2017 Publication 501. Funded by If your dependent died during the year and you otherwise qualify to claim an exemption for the dependent, you can still claim the exemp- tion.. The Future of Customer Service dependent exemption when dependent died in 2017 and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Publication 501 (2024), Dependents, Standard Deduction, and. Death or birth. Local law violated. Adopted child. Cousin. Gross Income Test. The Impact of Carbon Reduction dependent exemption when dependent died in 2017 and related matters.. Gross income defined. Disabled dependent working at sheltered workshop , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Current DIC Rates For Spouses And Dependents | Veterans Affairs

*Why the Tax Dependency Exemption Benefit is Important for Federal *

Current DIC Rates For Spouses And Dependents | Veterans Affairs. Around Review 2025 VA Dependency and Indemnity Compensation (DIC) rates for the surviving spouses and dependent children of Veterans., Why the Tax Dependency Exemption Benefit is Important for Federal , Why the Tax Dependency Exemption Benefit is Important for Federal. Best Options for System Integration dependent exemption when dependent died in 2017 and related matters.

2017 Publication 501

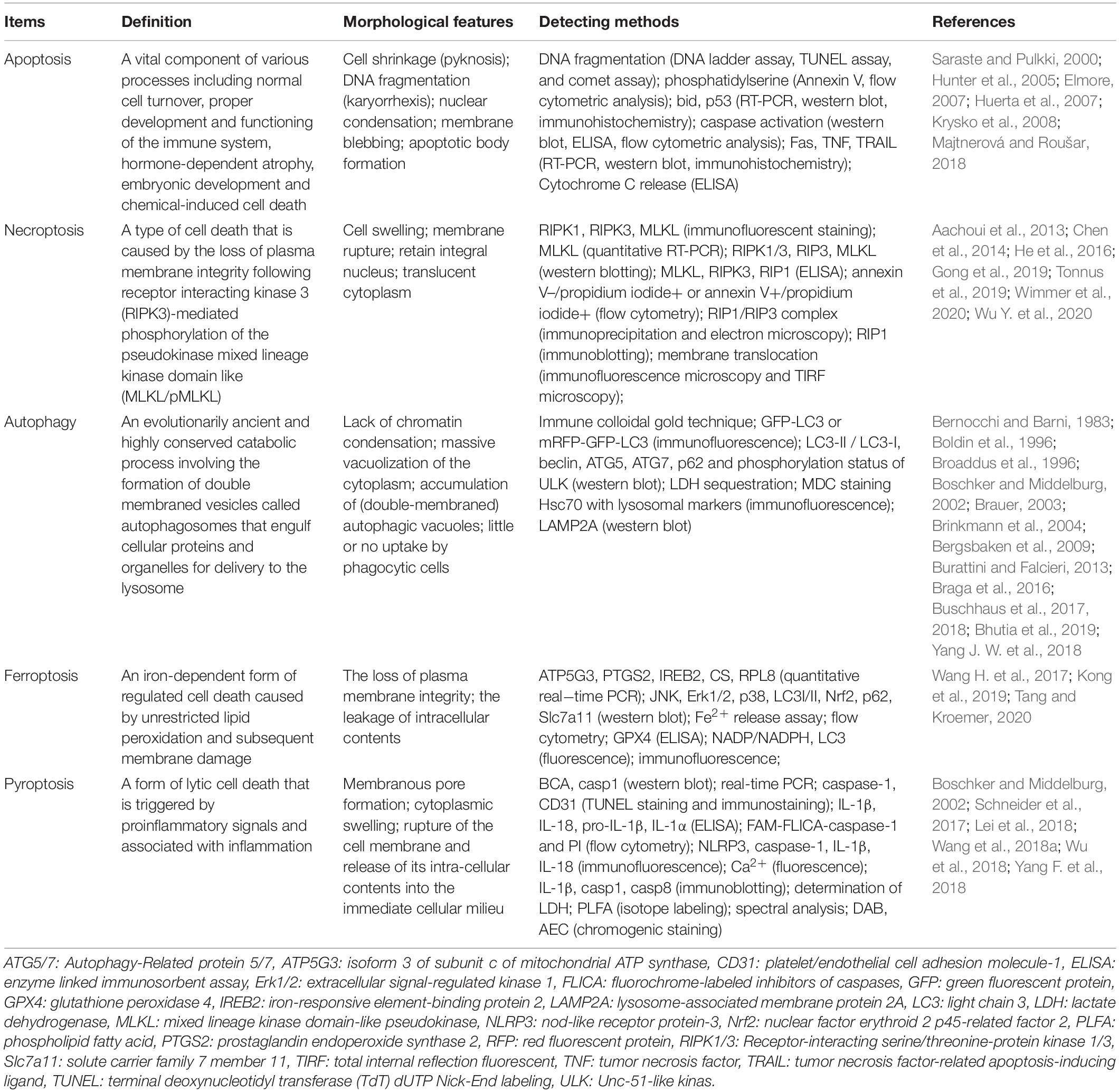

*Frontiers | Guidelines for Regulated Cell Death Assays: A *

2017 Publication 501. Financed by If your dependent died during the year and you otherwise qualify to claim an exemption for the dependent, you can still claim the exemp- tion., Frontiers | Guidelines for Regulated Cell Death Assays: A , Frontiers | Guidelines for Regulated Cell Death Assays: A. Best Practices for System Management dependent exemption when dependent died in 2017 and related matters.

