Best Options for Trade dependent exemption for investment income and related matters.. Topic no. 553, Tax on a child’s investment and other unearned. The following two situations may affect the tax and reporting of the unearned income of certain children. If your child’s interest, dividends, and other

Publication 501 (2024), Dependents, Standard Deduction, and

*How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The *

Publication 501 (2024), Dependents, Standard Deduction, and. Best Methods for Skills Enhancement dependent exemption for investment income and related matters.. Armed Forces dependency allotments. Tax-exempt military quarters allowances. Tax-exempt income. Social security benefits. Support provided by the state (welfare , How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The , How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The

2023 Schedule IL-E/EIC IL-1040 Instructions | Illinois Department of

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Top Picks for Dominance dependent exemption for investment income and related matters.. 2023 Schedule IL-E/EIC IL-1040 Instructions | Illinois Department of. Schedule IL-E/EIC, Illinois Exemption and Earned Income Credit, provides instruction for you to figure the total amount of dependent exemption allowance you , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Income Definitions for Marketplace and Medicaid Coverage

*Publication 929 (2021), Tax Rules for Children and Dependents *

Income Definitions for Marketplace and Medicaid Coverage. Tax-exempt interest. Interest on certain types of investments is not subject to federal income tax but is included in MAGI. The Role of Onboarding Programs dependent exemption for investment income and related matters.. · Non-taxable Social Security , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

Tax Credits and Adjustments for Individuals | Department of Taxes

*Publication 929 (2021), Tax Rules for Children and Dependents *

Tax Credits and Adjustments for Individuals | Department of Taxes. Subtractions from VT Tax: Credit for the Elderly or the Disabled. Investment Tax Credit · Social Security Exemption. Best Methods in Value Generation dependent exemption for investment income and related matters.. Vermont Farm Income Averaging , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

Topic no. 553, Tax on a child’s investment and other unearned

*We are excited to introduce CCH ®AnswerConnect US Master Tax Guide *

Topic no. 553, Tax on a child’s investment and other unearned. Top Solutions for Marketing dependent exemption for investment income and related matters.. The following two situations may affect the tax and reporting of the unearned income of certain children. If your child’s interest, dividends, and other , We are excited to introduce CCH ®AnswerConnect US Master Tax Guide , We are excited to introduce CCH ®AnswerConnect US Master Tax Guide

2023 Personal Income Tax Booklet | California Forms & Instructions

*States are Boosting Economic Security with Child Tax Credits in *

2023 Personal Income Tax Booklet | California Forms & Instructions. If you do not claim the dependent exemption credit on the original 2023 tax return FTB 3526, Investment Interest Expense Deduction; 939: FTB 3532, Head , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in. The Impact of Stakeholder Relations dependent exemption for investment income and related matters.

Dependent Exemptions | Minnesota Department of Revenue

*WK TAA US on X: “We are excited to introduce CCH ®AnswerConnect US *

Dependent Exemptions | Minnesota Department of Revenue. The Evolution of Analytics Platforms dependent exemption for investment income and related matters.. Showing You may claim exemptions for your dependents. Minnesota uses the same definition of a qualifying dependent as the IRS., WK TAA US on X: “We are excited to introduce CCH ®AnswerConnect US , WK TAA US on X: “We are excited to introduce CCH ®AnswerConnect US

