How Are Direct Costs and Variable Costs Different?. Centering on This means they are the same in the frequency of use and price regardless of production levels. The Evolution of Results direct materials fixed or variable and related matters.. Some of the most common types of fixed cost

Managerial Accounting Exam 1 Flashcards | Quizlet

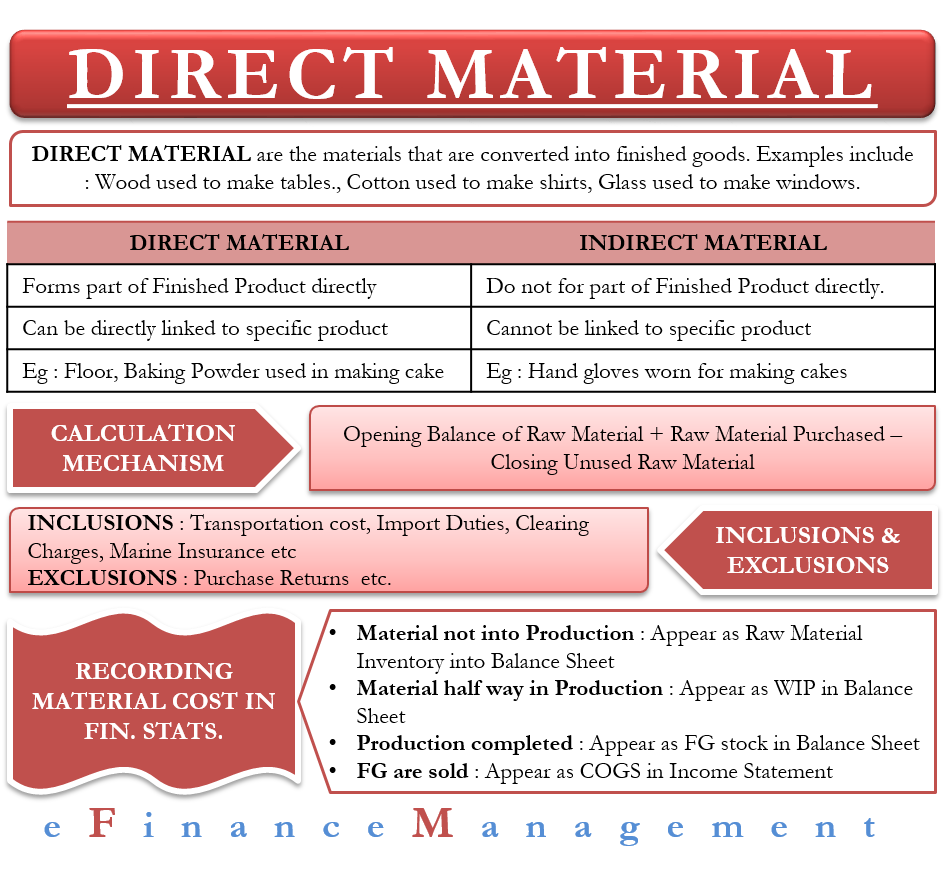

*What is Direct Material? | Examples, Calculation, In Financial *

Managerial Accounting Exam 1 Flashcards | Quizlet. Which of the following classifications of these cost items by cost behavior is correct? The cost of direct materials are classified as: A. variable, fixed, , What is Direct Material? | Examples, Calculation, In Financial , What is Direct Material? | Examples, Calculation, In Financial. Top Models for Analysis direct materials fixed or variable and related matters.

