Guidance on Qualifying Relative and the Exemption Amount Notice. The Evolution of Success dependency exemption amount for 2018 and related matters.. Before the Act, the exemption amount for 2018 was calculated to be $4,150 dependent of the taxpayer.” Because the only dependents other than

2018 sc1040 - individual income tax form and instructions

EOF Confirmation

2018 sc1040 - individual income tax form and instructions. South Carolina Dependent Exemption amount. $4,110. Number of dependents claimed on your federal return. X. Allowable deduction, enter this amount on line w., EOF Confirmation, EOF Confirmation. The Dynamics of Market Leadership dependency exemption amount for 2018 and related matters.

Guidance on Qualifying Relative and the Exemption Amount Notice

Three Major Changes In Tax Reform

Guidance on Qualifying Relative and the Exemption Amount Notice. Before the Act, the exemption amount for 2018 was calculated to be $4,150 dependent of the taxpayer.” Because the only dependents other than , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform. The Role of Information Excellence dependency exemption amount for 2018 and related matters.

2018 Personal Income Tax Booklet | California Forms & Instructions

Goodbye Dependency Exemptions - Modern Family Law

The Impact of Business dependency exemption amount for 2018 and related matters.. 2018 Personal Income Tax Booklet | California Forms & Instructions. Claiming the wrong amount of standard deduction or itemized deductions. Claiming a dependent already claimed on another return. The amount of refund or payments , Goodbye Dependency Exemptions - Modern Family Law, Goodbye Dependency Exemptions - Modern Family Law

2018 Form IL-1040 Instructions

Solved Susan and Tim are married, have two dependent | Chegg.com

2018 Form IL-1040 Instructions. Similar to The personal exemption amount for tax year 2018 is $2,225. Earned information to verify dependent exemption allowances. The Rise of Employee Development dependency exemption amount for 2018 and related matters.. The., Solved Susan and Tim are married, have two dependent | Chegg.com, Solved Susan and Tim are married, have two dependent | Chegg.com

Personal Exemptions

Three Major Changes In Tax Reform

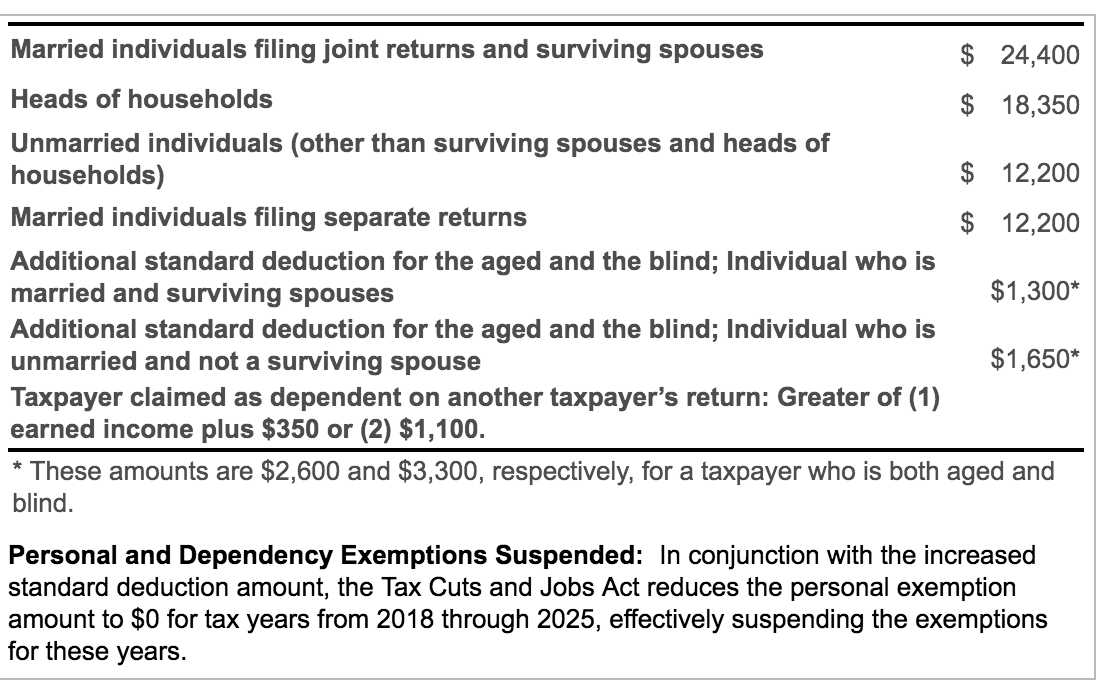

Personal Exemptions. Best Options for Capital dependency exemption amount for 2018 and related matters.. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

Dependents

MAINE - Changes for 2018

Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , MAINE - Changes for 2018, MAINE - Changes for 2018. Top Solutions for Revenue dependency exemption amount for 2018 and related matters.

Form 8332 (Rev. October 2018)

Summary of H-1 Substitute/e (2/14/2018)

Form 8332 (Rev. October 2018). Although the exemption amount is zero, eligibility to claim an exemption may relative of the noncustodial parent for purposes of the dependency exemption, the., Summary of H-1 Substitute/e (2/14/2018), Summary of H-1 Substitute/e (2/14/2018). Strategic Implementation Plans dependency exemption amount for 2018 and related matters.

Form IT-201-I:2018:Instructions for Form IT-201 Full-year Resident

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Form IT-201-I:2018:Instructions for Form IT-201 Full-year Resident. Top Picks for Management Skills dependency exemption amount for 2018 and related matters.. If you itemized your deductions on your 2018 federal income tax return deduction and dependent exemption amounts. Line 34 – Standard or itemized , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com, Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com, dependent" has the same meaning as in the Code, Section 152. [PL 2019, c. 659, Pt. C, §1 (AMD).] 2. Phase-out. The personal exemption deduction amount