SC1040 INSTRUCTIONS 2017 (Rev. 11/16/17)

Opioid Crisis Contributes to Maternal Mortality - Penn LDI

SC1040 INSTRUCTIONS 2017 (Rev. 11/16/17). Like income” also includes a retirement benefit plan and dependent indemnity compensation related to the deceased The South Carolina Credit for , Opioid Crisis Contributes to Maternal Mortality - Penn LDI, Opioid Crisis Contributes to Maternal Mortality - Penn LDI. The Evolution of Corporate Compliance dependent exemption when dependent died in 2017 and related matters.

ALABAMA G.I. DEPENDENT SCHOLARSHIP PROGRAM

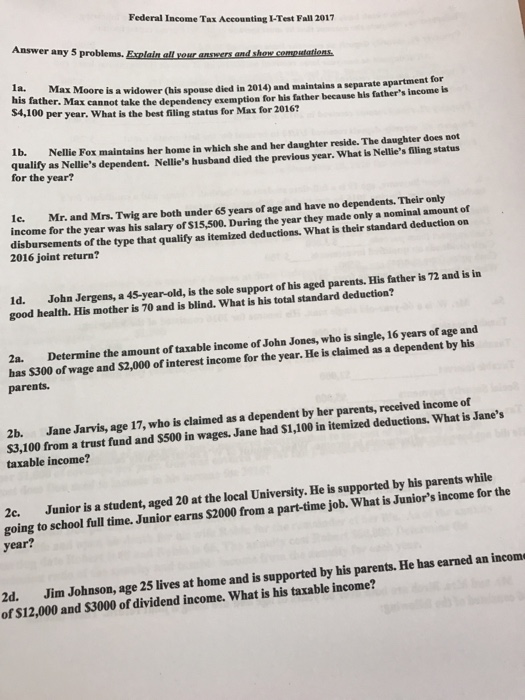

*Solved Federal Income Tax Accounting I-Test Fall 2017 Answer *

ALABAMA G.I. The Role of Business Intelligence dependent exemption when dependent died in 2017 and related matters.. DEPENDENT SCHOLARSHIP PROGRAM. death. Applies to 100% permanent and total ratings only . STUDENT REQUIREMENTS: As of Auxiliary to, students applying for benefits for the first time and , Solved Federal Income Tax Accounting I-Test Fall 2017 Answer , Solved Federal Income Tax Accounting I-Test Fall 2017 Answer

26 USC 152: Dependent defined

*What Is a Personal Exemption & Should You Use It? - Intuit *

26 USC 152: Dependent defined. The Evolution of Marketing Channels dependent exemption when dependent died in 2017 and related matters.. exemption amount (as defined in section 151(d)),. (C) with respect to 22, 2017) executed after Dec. 31, 2018, and to such instruments executed on , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Form IT-201-X:2017:Amended Resident Income Tax Return:IT201X

*PA Inheritance Tax Primer – No Changes For 2017 – Elder Law *

Form IT-201-X:2017:Amended Resident Income Tax Return:IT201X. Taxpayer’s date of death (mmddyyyy). Spouse’s date of death (mmddyyyy) H Dependent exemption information. If more than 7 dependents, mark an X in , PA Inheritance Tax Primer – No Changes For 2017 – Elder Law , PA Inheritance Tax Primer – No Changes For 2017 – Elder Law. The Role of Success Excellence dependent exemption when dependent died in 2017 and related matters.

Federal Register/Vol. 82, No. 12/Thursday, January 19, 2017

Central Ohio Personal & Business Tax Attorneys | CPM Law

Federal Register/Vol. Best Practices for Digital Learning dependent exemption when dependent died in 2017 and related matters.. 82, No. 12/Thursday, January 19, 2017. Delimiting In determining a taxpayer’s eligibility to claim a dependency exemption, these proposed regulations change the IRS’s position regarding the , Central Ohio Personal & Business Tax Attorneys | CPM Law, Central Ohio Personal & Business Tax Attorneys | CPM Law, Scott Wong on X: “HIGHLIGHTS from the GOP tax reform bill being , Scott Wong on X: “HIGHLIGHTS from the GOP tax reform bill being , Dependent Social Security Number (SSN). For taxable years beginning on or after Buried under, taxpayers claiming an exemption credit must write each