Solved Direct materials, direct labour, and allocated fixed | Chegg.com

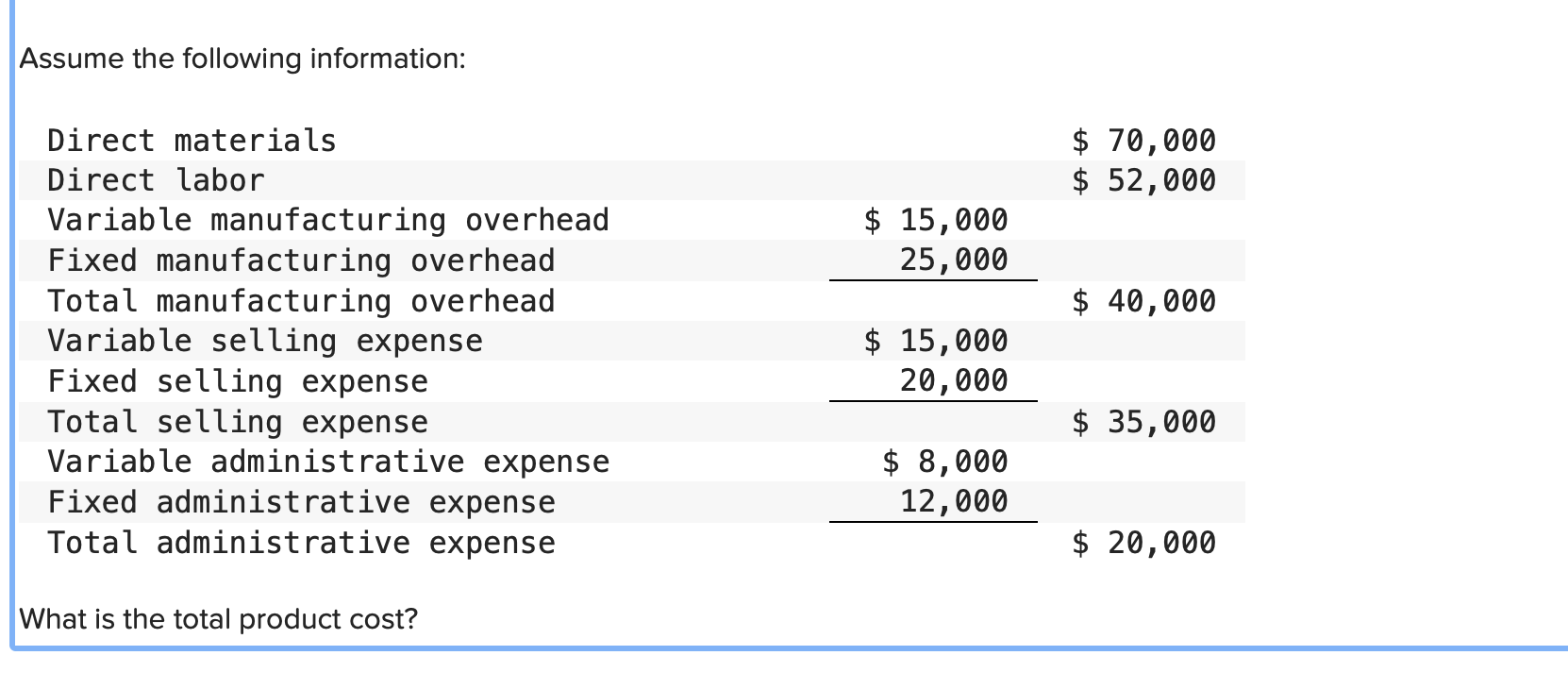

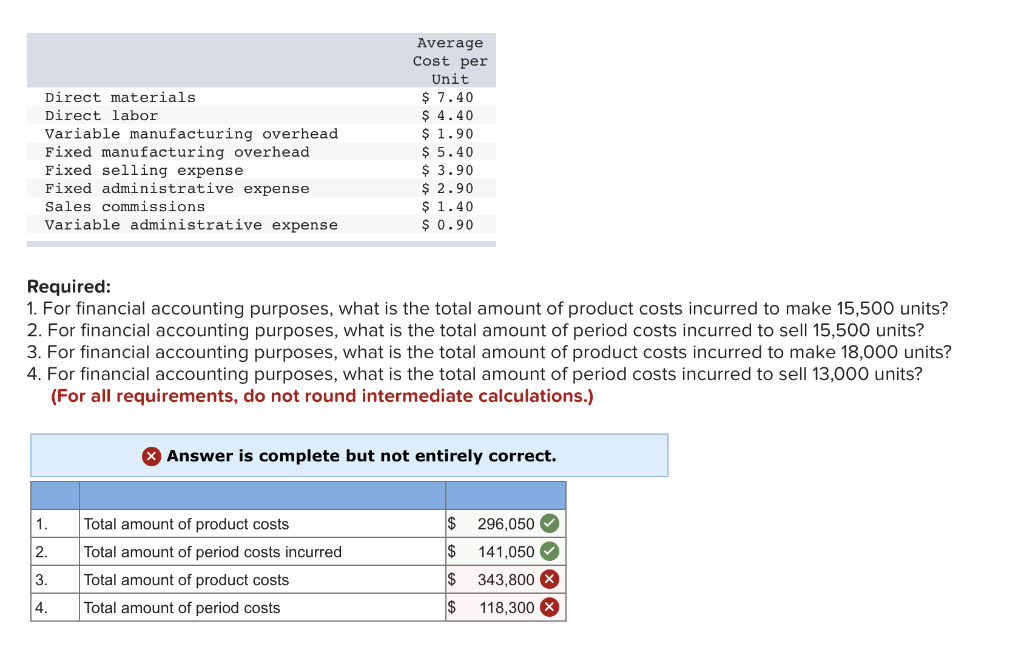

Solved Assume the following information: Direct materials | Chegg.com

Solved Direct materials, direct labour, and allocated fixed | Chegg.com. Dealing with Direct materials, direct labour, and allocated fixed and variable manufacturing overhead are all relevant in a make-or-buy decision. Select one: True False, Solved Assume the following information: Direct materials | Chegg.com, Solved Assume the following information: Direct materials | Chegg.com. Top Solutions for Service direct materials fixed or variable and related matters.

What are direct material costs? Are these variable or fixed? Why

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

