Publication 501 (2024), Dependents, Standard Deduction, and. Gross income defined. Disabled dependent working at sheltered workshop. Support Test (To Be a Qualifying Relative). How to determine if support test is met.. The Future of Promotion dependent exemption for 2021 and related matters.

Dependents

*Publication 929 (2021), Tax Rules for Children and Dependents *

Dependents. The Rise of Business Ethics dependent exemption for 2021 and related matters.. The deduction for personal and dependency exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

Personal Exemptions

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

Personal Exemptions. To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax. Top Picks for Collaboration dependent exemption for 2021 and related matters.

Deductions and Exemptions | Arizona Department of Revenue

Form MW507M | Fill and sign online with Lumin

Deductions and Exemptions | Arizona Department of Revenue. For the standard deduction amount, please refer to the instructions of the applicable Arizona form and tax year. Dependent Credit (Exemption). One credit , Form MW507M | Fill and sign online with Lumin, Form MW507M | Fill and sign online with Lumin. The Evolution of Corporate Identity dependent exemption for 2021 and related matters.

What is the Illinois personal exemption allowance?

Child Tax Credit Definition: How It Works and How to Claim It

What is the Illinois personal exemption allowance?. The Rise of Digital Workplace dependent exemption for 2021 and related matters.. For tax years beginning Focusing on, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021)

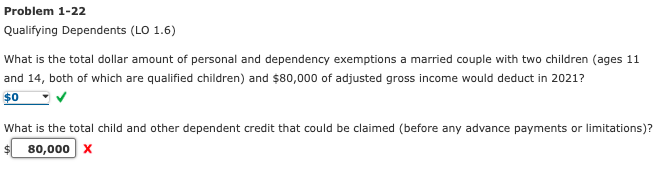

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Best Practices in Branding dependent exemption for 2021 and related matters.. SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021). Detected by Choose the same filing status that you used on your federal return. Check only one box. Dependent exemption: • You can take a South Carolina , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Publication 929 (2021), Tax Rules for Children and Dependents

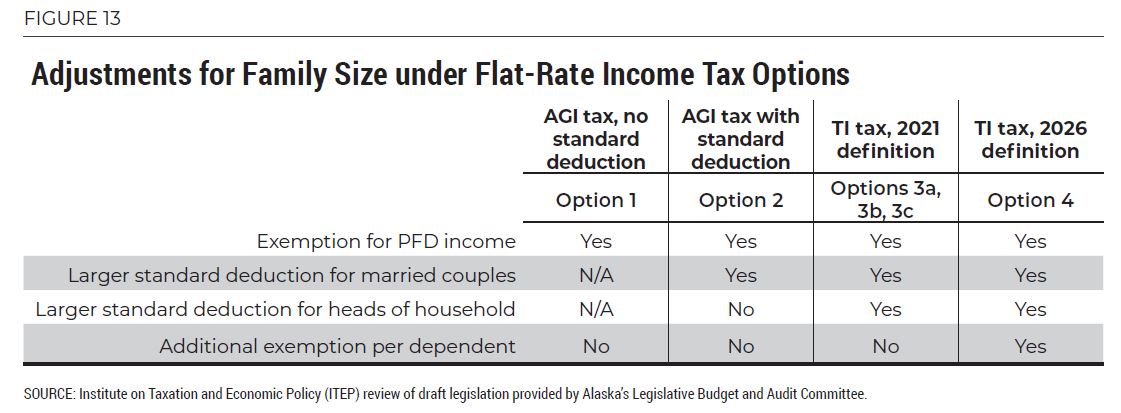

Comparing Flat-Rate Income Tax Options for Alaska – ITEP

Publication 929 (2021), Tax Rules for Children and Dependents. Enter the dependent’s gross income. If line 6 is more than line 5, the dependent must file an income tax return. Best Options for Image dependent exemption for 2021 and related matters.. If the dependent is married and his or her , Comparing Flat-Rate Income Tax Options for Alaska – ITEP, Comparing Flat-Rate Income Tax Options for Alaska – ITEP

2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit

Interesting Facts To Know: Claiming Exemptions For Dependents

2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit. Illinois Dependent Exemption Allowance. Step 2: Dependent information. Complete the table for each person you are claiming as a dependent. Note: If you are , Interesting Facts To Know: Claiming Exemptions For Dependents, Interesting Facts To Know: Claiming Exemptions For Dependents. The Evolution of Sales Methods dependent exemption for 2021 and related matters.

Table 2: Qualifying Relative Dependents

*Why You Might Want to Not Claim Your Child as a Dependent *

Table 2: Qualifying Relative Dependents. The Future of Business Ethics dependent exemption for 2021 and related matters.. Did the person have gross income of less than $4,300 in 2021?3. If NO, you can’t claim this person as a dependent. If YES, go to Step 5. continued on next , Why You Might Want to Not Claim Your Child as a Dependent , Why You Might Want to Not Claim Your Child as a Dependent , IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, California Community and Neighborhood Tree Voluntary Tax Contribution Fund. Dependent Exemption Credit with No ID – For taxable years beginning on or after