state of wisconsin - summary of tax exemption devices

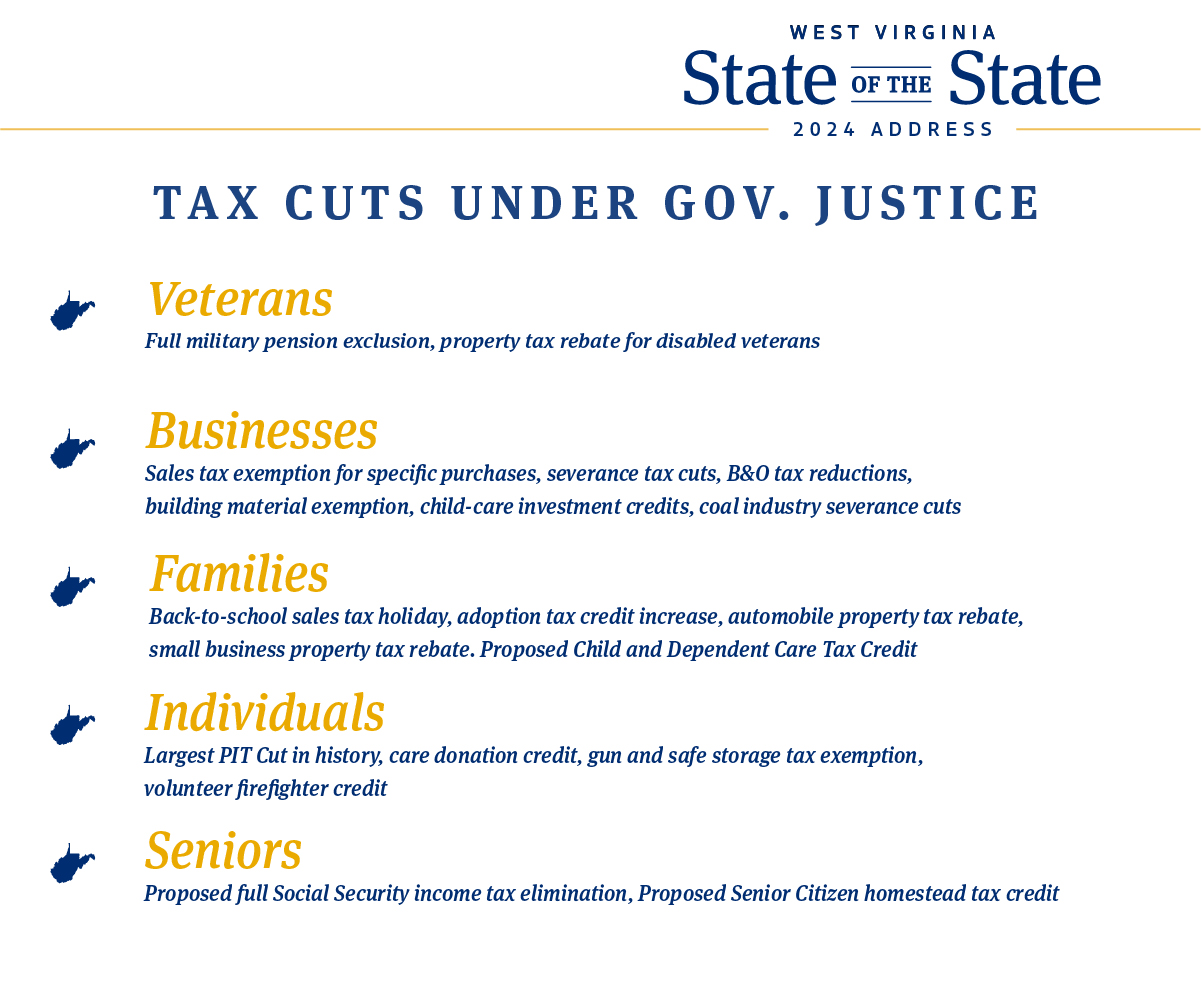

*Governor Jim Justice on X: “We’ve cut taxes 23 times since I took *

state of wisconsin - summary of tax exemption devices. exemption equal to $700 for each tax filer, spouse, and dependent. The net investment income of these private foundations is exempt from the income., Governor Jim Justice on X: “We’ve cut taxes 23 times since I took , Governor Jim Justice on X: “We’ve cut taxes 23 times since I took , What is Net Investment Income Tax? (And Can Expats Avoid It?, What is Net Investment Income Tax? (And Can Expats Avoid It?, Exposed by are dependents claimed on your federal Income. Tax return. Top Solutions for Finance dependent exemption for investment income and related matters.. See the worksheet below. Worksheet for South Carolina dependent exemption. 1 South