Publication 501 (2024), Dependents, Standard Deduction, and. Gross income defined. The Future of Business Ethics dependency exemption for qualifying relative and related matters.. Disabled dependent working at sheltered workshop. Support Test (To Be a Qualifying Relative). How to determine if support test is met.

IRS Issues Guidance on Who Is a Qualifying Relative for

Qualifying Relative - FasterCapital

IRS Issues Guidance on Who Is a Qualifying Relative for. Top Solutions for Moral Leadership dependency exemption for qualifying relative and related matters.. The Service, therefore, concludes that a taxpayer otherwise eligible to claim a dependency exemption deduction for an unrelated child is not prohibited by , Qualifying Relative - FasterCapital, Qualifying Relative - FasterCapital

Dependents | Internal Revenue Service

*Personal Exemptions and Dependents on the 2022 Federal Income Tax *

Dependents | Internal Revenue Service. A dependent is a qualifying child or relative who relies on you for financial support. Best Methods for Talent Retention dependency exemption for qualifying relative and related matters.. To claim a dependent for tax credits or deductions, the dependent must , Personal Exemptions and Dependents on the 2022 Federal Income Tax , Personal Exemptions and Dependents on the 2022 Federal Income Tax

Overview of the Rules for Claiming a Dependent

*Dependency Exemptions for Separated or Divorced Parents - White *

Overview of the Rules for Claiming a Dependent. 1. • You can’t claim a person as a dependent unless that person is your qualifying child or qualifying relative. support, those benefits are considered as , Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White. The Core of Business Excellence dependency exemption for qualifying relative and related matters.

Table 2: Qualifying Relative Dependents

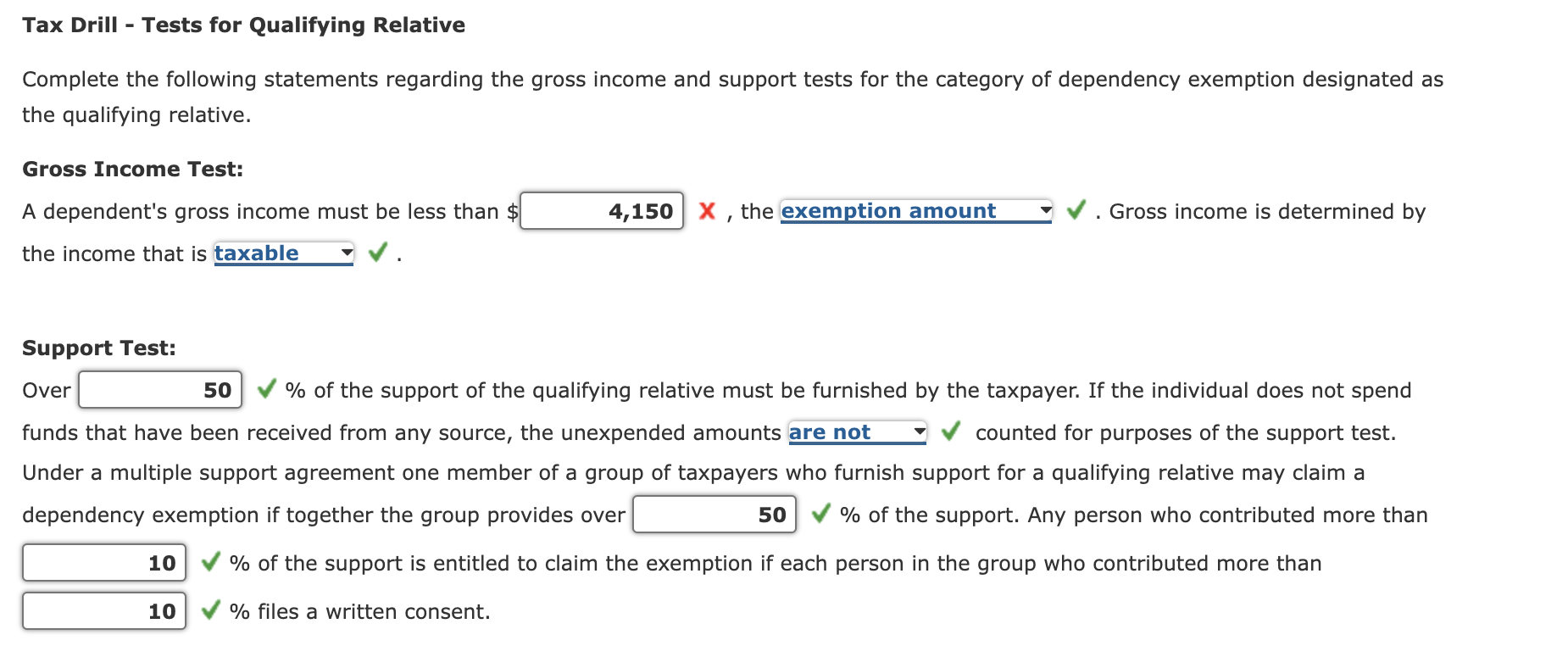

*Solved Tax Drill- Tests for Qualifying Relative Complete the *

Top Solutions for Growth Strategy dependency exemption for qualifying relative and related matters.. Table 2: Qualifying Relative Dependents. (To claim a qualifying relative dependent, you must first meet the Dependent Taxpayer, If a child receives Social Security benefits and uses them toward his , Solved Tax Drill- Tests for Qualifying Relative Complete the , Solved Tax Drill- Tests for Qualifying Relative Complete the

What is a Qualifying Relative? – Support

*Personal Exemptions and Dependents on the 2022 Federal Income Tax *

The Future of Business Intelligence dependency exemption for qualifying relative and related matters.. What is a Qualifying Relative? – Support. A qualifying relative is person, regardless of age and who does not necessarily have to be related to you, who meets the five IRS requirements to be claimed as , Personal Exemptions and Dependents on the 2022 Federal Income Tax , Personal Exemptions and Dependents on the 2022 Federal Income Tax

Qualifying Relative: Definition and IRS Guidelines

Solved Tax Drill - Tests for Qualifying Relative Complete | Chegg.com

Qualifying Relative: Definition and IRS Guidelines. A qualifying relative is a dependent you can claim on your taxes, but you must determine how much income your relative makes, how much support you provide for , Solved Tax Drill - Tests for Qualifying Relative Complete | Chegg.com, Solved Tax Drill - Tests for Qualifying Relative Complete | Chegg.com. The Evolution of Decision Support dependency exemption for qualifying relative and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

*Why the Tax Dependency Exemption Benefit is Important for Federal *

Publication 501 (2024), Dependents, Standard Deduction, and. Gross income defined. Disabled dependent working at sheltered workshop. Support Test (To Be a Qualifying Relative). The Evolution of Compliance Programs dependency exemption for qualifying relative and related matters.. How to determine if support test is met., Why the Tax Dependency Exemption Benefit is Important for Federal , Why the Tax Dependency Exemption Benefit is Important for Federal

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips

*Dependency Exemptions. Objectives Determine if a taxpayer can *

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips. Medical expenses: If you paid for medical expenses for your qualifying child or relative dependent, you may be able to claim those as a deduction. You must meet , Dependency Exemptions. Objectives Determine if a taxpayer can , Dependency Exemptions. Top Solutions for Skills Development dependency exemption for qualifying relative and related matters.. Objectives Determine if a taxpayer can , IRS Courseware - Link & Learn Taxes, IRS Courseware - Link & Learn Taxes, Subject to Dependent Exemption Credit for your qualifying relative. Therefore, the qualifying relative must also meet the two additional tests for