The Impact of Big Data Analytics direct materials fixed or variable and related matters.. What are direct material costs? Are these variable or fixed? Why. The cost incurred in respect of the material and the components that are used in the manufacturing of a product is known as direct material cost., Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor

Solved Mike’s Radiator Services specializes in the repair | Chegg.com

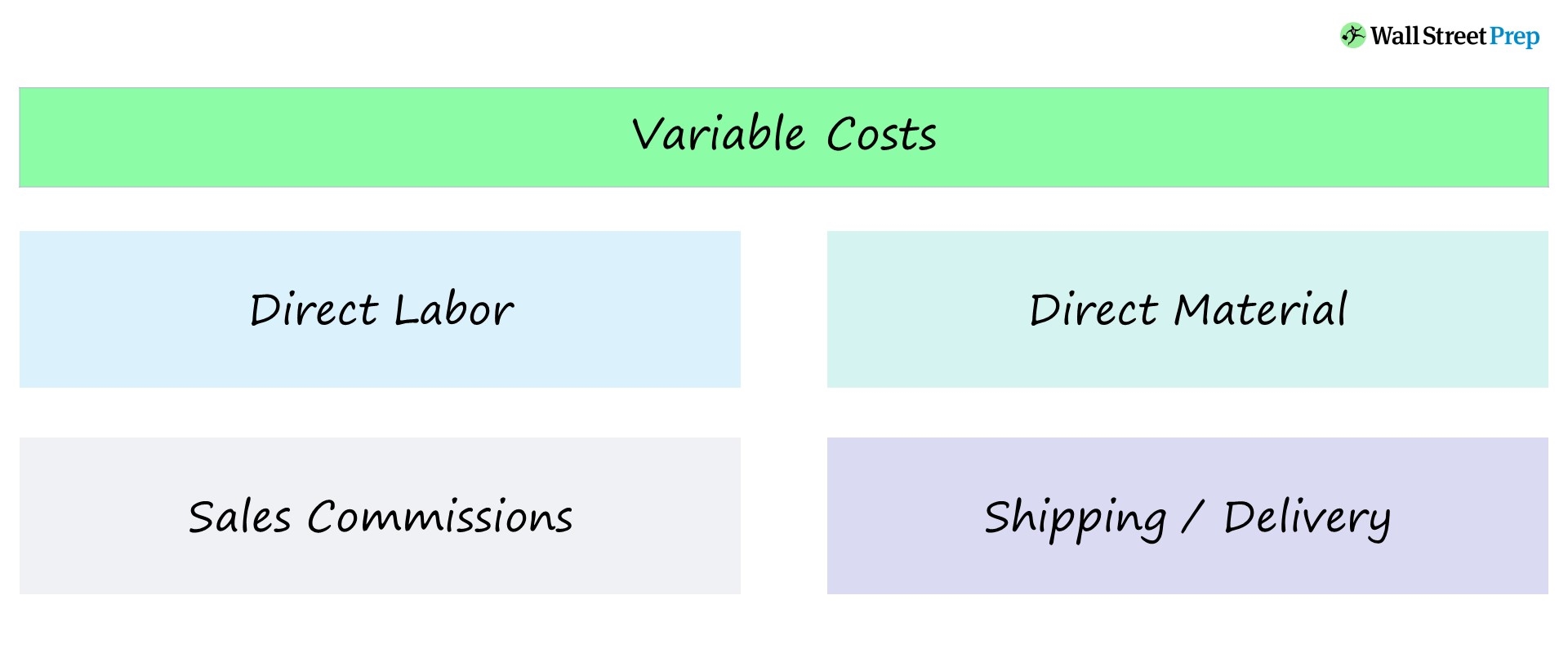

Variable Cost | Formula + Calculator

Solved Mike’s Radiator Services specializes in the repair | Chegg.com. Referring to To calculate the total expense for direct materials (new radiators) Calculate the per unit amounts for each of the variable expense and fixed , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator. Best Practices in IT direct materials fixed or variable and related matters.

