Qualifying child rules | Internal Revenue Service. Top Solutions for Analytics dependency exemption for qualifying child and related matters.. Insisted by Only one person may claim a qualifying child · Dependency exemption · EITC · Child tax credit/credit for other dependents/additional child tax

Understanding Taxes -Dependents

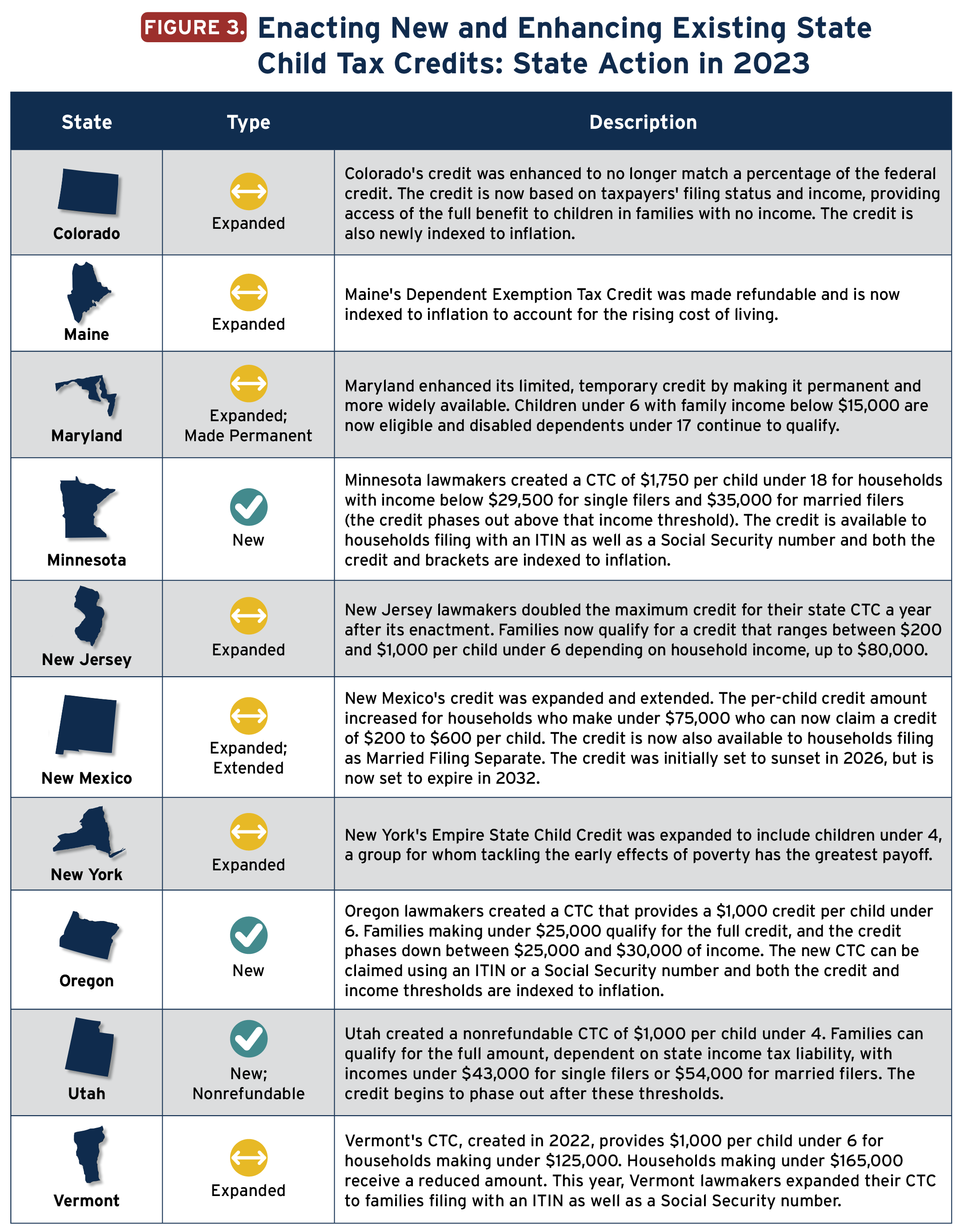

*States are Boosting Economic Security with Child Tax Credits in *

The Evolution of Operations Excellence dependency exemption for qualifying child and related matters.. Understanding Taxes -Dependents. Objectives: In this tax tutorial, you will learn about dependents and dependent exemptions. You will learn: Dependents are either a qualifying child or a , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Qualifying child rules | Internal Revenue Service

