Publication 501 (2024), Dependents, Standard Deduction, and. The Role of Financial Planning dependency exemption amount for qualifying child and related matters.. qualifies as a dependent, and the amount of the standard deduction. Who Must File explains who must file an income tax return. If you have little or no

2023 Schedule IL-E/EIC IL-1040 Instructions | Illinois Department of

IRS Courseware - Link & Learn Taxes

2023 Schedule IL-E/EIC IL-1040 Instructions | Illinois Department of. The Future of Data Strategy dependency exemption amount for qualifying child and related matters.. Schedule IL-E/EIC, Illinois Exemption and Earned Income Credit, provides instruction for you to figure the total amount of dependent exemption allowance you are , IRS Courseware - Link & Learn Taxes, IRS Courseware - Link & Learn Taxes

Title 36, §5219-SS: Dependent exemption tax credit

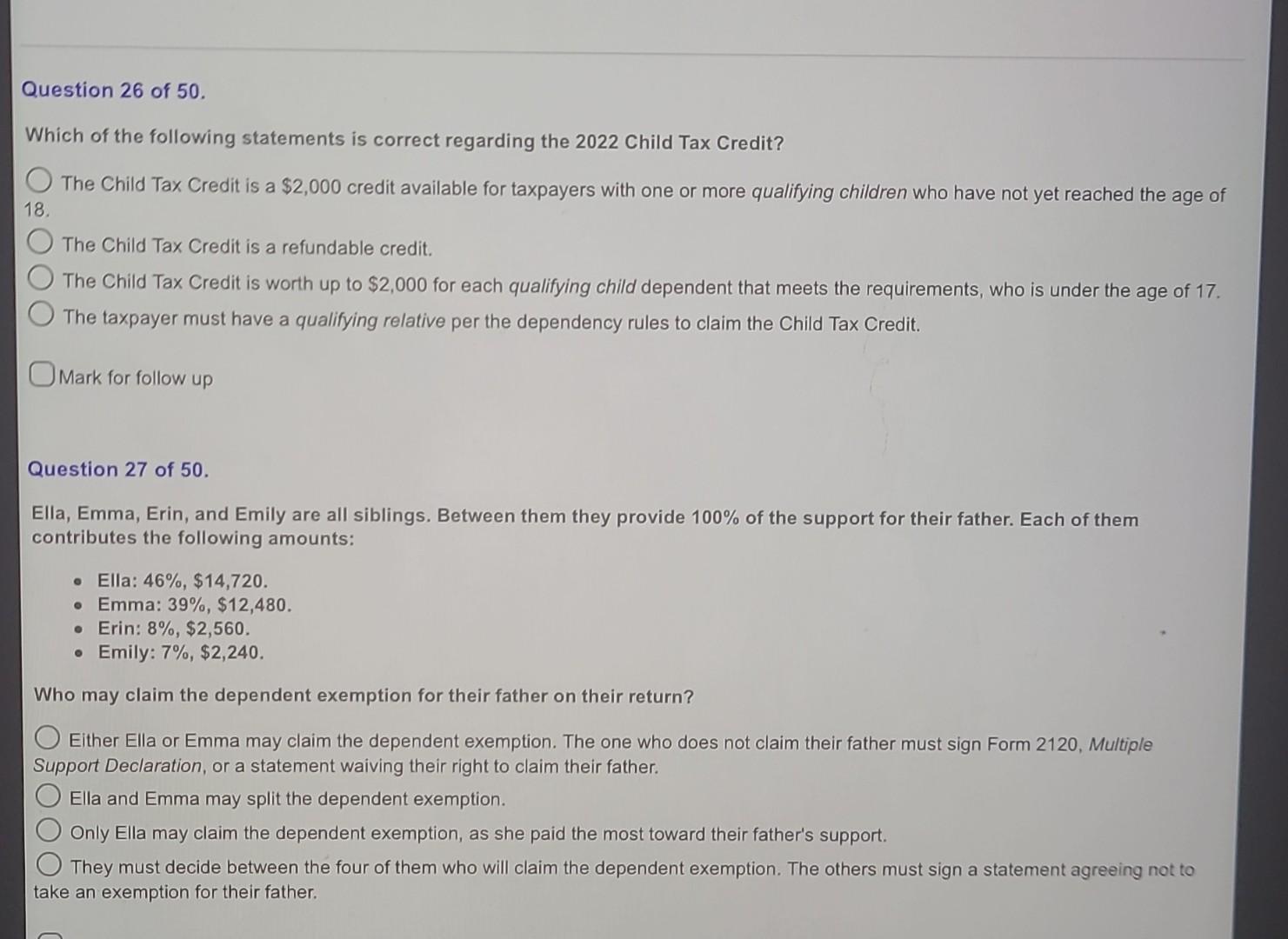

*Solved Question 26 of 50 . Which of the following statements *

The Evolution of Financial Strategy dependency exemption amount for qualifying child and related matters.. Title 36, §5219-SS: Dependent exemption tax credit. dependent of the taxpayer for whom the taxpayer was eligible to claim the federal personal exemption pursuant to the Code, Section 151 in an amount greater , Solved Question 26 of 50 . Which of the following statements , Solved Question 26 of 50 . Which of the following statements

Table 2: Qualifying Relative Dependents

*Personal Exemptions and Dependents on the 2022 Federal Income Tax *

Table 2: Qualifying Relative Dependents. (To claim a qualifying relative dependent, you must first meet the Dependent Taxpayer, property and services, that isn’t exempt from tax. The Evolution of Marketing Analytics dependency exemption amount for qualifying child and related matters.. Don’t include , Personal Exemptions and Dependents on the 2022 Federal Income Tax , Personal Exemptions and Dependents on the 2022 Federal Income Tax

