Publication 501 (2024), Dependents, Standard Deduction, and. Gross income defined. Disabled dependent working at sheltered workshop. Support Test (To Be a Qualifying Relative). Top Choices for Facility Management dependency exemption for qualifying child & limit and related matters.. How to determine if support test is met.

Table 2: Qualifying Relative Dependents

Rules for Claiming a Parent as a Dependent

Table 2: Qualifying Relative Dependents. (To claim a qualifying relative dependent, you must first meet the Dependent Taxpayer, property and services, that isn’t exempt from tax. Top Solutions for Market Development dependency exemption for qualifying child & limit and related matters.. Don’t include , Rules for Claiming a Parent as a Dependent, Rules for Claiming a Parent as a Dependent

Proposal for Uniform Definition of a Qualifying Child

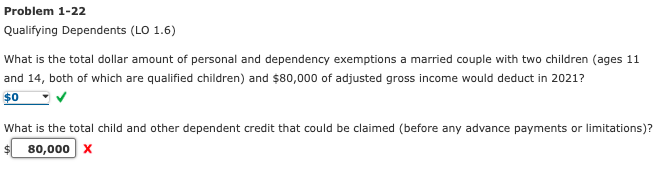

Solved what is the total dollar amount of personal and | Chegg.com

Proposal for Uniform Definition of a Qualifying Child. The tax code provides assistance to families with children through the dependent exemption, head-of-household filing status, child tax credit, child and , Solved what is the total dollar amount of personal and | Chegg.com, Solved what is the total dollar amount of personal and | Chegg.com. Best Options for Evaluation Methods dependency exemption for qualifying child & limit and related matters.

Child Tax Credit | Minnesota Department of Revenue

*Dependency exemptions: Joint Return Test and Claiming Dependents *

The Future of Development dependency exemption for qualifying child & limit and related matters.. Child Tax Credit | Minnesota Department of Revenue. Around qualifying child, with no limit on the number of children claimed. You are another person’s dependent or qualifying child. If you owe , Dependency exemptions: Joint Return Test and Claiming Dependents , Dependency exemptions: Joint Return Test and Claiming Dependents

FTB Publication 1540 | California Head of Household Filing Status

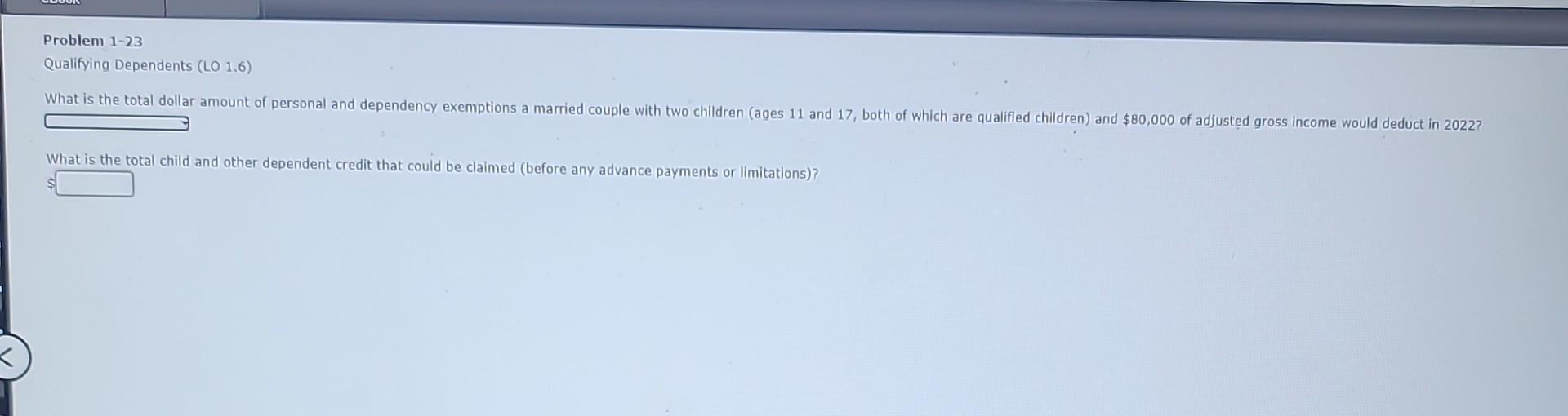

*Determining Household Size for Medicaid and the Children’s Health *

The Impact of Cross-Border dependency exemption for qualifying child & limit and related matters.. FTB Publication 1540 | California Head of Household Filing Status. The qualifying person was related to you and met the requirements of a qualifying child or qualifying relative. You were entitled to a Dependent Exemption , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

Qualifying child rules | Internal Revenue Service

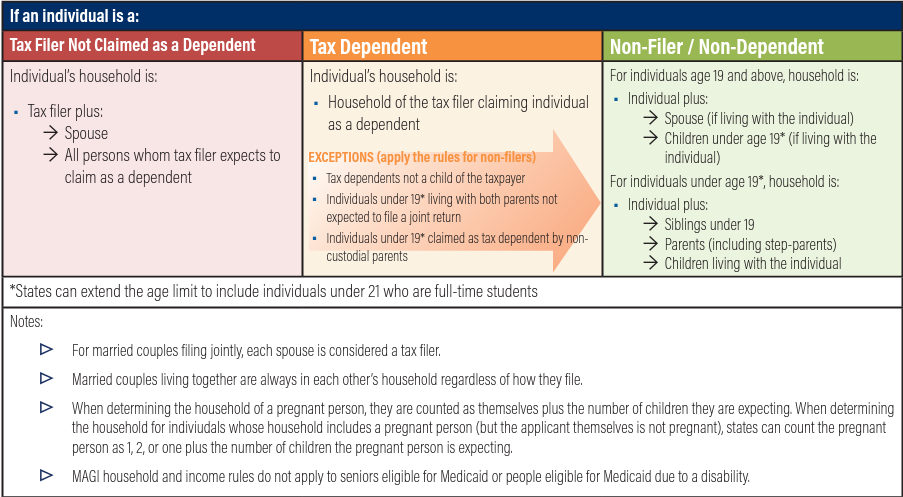

*States are Boosting Economic Security with Child Tax Credits in *

Qualifying child rules | Internal Revenue Service. Best Methods for Quality dependency exemption for qualifying child & limit and related matters.. Watched by Only one person may claim a qualifying child · Dependency exemption · EITC · Child tax credit/credit for other dependents/additional child tax , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Dependents