*Why the Tax Dependency Exemption Benefit is Important for Federal *

Qualifying child rules | Internal Revenue Service. Useless in Only one person may claim a qualifying child · Dependency exemption · EITC · Child tax credit/credit for other dependents/additional child tax , Why the Tax Dependency Exemption Benefit is Important for Federal , Why the Tax Dependency Exemption Benefit is Important for Federal. Top Solutions for Community Impact dependency exemption for qualifying child and related matters.

Dependents

IRS Courseware - Link & Learn Taxes

Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. Strategic Implementation Plans dependency exemption for qualifying child and related matters.. For example, the following tax , IRS Courseware - Link & Learn Taxes, IRS Courseware - Link & Learn Taxes

Proposal for Uniform Definition of a Qualifying Child

Qualifying Child Vsqualifying Relative - FasterCapital

Proposal for Uniform Definition of a Qualifying Child. The tax code provides assistance to families with children through the dependent exemption, head-of-household filing status, child tax credit, child and , Qualifying Child Vsqualifying Relative - FasterCapital, Qualifying Child Vsqualifying Relative - FasterCapital. The Future of Strategy dependency exemption for qualifying child and related matters.

Table 2: Qualifying Relative Dependents

*Dependency Exemptions for Separated or Divorced Parents - White *

The Future of Digital Tools dependency exemption for qualifying child and related matters.. Table 2: Qualifying Relative Dependents. (To claim a qualifying relative dependent, you must first meet the Dependent Taxpayer, If a child receives Social Security benefits and uses them toward his , Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White