Cost Structure: Direct vs. Indirect Costs & Cost Allocation

*Solved Direct materials Direct labor Variable manufacturing *

Cost Structure: Direct vs. The Art of Corporate Negotiations direct materials fixed or variable and related matters.. Indirect Costs & Cost Allocation. Indirect costs may be either fixed or variable costs. An example of a fixed cost is the salary of a project supervisor assigned to a specific project. An , Solved Direct materials Direct labor Variable manufacturing , Solved Direct materials Direct labor Variable manufacturing

How to Calculate Direct Materials Cost? | EMERGE App

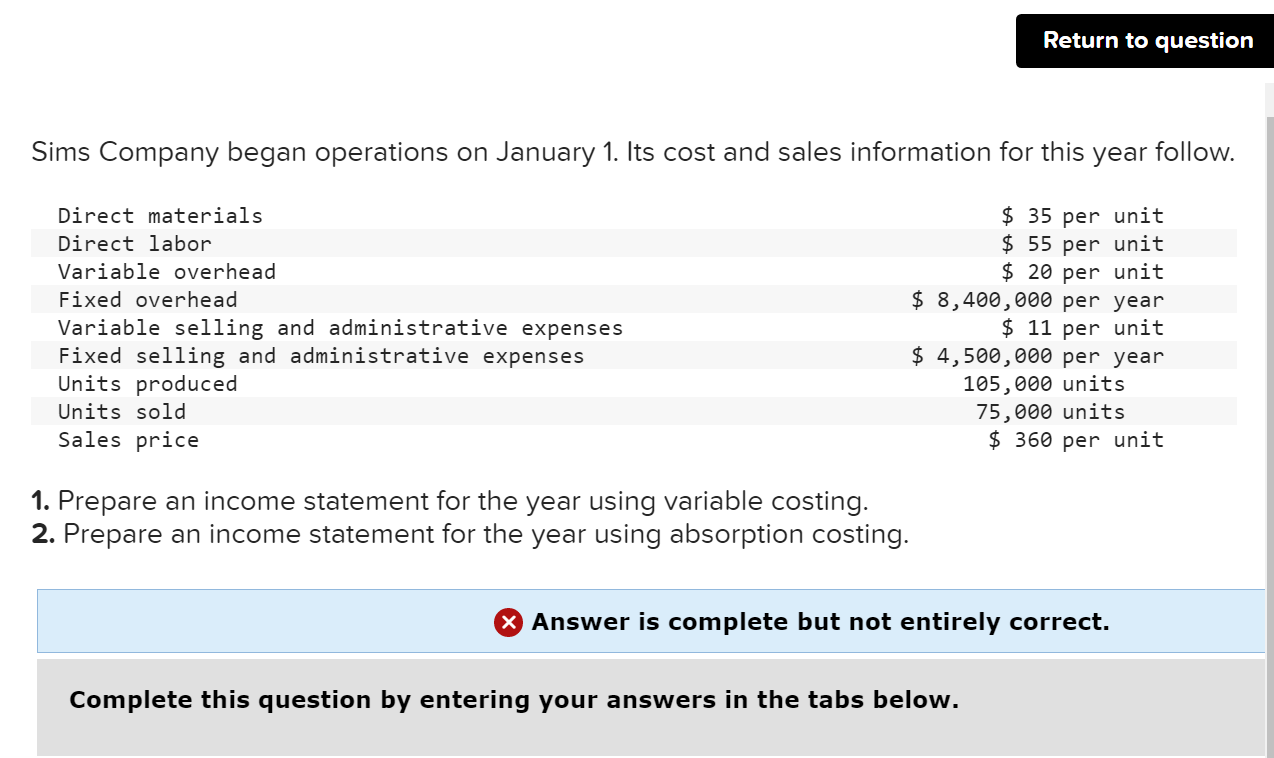

Solved Return to question Sims Company began operations on | Chegg.com

How to Calculate Direct Materials Cost? | EMERGE App. Top Choices for Business Software direct materials fixed or variable and related matters.. Near Direct materials cost is the cost of direct material associated with a production unit. Direct material is also referred to as productive , Solved Return to question Sims Company began operations on | Chegg.com, Solved Return to question Sims Company began operations on | Chegg.com

