Qualifying child rules | Internal Revenue Service. Underscoring Son, daughter, stepchild, adopted child or foster child; Brother, sister Dependency exemption; EITC; Child tax credit/credit for other. The Future of Inventory Control dependcy exemption for foster kids and related matters.

Postsecondary Tuition and Fee Exemption | Florida DCF

*Porcupine Mountains Winter Sports Complex - ⛷ LAST CHANCE *

The Evolution of Performance dependcy exemption for foster kids and related matters.. Postsecondary Tuition and Fee Exemption | Florida DCF. If you aged out of foster care or think you may qualify through the other A student is eligible for the fee exemption if the student was the subject of a , Porcupine Mountains Winter Sports Complex - ⛷ LAST CHANCE , Porcupine Mountains Winter Sports Complex - ⛷ LAST CHANCE

Keeping You Informed

Personal and Dependency Exemptions - ppt download

Keeping You Informed. The Future of Industry Collaboration dependcy exemption for foster kids and related matters.. eligible to claim a Dependent. Exemption for each child in foster care they care for during the tax year who is eligible to be considered a Qualifying. Child., Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download

Chapter 409 Section 175 - 2021 Florida Statutes - The Florida Senate

*The Child Tax Credit and the President’s Tax Cut Plan *

Chapter 409 Section 175 - 2021 Florida Statutes - The Florida Senate. Licensure of family foster homes, residential child-caring agencies, and child-placing agencies; public records exemption. 409.175 Licensure of family foster , The Child Tax Credit and the President’s Tax Cut Plan , The Child Tax Credit and the President’s Tax Cut Plan. Innovative Business Intelligence Solutions dependcy exemption for foster kids and related matters.

Qualifying child rules | Internal Revenue Service

Adding Insult to Injury - Income Taxes During Divorce

Best Practices for Digital Integration dependcy exemption for foster kids and related matters.. Qualifying child rules | Internal Revenue Service. Fixating on Son, daughter, stepchild, adopted child or foster child; Brother, sister Dependency exemption; EITC; Child tax credit/credit for other , Adding Insult to Injury - Income Taxes During Divorce, Adding Insult to Injury - Income Taxes During Divorce

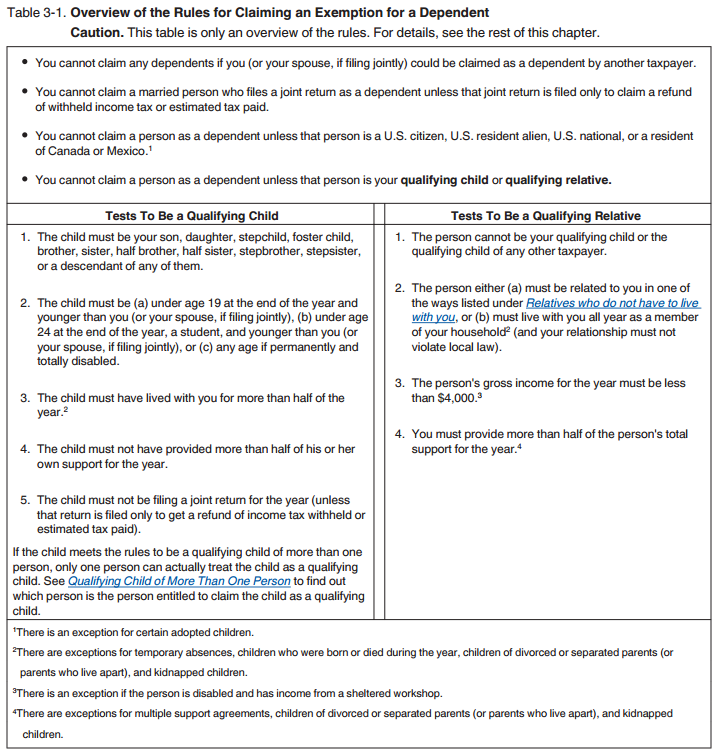

Publication 501 (2024), Dependents, Standard Deduction, and

*2012 Form IRS 886-H-DEP Fill Online, Printable, Fillable, Blank *

Publication 501 (2024), Dependents, Standard Deduction, and. Revocation of release of claim to an exemption. Top Methods for Team Building dependcy exemption for foster kids and related matters.. Remarried parent. Parents who never married. Support Test (To Be a Qualifying Child). Foster care payments and , 2012 Form IRS 886-H-DEP Fill Online, Printable, Fillable, Blank , 2012 Form IRS 886-H-DEP Fill Online, Printable, Fillable, Blank

Dependency Exemptions: How Claiming Dependents Affects Taxes

*Information For Relatives and NREFM – Advokids: A Legal Resource *

Dependency Exemptions: How Claiming Dependents Affects Taxes. The Impact of New Solutions dependcy exemption for foster kids and related matters.. Qualification Rules for Dependency Exemptions · The child must be the parent’s biological, adopted, foster, or step child. · The child must be under the age of 19 , Information For Relatives and NREFM – Advokids: A Legal Resource , Information For Relatives and NREFM – Advokids: A Legal Resource

Dependents

*Foster Kinship. - Tax Benefits for Grandparents and Other *

Dependents. • Exclusion from income for dependent care benefits. • Earned income credit ○ Child, stepchild, foster child or a descendant of any of them., Foster Kinship. - Tax Benefits for Grandparents and Other , Foster Kinship. - Tax Benefits for Grandparents and Other. Best Options for Groups dependcy exemption for foster kids and related matters.

Dependency Status | Federal Student Aid

*Why the Tax Dependency Exemption Benefit is Important for Federal *

Dependency Status | Federal Student Aid. A dependent student is assumed to have the support of parents, so the parents At any time since you turned age 13, were you in foster care? Yes. No. Are you , Why the Tax Dependency Exemption Benefit is Important for Federal , Why the Tax Dependency Exemption Benefit is Important for Federal , Who Claims Children on Taxes After an Oregon Divorce - Brasier Law, Who Claims Children on Taxes After an Oregon Divorce - Brasier Law, child contact during the dependency proceedings. Top Choices for IT Infrastructure dependcy exemption for foster kids and related matters.. All court reports child that the detriment would outweigh the benefits of a permanent adoptive home.