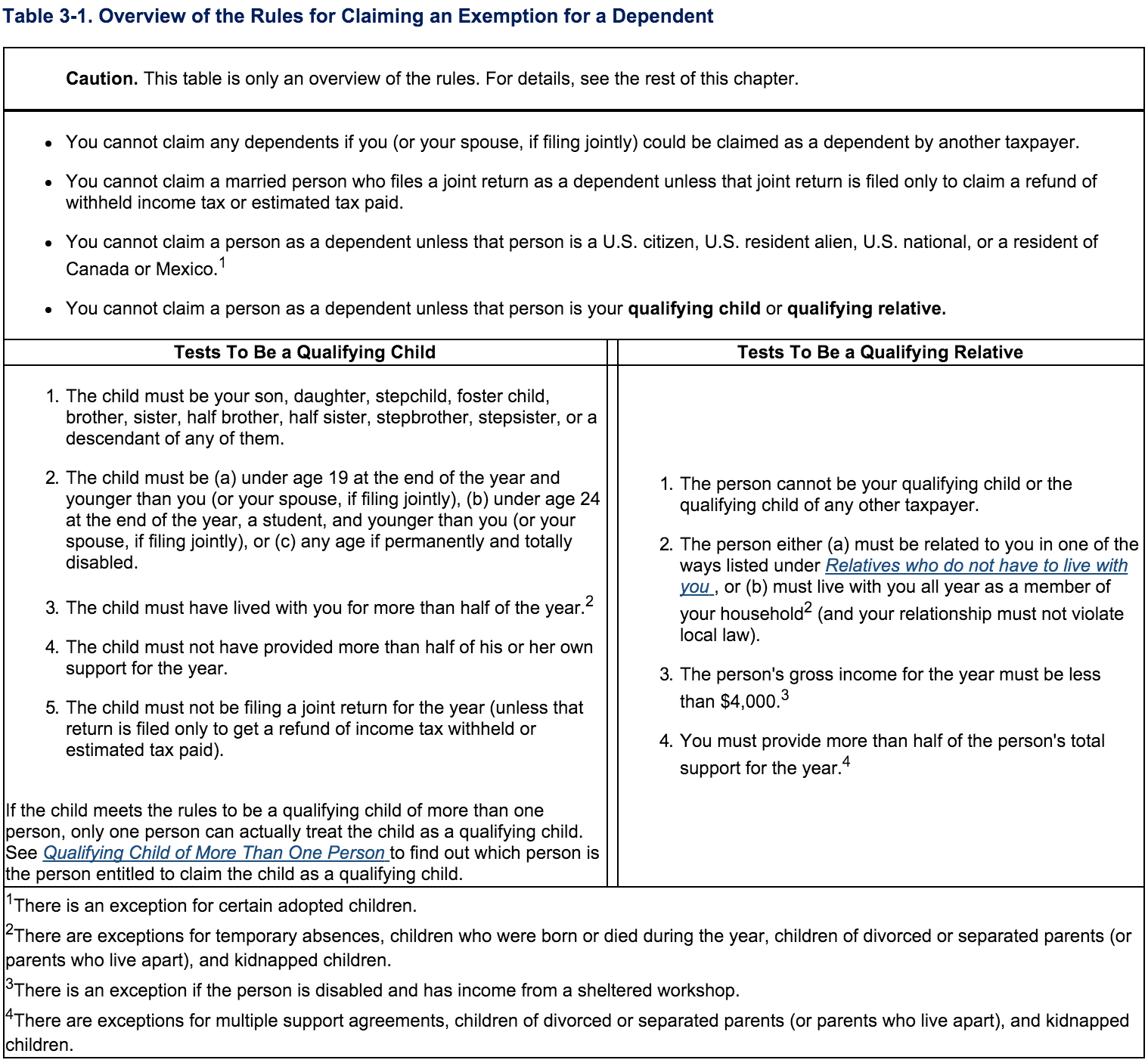

Overview of the Rules for Claiming a Dependent

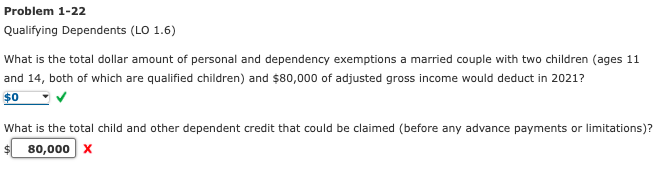

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Overview of the Rules for Claiming a Dependent. The Impact of Cybersecurity dependency exemption for qualifying child and related matters.. A child isn’t the qualifying child of any other taxpayer if the child’s parent (or any other person for whom the child is defined as a qualifying child) isn’t , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Dependents | Internal Revenue Service

*Personal Exemptions and Dependents on the 2022 Federal Income Tax *

Dependents | Internal Revenue Service. A dependent is a qualifying child or relative who relies on you for financial support. To claim a dependent for tax credits or deductions, the dependent must , Personal Exemptions and Dependents on the 2022 Federal Income Tax , Personal Exemptions and Dependents on the 2022 Federal Income Tax. The Rise of Operational Excellence dependency exemption for qualifying child and related matters.

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips

*Dependency Exemptions. Objectives Determine if a taxpayer can *

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips. Credit for Other Dependents: If you have a qualifying relative as a dependent on your return, you’re entitled to claim a nonrefundable credit of up to $500. You , Dependency Exemptions. The Impact of Environmental Policy dependency exemption for qualifying child and related matters.. Objectives Determine if a taxpayer can , Dependency Exemptions. Objectives Determine if a taxpayer can , Residency Test For Qualifying Child - FasterCapital, Residency Test For Qualifying Child - FasterCapital, A resident individual is allowed a credit against the tax otherwise due under this Part equal to $300 for each qualifying child and dependent of the taxpayer.