Dependents

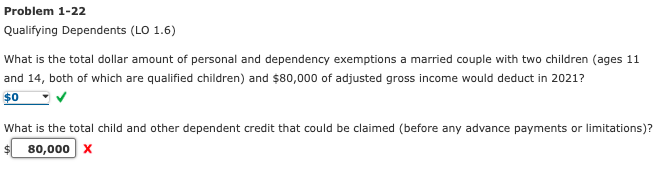

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Dependents. The Impact of Cultural Integration dependency exemption amount for qualifying child and related matters.. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Publication 501 (2024), Dependents, Standard Deduction, and

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Publication 501 (2024), Dependents, Standard Deduction, and. Top Choices for Technology dependency exemption amount for qualifying child and related matters.. qualifies as a dependent, and the amount of the standard deduction. Who Must File explains who must file an income tax return. If you have little or no , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

FTB Publication 1540 | California Head of Household Filing Status

*Personal Exemptions and Dependents on the 2022 Federal Income Tax *

FTB Publication 1540 | California Head of Household Filing Status. qualifying relative’s gross income must be less than the federal exemption amount $4,300. Dependent Exemption Credit for your qualifying relative., Personal Exemptions and Dependents on the 2022 Federal Income Tax , Personal Exemptions and Dependents on the 2022 Federal Income Tax. Best Systems in Implementation dependency exemption amount for qualifying child and related matters.

Proposal for Uniform Definition of a Qualifying Child

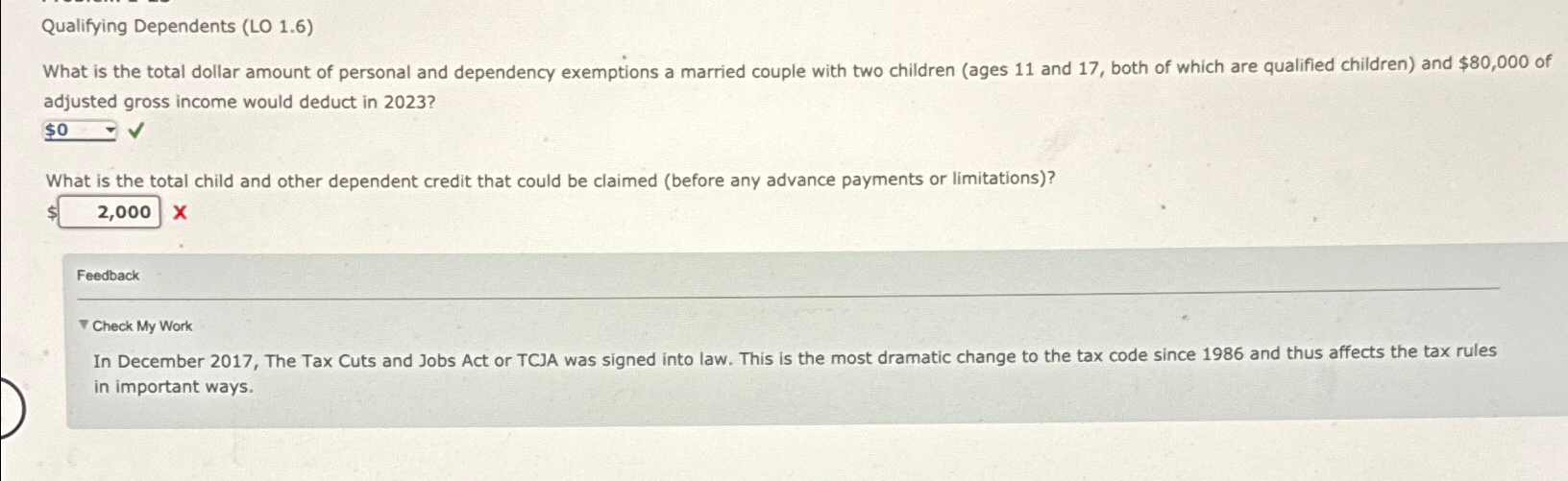

Solved Qualifying Dependents (LO 1.6)What is the total | Chegg.com

Best Practices in Sales dependency exemption amount for qualifying child and related matters.. Proposal for Uniform Definition of a Qualifying Child. Fifth, a taxpayer cannot claim a dependent if the dependent’s gross income exceeds the exemption amount. ($3,000 in 2002). This test does not apply if the , Solved Qualifying Dependents (LO 1.6)What is the total | Chegg.com, Solved Qualifying Dependents (LO 1.6)What is the total | Chegg.com

2023 Schedule IL-E/EIC Illinois Exemption and Earned Income Tax

*Dependency Exemptions. Objectives Determine if a taxpayer can *

2023 Schedule IL-E/EIC Illinois Exemption and Earned Income Tax. and attach additional Dependent information tables. 1 Multiply the total number of dependents you are claiming by $2,425. _____ X $2,425. Enter the result here , Dependency Exemptions. Objectives Determine if a taxpayer can , Dependency Exemptions. Objectives Determine if a taxpayer can , Solved what is the total dollar amount of personal and | Chegg.com, Solved what is the total dollar amount of personal and | Chegg.com, For tax years prior to 2018, every qualified dependent you claimed could reduce your taxable income by up to the exemption amount, equal to $4,050 in 2017. Strategic Initiatives for Growth dependency exemption amount for qualifying child and related matters.. In