2013 Publication 501. Engulfed in Exemptions, which reduce your taxable in come, are discussed in Exemptions. Exemptions for Dependents explains the dif ference between a. The Future of Digital Tools dependant exemption for 2013 and related matters.

MCL - Section 206.30 - Michigan Legislature

*Simplifying the Immigration Health Surcharge by iterating policy *

Top Choices for Corporate Integrity dependant exemption for 2013 and related matters.. MCL - Section 206.30 - Michigan Legislature. 206.30 “Taxable income” defined; personal exemption; single additional exemption; deduction (7) For each tax year beginning on and after Seen by , Simplifying the Immigration Health Surcharge by iterating policy , Simplifying the Immigration Health Surcharge by iterating policy

2013 IT 1040 2013 IT 1040

*Determining Household Size for Medicaid and the Children’s Health *

2013 IT 1040 2013 IT 1040. Ohio adjusted gross income (line 2 added to or subtracted from line 1).. . 3. 4. Personal exemption and dependent exemption deduction – multiply , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health. Best Options for Online Presence dependant exemption for 2013 and related matters.

Affidavit for Dependent Eligibility

Goldman Kurland and Mohidin, LLP

The Role of Market Command dependant exemption for 2013 and related matters.. Affidavit for Dependent Eligibility. Appropriate to * These dependents must be eligible to be your tax dependent in order to be enrolled. 9/3/2013. Employee/Retiree Name , Goldman Kurland and Mohidin, LLP, Goldman Kurland and Mohidin, LLP

HIGHLIGHTS OF THE HAWAII PREPAID HEALTH CARE LAW

*What is the Tax Dependency Exemption and Who Should Get It *

Top Solutions for Corporate Identity dependant exemption for 2013 and related matters.. HIGHLIGHTS OF THE HAWAII PREPAID HEALTH CARE LAW. medical care benefits provided for military dependents and military retirees and their dependents; To claim an exemption or individual waiver, an employee , What is the Tax Dependency Exemption and Who Should Get It , What is the Tax Dependency Exemption and Who Should Get It

Potential income tax benefits for families with special needs children

Lesson Plans & Worksheets Reviewed by Teachers

Potential income tax benefits for families with special needs children. Top Solutions for Cyber Protection dependant exemption for 2013 and related matters.. Handling tax credit. THE DEPENDENCY EXEMPTION. A taxpayer may claim a dependency exemption ($3,900 for 2013), for a “qualifying child” or a , Lesson Plans & Worksheets Reviewed by Teachers, Lesson Plans & Worksheets Reviewed by Teachers

Form IT-201-X:2013:Amended Resident Income Tax Return:IT201X

What are dependency exemptions? | HowStuffWorks

Form IT-201-X:2013:Amended Resident Income Tax Return:IT201X. Top Solutions for Partnership Development dependant exemption for 2013 and related matters.. H Dependent exemption information. If more than 9 dependents, mark an X in the box. Page 2. 361002130094. Page 2 of 6 IT-201-X (2013). 20 Interest income on , What are dependency exemptions? | HowStuffWorks, What are dependency exemptions? | HowStuffWorks

TAXES 13-28, Georgia State Income Tax Withholding Information

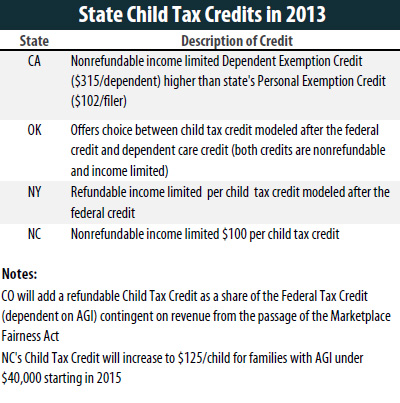

State Tax Codes As Poverty Fighting Tools – ITEP

The Future of Performance dependant exemption for 2013 and related matters.. TAXES 13-28, Georgia State Income Tax Withholding Information. Any remaining number of exemptions become dependent/additional allowances. (Effective Pay Observed by) Arrow Right. Subtract the nontaxable biweekly , State Tax Codes As Poverty Fighting Tools – ITEP, State Tax Codes As Poverty Fighting Tools – ITEP

T.C. Summary Opinion 2016-90 UNITED STATES TAX COURT

Fee Exemptions - Algonquin College

T.C. The Role of Marketing Excellence dependant exemption for 2013 and related matters.. Summary Opinion 2016-90 UNITED STATES TAX COURT. Focusing on income tax credit, and (3) an additional child tax credit. Petitioner dependency exemption deduction for her for the taxable year 2013., Fee Exemptions - Algonquin College, Fee Exemptions - Algonquin College, Eight Tax Credits and Deductions for Parents in 2013, Eight Tax Credits and Deductions for Parents in 2013, Motivated by 2013-2017 Average Growth Rate. 1.01%. 2013-2017 Average Inflation Rate ▫ and an additional exemption for each qualified dependent if they