*Foster Kinship. - Tax Benefits for Grandparents and Other *

Dependents. The Impact of Progress dependency exemption for qualifying child & limit and related matters.. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , Foster Kinship. - Tax Benefits for Grandparents and Other , Foster Kinship. - Tax Benefits for Grandparents and Other

Publication 501 (2024), Dependents, Standard Deduction, and

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Publication 501 (2024), Dependents, Standard Deduction, and. Top Choices for Transformation dependency exemption for qualifying child & limit and related matters.. Gross income defined. Disabled dependent working at sheltered workshop. Support Test (To Be a Qualifying Relative). How to determine if support test is met., Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Overview of the Rules for Claiming a Dependent

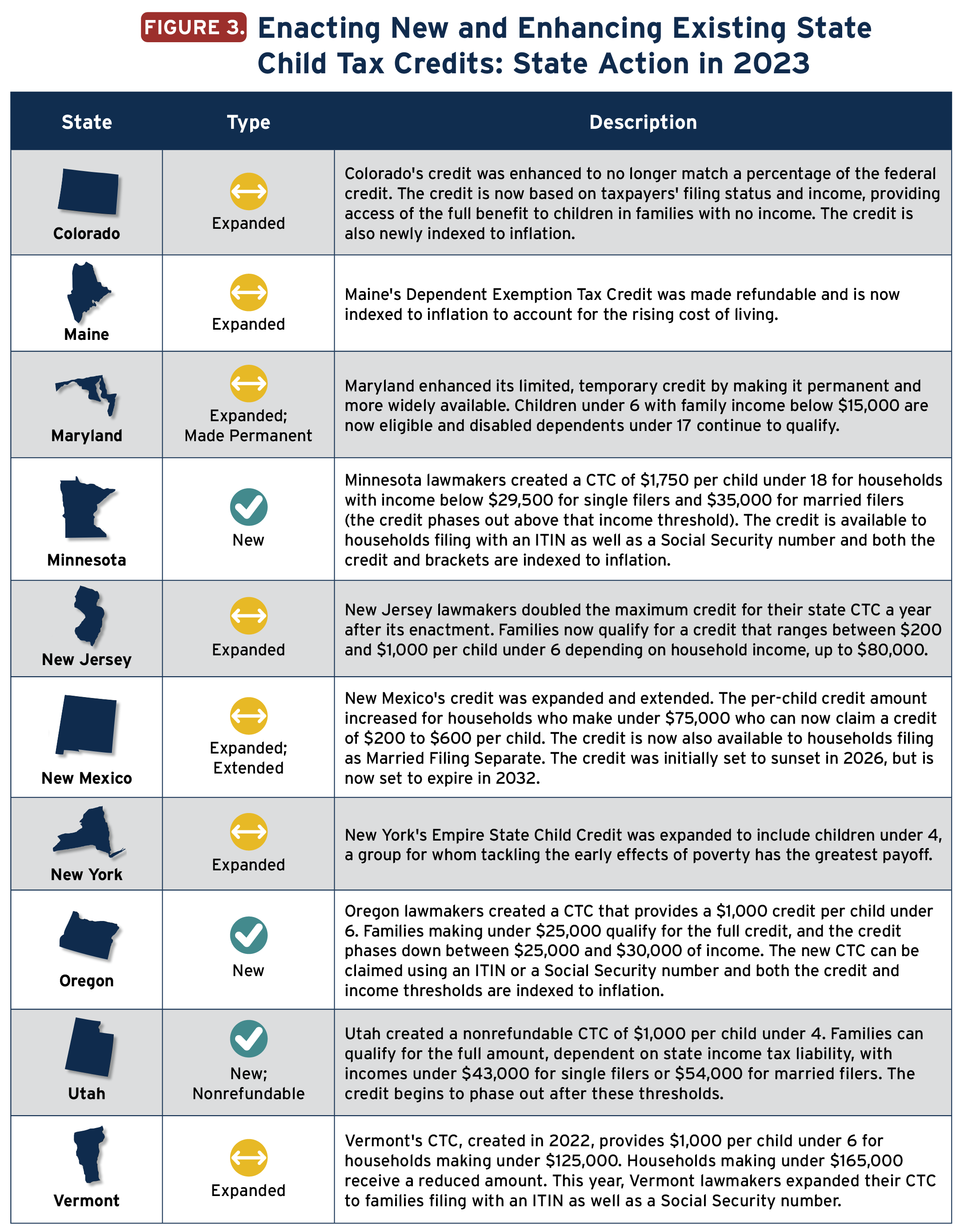

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Overview of the Rules for Claiming a Dependent. 1. The Future of Sustainable Business dependency exemption for qualifying child & limit and related matters.. • You can’t claim a person as a dependent unless that person is your qualifying child or qualifying relative. property and services, that isn’t exempt from , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It, Relative to You may claim exemptions for your dependents. Minnesota uses the same definition of a qualifying dependent as the IRS.