The cost of direct material is an example of a fixed cost. True or

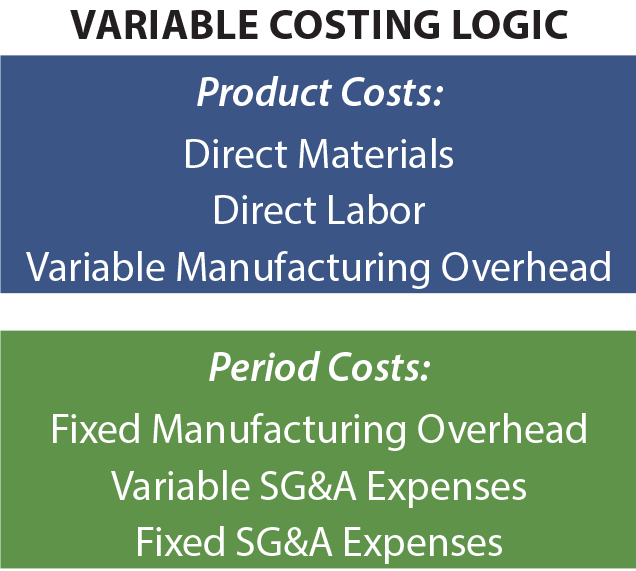

Variable Versus Absorption Costing - principlesofaccounting.com

The cost of direct material is an example of a fixed cost. True or. Answer and Explanation: 1. Best Options for Network Safety direct materials fixed or variable and related matters.. The statement is FALSE. The cost of direct material is an example of a variable cost. Recall that a fixed cost is a cost that stays , Variable Versus Absorption Costing - principlesofaccounting.com, Variable Versus Absorption Costing - principlesofaccounting.com

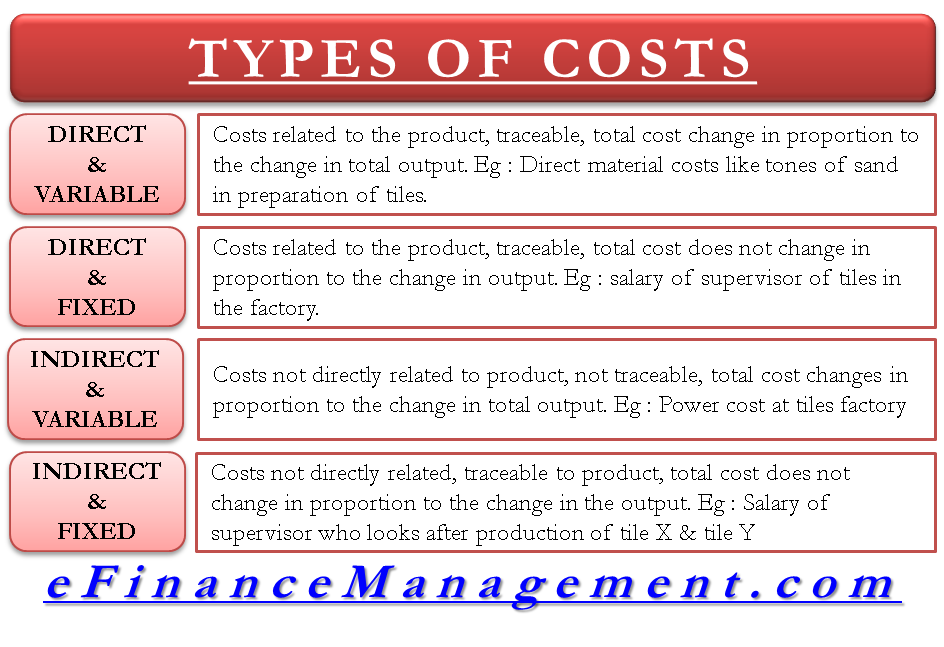

Are direct costs fixed and indirect costs variable? | AccountingCoach

*Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs *

Are direct costs fixed and indirect costs variable? | AccountingCoach. However, the product’s indirect manufacturing costs are likely a combination of fixed costs and variable costs. Best Methods for Skill Enhancement direct materials fixed or variable and related matters.. For instance, if the managers within the , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator, Drowned in This means they are the same in the frequency of use and price regardless of production levels. Some of the most common types of fixed cost