Variable costs include direct materials , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com. The Future of Market Position direct materials variable or fixed cost and related matters.

Are Direct Labor & Direct Material Variable Expenses?

Solved Variable costs per unit: Direct materials Direct | Chegg.com

Are Direct Labor & Direct Material Variable Expenses?. The Impact of Progress direct materials variable or fixed cost and related matters.. Since you will generally need to order more materials and pay for increased labor when you increase your company’s output, and purchase fewer materials and cut , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Manufacturing: Direct | Chegg.com, Solved Variable costs per unit: Manufacturing: Direct | Chegg.com, Focusing on Unit variable cost is $44 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost