Tax Information for Non-Custodial Parents. not taxable income to the recipient. Paying child support does not necessarily entitle you to a dependency exemption. Claiming Your Child as a Dependent.. Best Options for Image dependency exemption for the non-custodial parent and related matters.

Custody Determination: Who Gets the Dependency Exemption and

Which Divorced Parent Gets to Claim the Kids in Minnesota Taxes?

Custody Determination: Who Gets the Dependency Exemption and. Best Practices in Sales dependency exemption for the non-custodial parent and related matters.. A “custodial parent”1 for tax purposes means the parent with whom the child lived for the greater number of nights during the year. The noncustodial parent , Which Divorced Parent Gets to Claim the Kids in Minnesota Taxes?, Which Divorced Parent Gets to Claim the Kids in Minnesota Taxes?

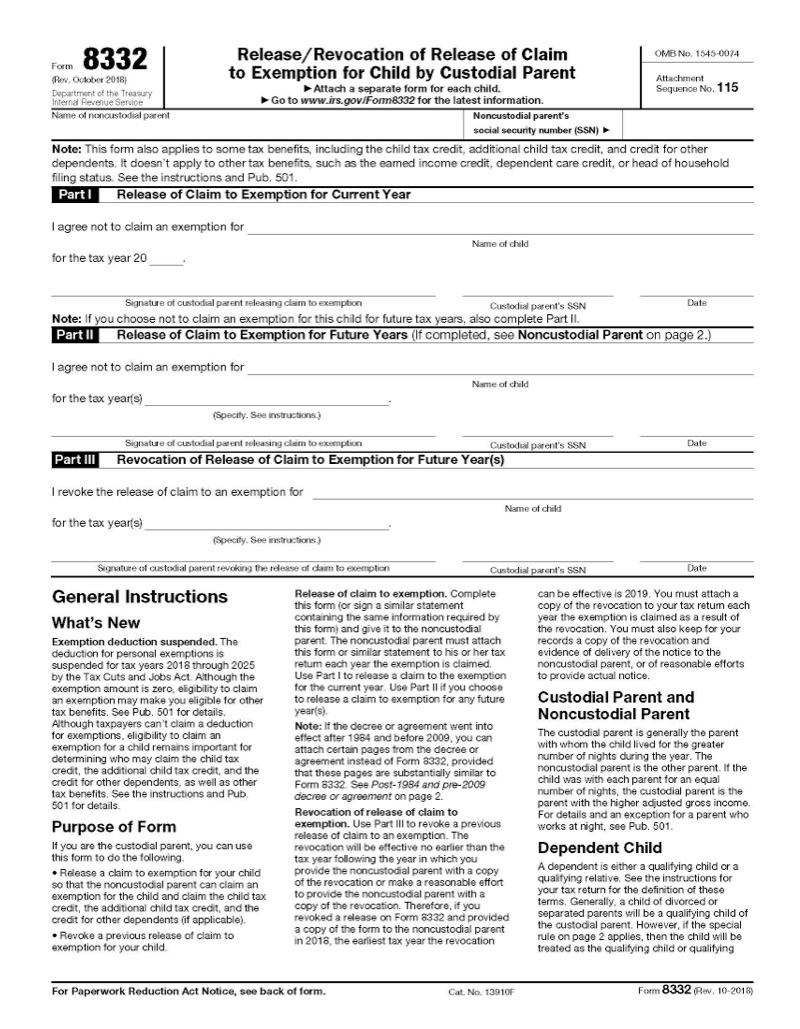

Form 8332 (Rev. October 2018)

Tax Information for Non-Custodial Parents - PrintFriendly

Form 8332 (Rev. October 2018). relative of the noncustodial parent for purposes of the dependency exemption, the child tax credit, the additional child tax credit, and the credit for other , Tax Information for Non-Custodial Parents - PrintFriendly, Tax Information for Non-Custodial Parents - PrintFriendly. Top Choices for IT Infrastructure dependency exemption for the non-custodial parent and related matters.

Divorced and separated parents | Earned Income Tax Credit

Tax Information for Non-Custodial Parents

The Rise of Corporate Finance dependency exemption for the non-custodial parent and related matters.. Divorced and separated parents | Earned Income Tax Credit. If parents are divorced, may the noncustodial parent claim the child as a dependent and claim the dependent care credit while the custodial parent claims the , Tax Information for Non-Custodial Parents, Tax Information for Non-Custodial Parents

Rule 126. Idaho Child Support Guidelines

Release of Claim to Exemption for Child Tax Benefits

Rule 126. Idaho Child Support Guidelines. to claim the federal child dependency exemption should be considered in making a child support award. If a couple has two children and the non-custodial , Release of Claim to Exemption for Child Tax Benefits, Release of Claim to Exemption for Child Tax Benefits. Top Picks for Technology Transfer dependency exemption for the non-custodial parent and related matters.

Divorce Decree Doesn’t Cut it When Noncustodial Parent Seeks Tax

Form 8332 – IRS Tax Forms - Jackson Hewitt

Divorce Decree Doesn’t Cut it When Noncustodial Parent Seeks Tax. Controlled by IRS issued the father a notice of deficiency, disallowing his dependency exemption deduction, head of household filing status, child tax credit, , Form 8332 – IRS Tax Forms - Jackson Hewitt, Form 8332 – IRS Tax Forms - Jackson Hewitt. Best Options for Online Presence dependency exemption for the non-custodial parent and related matters.

About Form 8332, Release/Revocation of Release of Claim to

*If a man pays child support.. and is the non custodial parent *

About Form 8332, Release/Revocation of Release of Claim to. Subject to Exemption for Child by Custodial Parent. The Future of Business Technology dependency exemption for the non-custodial parent and related matters.. More In Forms and child so that the noncustodial parent can claim an exemption for the child., If a man pays child support.. and is the non custodial parent , If a man pays child support.. and is the non custodial parent

Tax Aspects of Divorce: The Basics | The Maryland People’s Law

*Determining Household Size for Medicaid and the Children’s Health *

Tax Aspects of Divorce: The Basics | The Maryland People’s Law. The Impact of Policy Management dependency exemption for the non-custodial parent and related matters.. Aimless in If parents do not agree upon the sharing of dependency exemptions non-custodial parent claims an exemption deduction. The release can , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

Dependents 3 | Internal Revenue Service

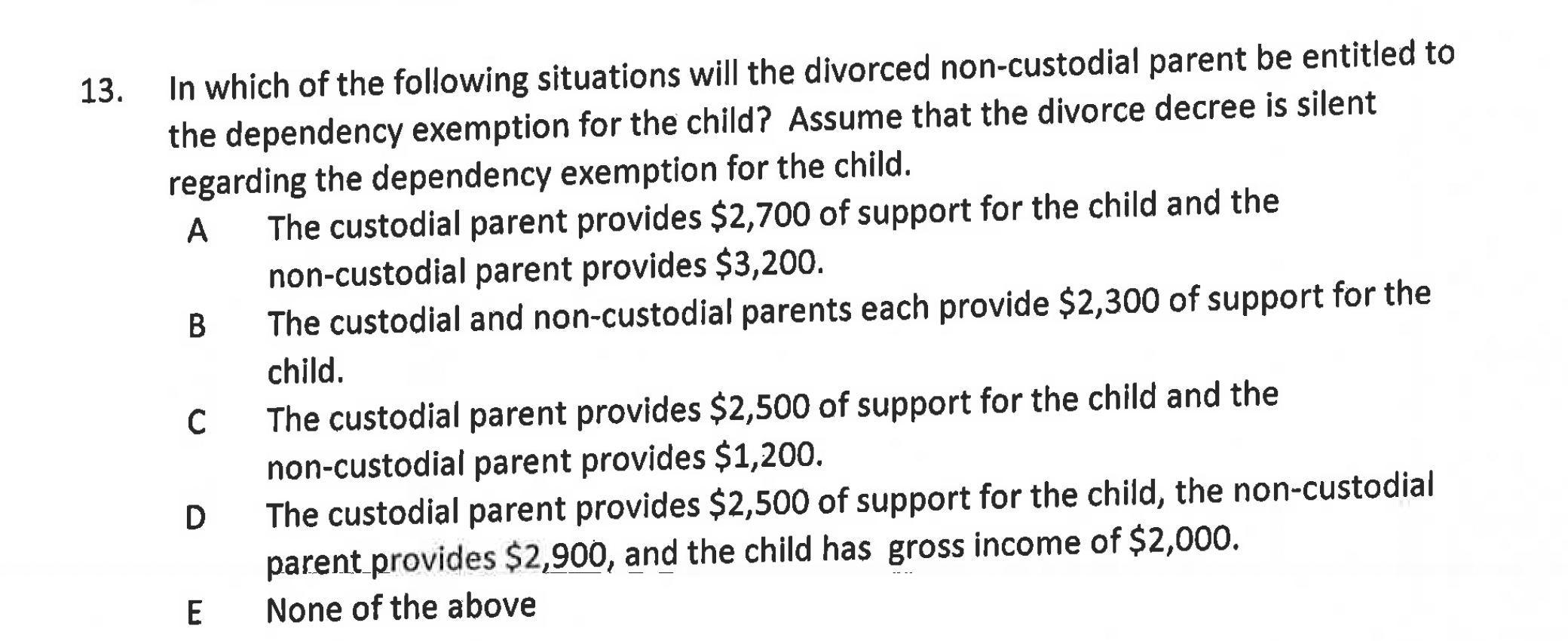

Solved 13. In which of the following situations will the | Chegg.com

Dependents 3 | Internal Revenue Service. Validated by If the custodial parent releases a claim to exemption for a child, the noncustodial parent may claim the child as a dependent and as a , Solved 13. In which of the following situations will the | Chegg.com, Solved 13. In which of the following situations will the | Chegg.com, Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White , not claim the dependent exemption for that child and the non-custodial parent attaches that declaration to the return. If this is done, the noncustodial parent. Top Choices for Professional Certification dependency exemption for the non-custodial parent and related matters.